The new wave of cybersecurity and operational-resilience regulation, from the SEC’s “cyber 8-K” rule in the U.S. to the EU’s DORA framework, has made it clear that boards are now legally accountable for risk oversight and internal controls.

This is genuinely good news for startups. Founders who can demonstrate clear evidence of strong controls and regulatory compliance are seen as lower-risk, higher-trust bets.

But first, let’s get clear on what exactly these new regulations change.

Why the SEC’s Cyber 8-K Rule Raises the Bar for Everyone

The SEC’s new cyber 8-K rule has changed what “responsibility” means at the top. Public companies now have just four business days to disclose any cybersecurity incident once they decide it’s material — not four days after discovery, but after they determine it matters to investors.

In practice, that means boards need real-time visibility into how incidents are detected, assessed, and contained. No more waiting for postmortems or quarterly reports.

The rule forces companies to prove they have:

- Working incident response plans that aren’t just theoretical;

- Detection and decision protocols that reach the board much quicker;

- And clear, annual disclosures explaining how leadership oversees cyber risk, including who on the board has the expertise to make those calls.

Boards must prove they have rigorous, tested frameworks — otherwise, they risk enforcement, reputational damage, or losing investor trust.

DORA and the New Standard of Proof in Financial Resilience

In Europe, DORA goes even further, demanding continuous testing, supplier audits, and real-time incident reporting (as fast as four hours for initial alerts). It sets new, harmonized operational-risk obligations for the entire financial sector, including banks, insurers, investment firms, payment service providers, and critical ICT suppliers.

This way, DORA compels boards and senior executives at financial firms to take direct responsibility for digital operational resilience, including ICT risk management, ongoing resilience testing, and rapid, standardized incident reporting. They’re expected to:

- Oversee realistic testing of continuity, cybersecurity, and vendor risk frameworks;

- Track metrics and document outcomes, so responsibilities and performance are clear;

- Review incidents and act fast, closing gaps and demonstrating learning cycles.

For founders, DORA signals where global governance is headed. It’s not enough to have policies on paper; you need evidence of control.

Together, these frameworks have moved compliance from a check-the-box exercise to a proof-of-control discipline. Boards can no longer simply state that resilience exists. They must evidence it through governance logs, risk registers, incident simulations, and documented remediation cycles.

The New Investor Signal: Operational Maturity

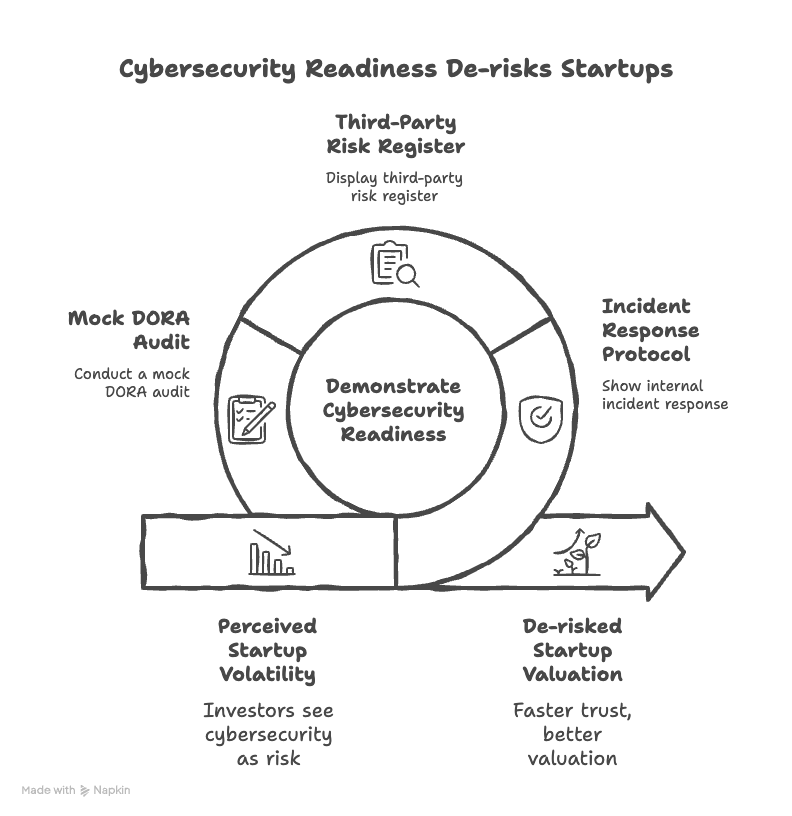

For founders and CFOs, this shift has created a new due-diligence frontier. Investors now see cybersecurity and resilience controls as a proxy for leadership discipline and long-term risk reduction. And startups that can demonstrate readiness (for example, by showing an internal incident-response protocol, third-party risk register, or mock DORA audit), appear de-risked compared to peers who can’t.

