What is gamification?

Gamification happens when one integrates game-like elements and mechanics into non-gaming contexts. In FinTech, this integration fits for apps or platforms when there is a need to enhance user engagement and experience.

By incorporating features like avatars, leaderboards, and reward systems, businesses leverage our inherent love for games to make their services more interactive and enjoyable. Devised by designers, this concept transforms traditional tasks or services into more compelling experiences, encouraging users to return through elements of entertainment and competition.

Important: gamification is not about creating an actual game. While businesses use the term “game” to describe the process of interaction with a gamified system, the game is not an ultimate goal for them. Companies just add gamification elements and mechanisms when shaping their product.

Why gamification is the next big thing in FinTech

FinTech services can be quite set-up intensive. They often require submitting documents, building financial literacy, and integrating with a bank account.

One of the points where it can be challenging to maintain customer momentum is the sign-up process. In this case, FinTech gamification is a powerful tool to eliminate onboarding bottlenecks, making it smooth and letting the customer finish the process without distractions.

Through features such as personalized goal tracking, virtual rewards, and interactive financial education, gamification encourages users to actively manage their finances, make informed decisions, and achieve their financial goals. Additionally, gamification has the potential to increase financial literacy and improve financial well-being by making financial concepts and products easier to understand and navigate.

Overall, gamification in FinTech has proven to be an efficient strategy, enticing new users and heating the interest of existing ones by introducing playful elements like unlocking avatars or earning virtual rewards. By employing the gamification concept, financial companies can minimize bounce rate and generate higher profits.