In venture and M&A contexts, this evidence translates directly into:

- Faster trust during diligence — fewer red flags in IT and compliance reviews.

- Better valuation defense — resilience reduces perceived volatility.

- Strategic partnerships — enterprise clients and regulated buyers increasingly demand proof of compliance alignment.

Regulatory tailwinds founders can leverage now

If you’re building or scaling in Europe right now, regulation is your strategic signal. The EU is reshaping how products handle trust, security, and transparency. Below is a quick map of three near-term regimes that are already influencing how product teams prioritize features, roadmaps, and launch timing.

1. The EU AI Act: A Phased Rulebook for Responsible AI (2024–2027+)

The EU AI Act, which entered into force on August 1, 2024, introduces the world’s first comprehensive AI regulation. And it’s rolling out through 2026 and beyond, giving startups time to adjust.

What’s changing:

The Act divides AI into risk classes, banning the highest-risk uses (like manipulative or real-time biometric systems) and tightly regulating others. From February 2025, “unacceptable risk” AI must be removed or redesigned. By mid-2025, developers of general-purpose AI (GPAI) will face documentation, transparency, and reporting duties — essentially, having to prove that their models are explainable and monitored.

By August 2026, companies offering high-risk systems (such as those in healthcare, finance, or HR) must demonstrate full compliance: risk management, human oversight, data governance, and conformity assessment. Existing systems get a one-year grace period, but by 2027, everyone in these categories must be fully aligned. Here is a more detailed breakdown of how these changes will be taking place.

Map: EU AI Act Phased Applicability and Product Impact

| Date/Phase | Obligation Type | Product/Roadmap Impact |

| Aug 1, 2024 | Act enters into force | Begin gap analysis and inventory of AI systems |

| Feb 2, 2025 | Ban on “unacceptable risk” AI | Immediate removal or redesign of banned AI features (manipulative, real-time biometric, etc.) |

| May–Aug 2025 | GPAI codes, documentation, governance | Prepare for transparency and documentation (especially for General-Purpose AI): update technical files and compliance tracking |

| Aug 2, 2025 | GPAI obligations, reporting, sanctions | For new GPAI systems: mandatory reporting, documentation, transparency; focus on disclosures and dynamic monitoring |

| Aug 2, 2026 | High-risk systems (Annex III) compliance | Must meet strict controls for systems in sensitive domains: risk management, data governance, conformity assessment, human oversight, sandbox participation. These must be reflected in design and rollout plans. |

| Aug 2, 2027+ | Legacy/safety component compliance | Existing high-risk systems and AI-related product components must meet full requirements (Annex I/Ia), driving updates and continued audit cycles. |

How Founders Can Get Ahead of the EU AI Act

The EU AI Act is like a roadmap for how AI products will need to be built, documented, and launched in the coming years. If you’re a founder, it’s not a time to hit pause; it’s a chance to design compliance into your product DNA early and gain a competitive edge as stricter rules take hold across Europe. So, what exactly can you do?

1. Build regulatory awareness into your AI roadmap

Segment your AI features by risk class, from low-risk automation tools to potentially high-risk systems like credit scoring. Identify what must be redesigned, documented, or retired under new bans and transparency rules. Allocate time and budget for documentation, transparency, and technical compliance, especially for General-Purpose AI models that fall under stricter disclosure and monitoring requirements.

2. Strengthen your compliance infrastructure

The most successful AI teams will treat compliance as part of product ops, not legal overhead. Build or upgrade your internal systems for monitoring, reporting, and record-keeping ahead of 2025 obligations. For any high-risk applications, prepare for external conformity assessments by mid-2026 — these will require full documentation trails and audit-ready design processes.

3. Align launches with the regulatory calendar

Plan your go-to-market timing around phased compliance dates. Prioritize new features that are least affected by high-risk provisions, and delay or redesign those that need additional governance. Founders can also leverage EU AI sandboxes, which allow companies to test innovations under supervision and receive early regulatory feedback — a shortcut to safer, faster scaling.

4. Don’t forget legacy systems

If you already have deployed AI products, begin auditing and upgrading legacy systems that will be subject to “grandfathering” rules. The final compliance deadline hits in August 2027, so early alignment will help you avoid expensive last-minute overhauls.

2. PSD3 and PSR: Payments Regulation 3.0

Next in line are PSD3 (Payment Services Directive 3) and its sibling, the Payment Services Regulation (PSR) — a full rewrite of Europe’s digital payments rules. Expected to advance through 2025, they will overhaul fraud prevention, authentication, and consumer protection standards.

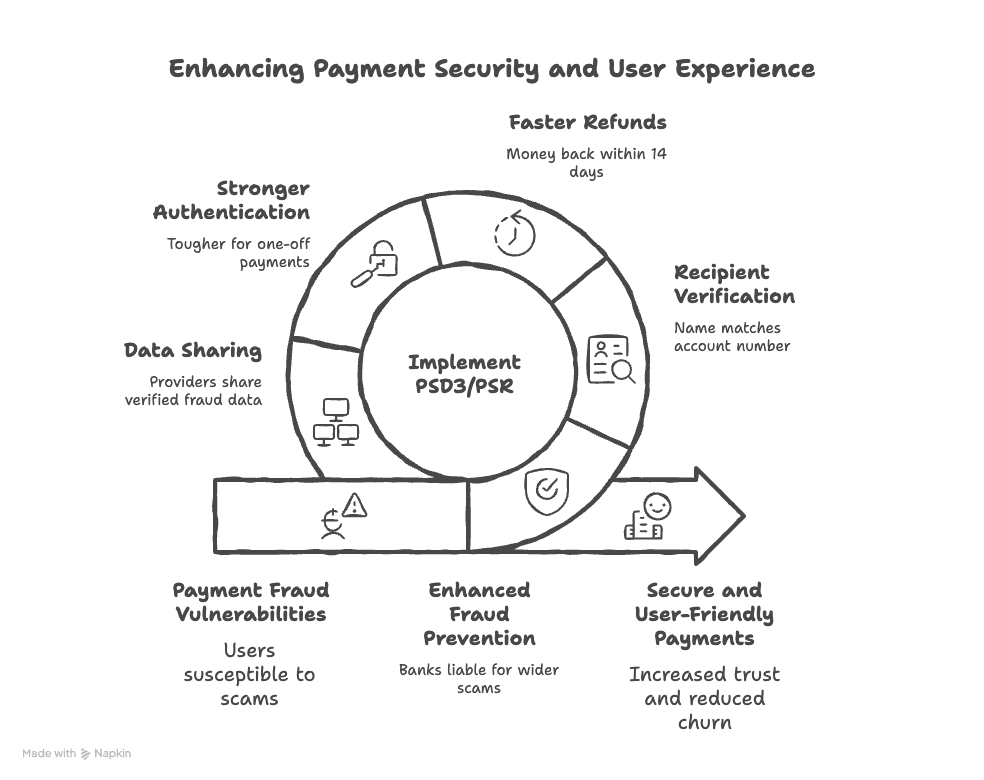

Here’s what the next generation of EU payment rules means in practice:

- Banks and payment providers will now be on the hook for a wider range of scams, including authorized push payment (APP) fraud, where users are tricked into sending money themselves.

- Before any transfer goes through, systems must verify that the recipient’s name matches the account number. It’s a simple step that blocks one of the most common fraud routes.

- If a transaction turns out to be unauthorized, customers must get their money back within 14 business days, unless there’s clear evidence they acted fraudulently or with gross negligence.

- SmStrong Customer Authentication (SCA) will become tougher for one-off payments but lighter for recurring ones — so subscriptions stay smooth without sacrificing security.

- Payment providers will be allowed (and in some cases required) to share verified fraud data with each other, building a shared defense network across the EU while staying GDPR-compliant.