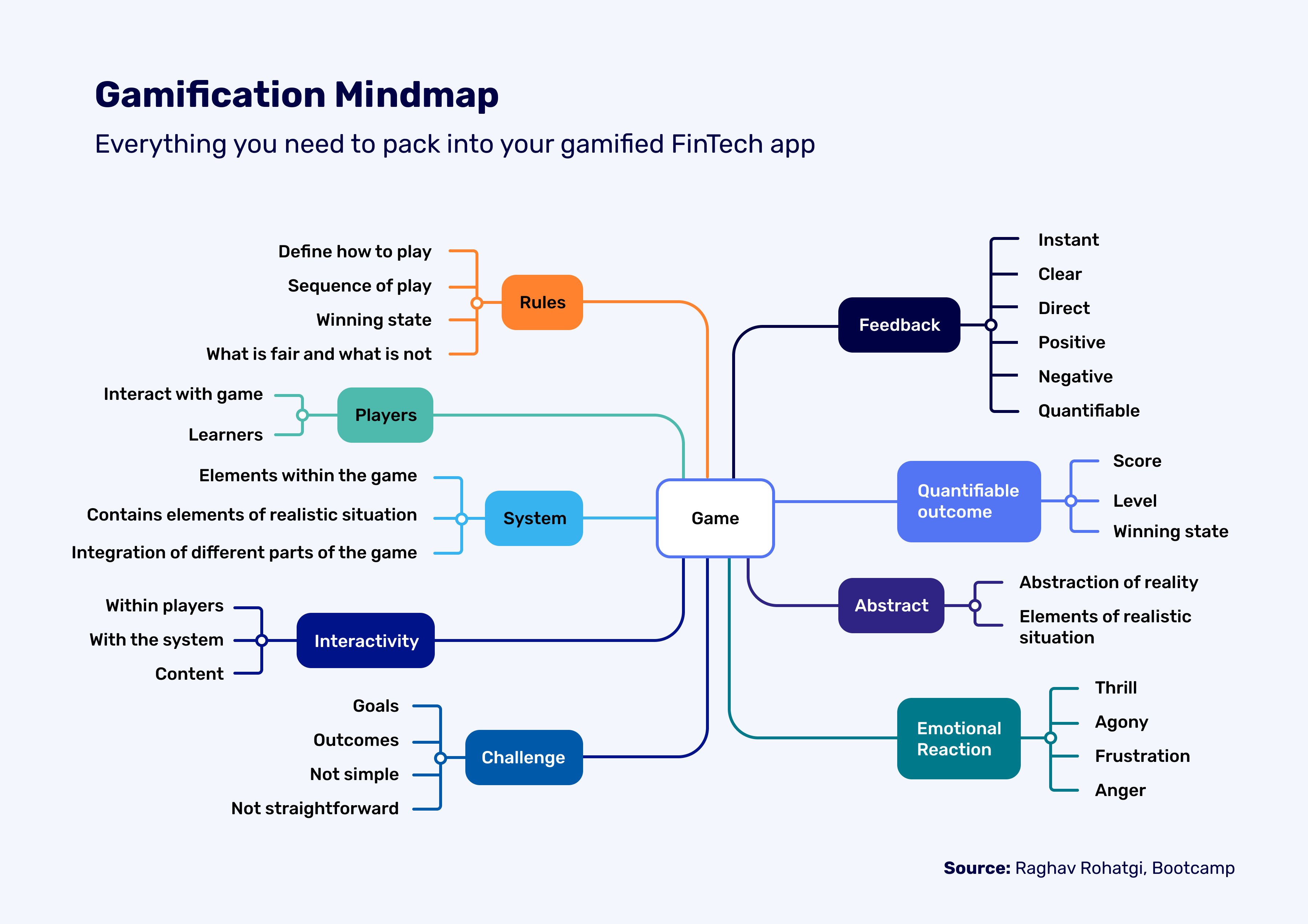

Key features your game system must have

To attract users and keep them entertained, a gamified system needs to spark the competitive spirit. It should prompt the user to collect points and have a fair reward distribution system. But what’s particularly important for a FinTech business is that the system has to meet the key efficiency characteristics.

Gamification relies on methods that appeal to humans’ instincts. At the core of the bunch is competition, which further invokes the desire for achievements and reaching a higher social status. To fulfill both desires, individuals should leverage their problem-solving skills and, possibly, “save” someone or something to tickle their selfish altruism. The whole action must also serve the individual’s self-expression.

So essentially, the basis of gamification is the solution of problems or tasks, which results in the player receiving rewards, with tasks and rewards gradually gaining complexity and value, respectively. Various progress indicators, such as points, honors, and levels, serve as incentives and help users track their progress. As the user advances along the journey, storytelling should glue the levels (their story chapters) together to make sense of the journey.

All elements mentioned must have relevant features to provide the best user experience.

Free will, no pressure. It should be the player’s decision only to join the game and progress on it. The imposed actions, as well as ones that trigger no interest, users will ignore or resist.

Just enough complexity. Your gamified FinTech app should have a level system that keeps the users engaged and interested. You achieve this by making each level simple yet challenging enough. To achieve this for every user, you can add optional hints or additional tasks for each level: when the user gets the feeling that they cannot pass the level on their own, they can use help to tune the complexity a bit and still figure out the challenge on their own.

For instance, the user struggles with their second try to complete the savings challenge. The app can offer them a one-time option to lower the bar for completion in exchange for several points. Alternatively, you can give the user the option to complete an additional one-day task to compensate for the missed requirements, etc.

This interaction between the user and the system to balance the difficulty will ensure the user will be motivated and interested to stay in the game for longer.

Effort that pays out. Any success in the game should translate into rewards to keep the motivation high. It’s also essential to provide a variety of them: the user should be able to earn titles, customization elements, better conditions, money, discounts, etc.

Socialization. A game society (peers, friends, etc.) helps users assess their success, gain confidence, and stay competitive. Ensure the user can communicate with others, compare their progress against their own, and compete.

A sense of novelty. Update the app content now and then to avoid the users getting used to the system and losing interest. Add new features, amplify the discounts array, improve customization and user interface, etc.

How to engineer a gamified app

Gamification tools

There is a variety of gamification tools for every purpose. If you want to add fun to your customers’ onboarding process, UserGuiding can help you. The Mambo.IO platform can gamify both your customers’ and staff’s experience, specializing in e-learning and training systems.

As for gamified product development, let’s see how specialized tools can help you on the example of GWEN.

GWEN offers a gamification toolkit for gamified product development and actionable user insights. This SaaS platform helps scale development with minimal coding efforts while its analytic tools improve user conversion, engagement, and retention. By leveraging GWEN’s insights, businesses can see how active their app users are and what engagement mechanics to apply to achieve the target behaviors.