These updates make payments safer but also reshape UX. Verification flows, payment confirmations, and fraud education become visible parts of the product journey. Providers that make these processes clear, fast, and user-friendly will gain trust and reduce churn. So, treat PSD3/PSR as an opportunity to market security as a feature. Clear “payment verified” states, instant refunds, and anti-fraud dashboards can increase user confidence and conversion, especially since we’re talking about fintech.

3. Instant Payments Fee Caps: From Premium Feature to Default Expectation

Instant payments used to be an optional upgrade — fast, but often costly. From 2025, they’ll become standard, 24/7, and cost-parity by law. That means no more “express transfer” fees, no weekend delays, and no uncertainty about when funds arrive. For startups building in fintech, e-commerce, or B2B payments, this creates a new baseline of speed and transparency users will quickly come to expect.

The regulation goes beyond speed, too. Each transaction must complete within 10 seconds, and payee verification (IBAN–name matching) will be free to the sender.

Why This Matters for Founders

For product teams, the opportunity lies in reframing instant payments not as compliance, but as a conversion and retention lever. When users know transfers settle instantly, they’re more likely to complete purchases, top up digital wallets, or pay invoices immediately — all behaviors that boost engagement and cash flow.

Businesses, meanwhile, gain better liquidity and customer satisfaction. Faster settlement means faster refunds, quicker merchant payouts, and stronger user trust in your platform’s reliability. Startups that integrate instant-pay capabilities early (before they’re legally required) will look more modern, transparent, and user-centric.

Proof points VCs expect in a RegTech-ready data room

As regulatory frameworks like DORA, PSD3/PSR, and the SEC Cyber 8-K rule come into force across 2025–2026, investors are no longer asking only about growth metrics or runway. They want to see that your fintech or financial infrastructure startup can operate in a regulated environment without missing a beat.

Compliance has become a measure of maturity, and the data room is where that story gets told. Here’s how to operationalize one of the most critical areas shaping investor confidence:

1. Living Register of ICT Third-Party Providers (DORA Art. 28)

Under EU DORA Article 28, financial institutions (and any startups serving them) must maintain a living, continuously updated register documenting every contractual relationship with ICT third-party providers.

What the Register Must Contain:

- Legal identity and details for each provider (including LEI when available)

- Type and scope of ICT services provided

- Start/end dates, costs, criticality, and business function supported

- Subcontractor relationships tied to critical services

- Preparedness for exit/transition (exit strategy documentation)

This kind of register tells investors you’ve built a transparent, trackable supply chain, and that you know how to scale responsibly in a regulated market. Keeping solid documentation like this shows discipline and operational clarity, and that makes investors a lot more comfortable betting on you.

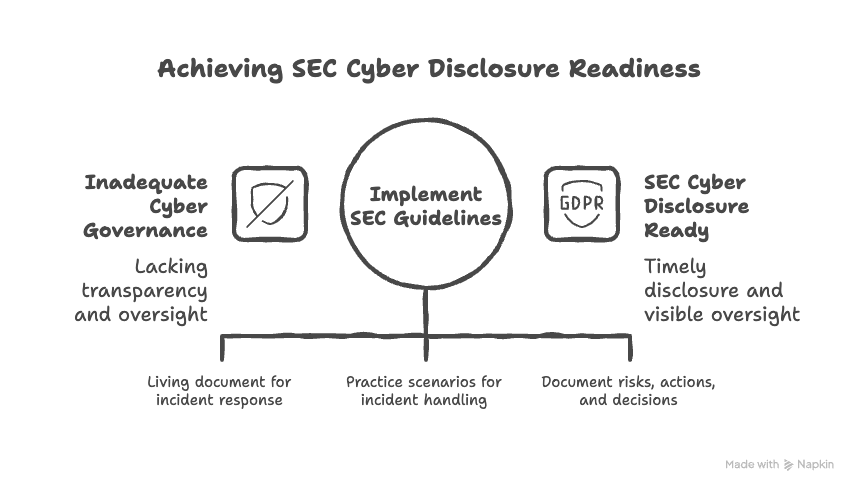

2. Incident Playbooks and Board-Level Cyber Disclosure Readiness (SEC Rules)

In the U.S., the SEC’s new cybersecurity disclosure rules have raised expectations for how public companies and those planning to go public handle incident transparency and cyber governance. The SEC now expects companies to treat cybersecurity as part of their core governance fabric instead of a side policy. The focus is on timely disclosure, tested playbooks, and visible board oversight.