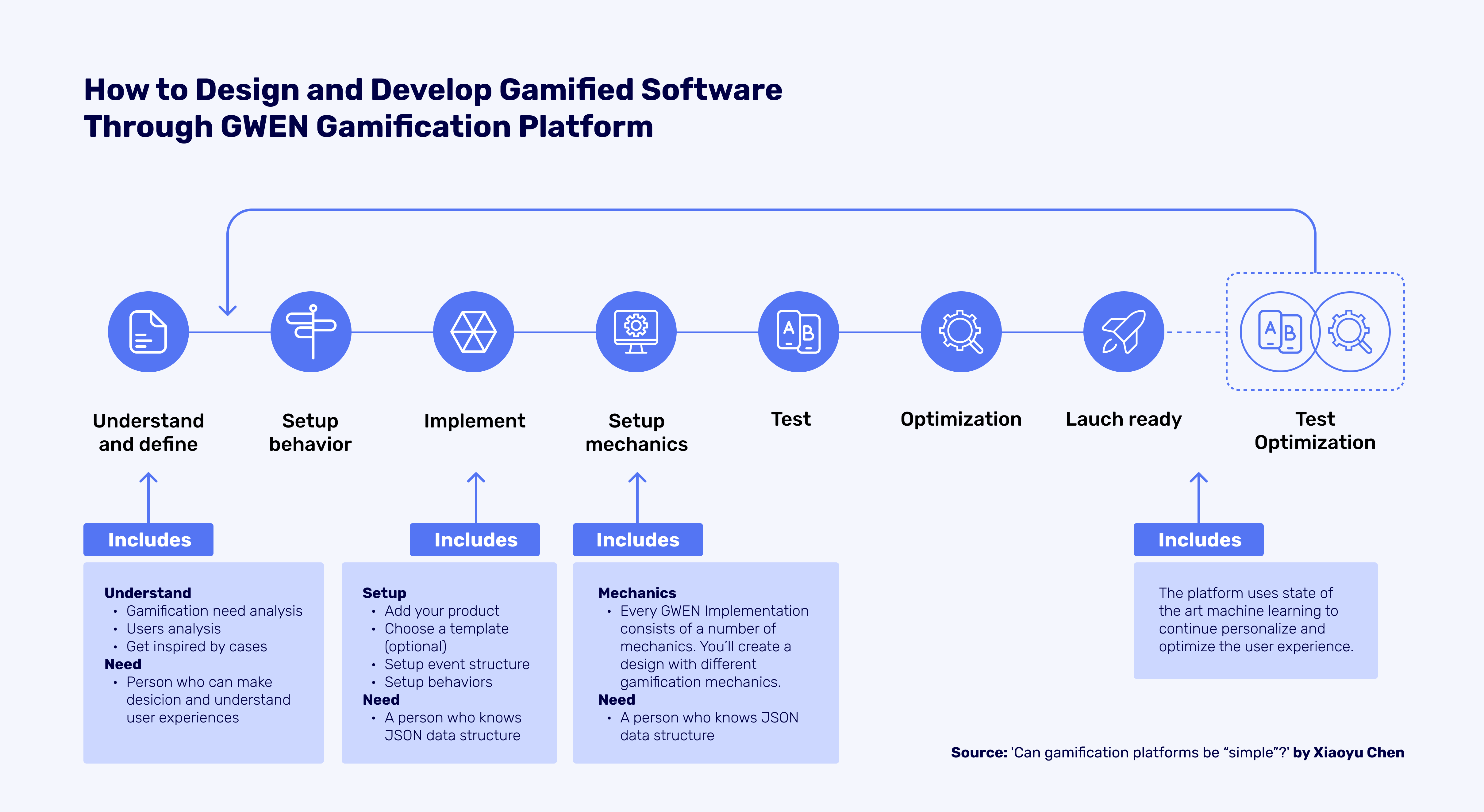

Designing and developing gamified software through the GWEN gamification platform involves eight steps.

- Understand behaviors and define goals.

Start with grasping the user’s current perception of the product. This will help you determine the goal of gamification—whether to enhance production services, processes, or user experience by injecting fun and driving competition. Drawing inspiration from similar industry gamification examples can help when users are uncertain about their preferences.

2. Locate gamification efforts.

To set up gamified behaviors—or identify interaction points where gamification elements like rewards can elevate user experience—clarify which aspects of the product can incorporate gamification elements.

3. Implement gamification elements.

In the GWEN platform, technical staff knowledgeable in JSON data structures configure gamification behavior. The early involvement of a technician assesses the feasibility of gamification requirements. Any unmet requirements can be adjusted promptly.

4. Set up gamification mechanisms.

Based on identified gamification behaviors, set up corresponding mechanisms. Common elements like Achievements, Leaderboards, and Progression are pre-developed on the platform and easily invoked for setup.

5. Test.

At this stage, you’ll evaluate various aspects during platform testing, including the visual appeal and player interaction, and how effectively gamification elements serve their intended purpose.

6. Launch.

After internal testing, release the product, ensuring proper functionality. Continuous analysis is crucial to assess user experience improvement and goal achievement. Additionally, it aids users with KPI analysis.

- – 8. Testing and optimization

To prevent player boredom, introduce new rules gradually, allowing users to adapt. Implementing a phased approach to rule changes ensures skill-building and ongoing engagement.

Using third-party tools for gamification will provide you with the relevant expertise in this field. However, make sure that the provider has experience in the FinTech industry and understands the specifics of FinTech apps.

Building on your own

If you want to design and implement effective gamification elements for your app, you can get by with your own resources. But if your team has little to no experience in app gamification, particularly in the FinTech business domain, you may need to seek consultation to provide a high-level experience to your customers.

Another option is to delegate the development efforts altogether to an external team with experience in FinTech-specific gamification. This variant can be a better fit for startups at the beginning of their journey who don’t have a product or full-fledged team yet.

Technological partners can bring specialized experience in the FinTech sector to your team, understanding the nuances of financial applications and regulations as well as industry best practices and emerging trends. For instance, certain gamification elements can work differently for various audiences. One clear example is Ukrainian neobank Monobank, which has a signature cat mascot. It adds uniqueness to the Monobank app user experience, also building brand trust. However, you won’t find the cat in Monobank’s UK project, The Credit Thing. The reason behind the cat’s “ban” is its facial expressions. It looked ‘too cunning’ and would make people suspicious of the credit service.

If you have decided to rely on internal efforts mainly or exclusively, you’ll need to cover the following bases:

- Understanding your user dynamics by comprehending user behavior and preferences through in-depth analysis, identifying potential touchpoints for gamification.

- Defining clear objectives, which can be the enhancement of user engagement, promotion of financial literacy, or encouragement of specific user actions.

- Utilizing the expertise of internal teams, including developers, UX/UI designers, and product managers, to brainstorm and implement gamification strategies tailored to the Fintech domain.

Best examples of app gamification in FinTech

This app is the definition of boldness. Everything from its brand voice to the game elements it incorporates speaks to Gen Z to help them unwrap the shame around their financial life and throw it away for good.

Frich transforms personal finance into a social and accountable experience, enabling users to establish shared or personal budget goals. The app helps users set individual and group challenges, track progress, and compare their financial strategies to their peers anonymously. Frich’s algorithms analyze users’ jobs, age group, and geographic locations to match them with peers and their answers. The questions help users discover the best tools and tips for their financial journey. For triumphs in challenges, the app gives users free gift cards to their favorite city spots.

See all the gamification elements Frich added to its platform:

CRED

CRED is a mobile app simplifying credit card payments. It enhances user experience through gamification elements such as a unique AI-backed referral program that rewards users with Gems, redeemable for cool rewards. This approach helps CRED combat common referral program pitfalls.

The app also features a Spin-the-Wheel game in the “Club” section, offering daily chances to win exciting rewards like bitcoins and gift vouchers. Users earn CRED coins with each app use, redeemable for fixed rewards or variable rewards that can be used in CRED games, providing an engaging and rewarding experience for members during special events like the IPL season.

Cash App

Cash App changes the way users send, spend, save, invest, and get discounts at merchants. Its gamified experience encourages users to invite friends, solve tasks, join challenges, and donate to charities to earn rewards. Let’s take a look at how gamification works for the latter.

- Users can “stamp” charities with a Cash App approval sign so that other users know that Cash App has reviewed and approved this charity.

- The friend leaderboard shows the users who have donated the most to that charity.

- By filling out a short form, users can discover relevant charities and let the app know which ones they are not interested in. Based on the information in these forms, feeds show trending and recommended charities for each individual.

- Users can subscribe for updates on a particular charity and share them to Cash App or their personal social media feeds. Cash App social feed lets users see where their friends’ donations go and support these charities.

Wrapping it up on FinTech gamification

Gamification is a powerful strategy, transforming complex financial tasks into engaging, enjoyable experiences. Integration of game-like elements into non-gaming contexts is a game-changer in FinTech.

- Incorporating avatars, leaderboards, and reward systems harnesses our innate love for games, creating more interactive and enjoyable financial services.

- From simplifying the sign-up process to encouraging active financial management, gamification fosters user engagement, increasing financial literacy and improving overall financial well-being.

- Key features for an effective gamified system include sparking the competitive spirit, maintaining just enough complexity, ensuring efforts translate into rewards, promoting socialization, and introducing a sense of novelty through regular updates.

- Building an effective gamified app involves understanding user behaviors, defining clear goals, utilizing internal expertise, and employing gamification tools.

While building on internal resources is an option, partnering with a specialized technology partner like INSART can deliver a more streamlined and efficient process. Book a free consultation with us to discover how gamification can revolutionize your FinTech offering.