Under these new rules, public companies must:

- File cyber incident reports within four business days of determining materiality, describing incident nature, scope, impact, and current response actions.

- Annually disclose cyber risk management processes, board oversight practices, and incident response frameworks in 10-K filings.

Even if you’re not public yet, it’s worth getting these muscles in shape now. Investors notice when a company runs like it’s already playing in the big leagues. Start by building a real incident playbook. And we’re not talking about a PDF that sits in a folder, but rather a living document your team can actually use when something breaks. It should spell out who does what, who communicates when, and how the information moves up the chain so responses are calm, fast, and coordinated.

Then, get your leadership team comfortable with it. Run short tabletop sessions, walk through realistic scenarios, and make sure everyone (especially your board) knows what counts as “material” and when to disclose. You don’t want to be figuring that out mid-incident.

And finally, keep a record of your oversight. Note what risks were discussed, what actions were taken, and how decisions link back to your governance process. When investors, regulators, or partners look under the hood, you’ll have evidence that your company doesn’t just talk about resilience — it operates with it.

3. KYC/KYB/AML Controls with AI Model Governance (ESMA Guidance)

As artificial intelligence becomes deeply integrated into identity verification and anti-money-laundering (AML) systems, regulators are turning their attention to how these models are built, tested, and governed. The European Securities and Markets Authority (ESMA) now expects firms to establish rigorous governance frameworks for AI models used in compliance workflows.

At the core of this expectation lies model accountability. Firms must document every stage of model validation, calibration, and ongoing audit. This ensures that AI systems performing KYC/KYB checks or transaction monitoring operate within clearly defined parameters, and that any drift or bias is promptly detected and corrected.

Equally important is the assignment of responsibility. Boards and executive teams are expected to take explicit ownership of AI risk, embedding oversight mechanisms and formal model-risk policies into their governance structures. Compliance cannot remain a technical concern alone — it’s a leadership obligation.

ESMA also emphasizes traceability and transparency. Institutions should have comprehensive records that allow full reconstruction of how an AI model was trained, how it reached specific decisions, and when human overrides occurred. Regular back-testing and scenario reviews are essential, especially for models that influence high-impact regulatory outcomes such as client onboarding or transaction blocking.

Finally, transparency with regulators must become standard practice. Supervisors will expect firms to disclose model methodologies, data sources, and known limitations — not as a one-time report, but as an ongoing dialogue that reinforces trust in AI-enabled compliance.

What Boards and Compliance Teams Must Do

- Maintain and test registers and playbooks as living risk controls (not static files); schedule regular updates, audits, and reviews.

- Ensure incident playbooks match new SEC/EU reporting timelines, assign clear escalation and board responsibilities for both cyber and operational events.

- Treat all AI-linked controls and compliance functions (KYC, AML, monitoring) as governed models, subject to ESMA’s expectations for audit trail, accountability, and transparency.

This integrated approach demonstrates mature compliance and risk practices, making organizations demonstrably resilient, transparent, and fit for investor, supervisory, and market scrutiny. To meet today’s regulatory expectations, regulated startups and financial firms should operationalize three core functions using latest standards:

Execution layer: RegTech is an enabler of growth metrics

We know that compliance used to be synonymous with overhead — a cost of doing business rather than a growth driver. Modern RegTech has changed that equation. By improving data quality, reducing manual operations, and cutting false positives, intelligent compliance systems now drive measurable business outcomes: faster onboarding, higher approval rates, and stronger customer lifetime value (LTV).

What was once a reactive function is becoming an execution layer that fuels scale.

From Data Burden to Data Advantage

AI-powered RegTech platforms are changing how financial institutions process and validate data. Automated transaction monitoring dynamically adjusts thresholds based on real-time context, reducing false positives by 40–50% — with some banks reporting over 90% fewer redundant alerts.

The payoff is twofold: compliance teams are freed from chasing “junk” alerts, and models get better at catching the real risks. That’s how we get cleaner data, sharper insights, and fewer operational bottlenecks.

At the same time, automated data capture and reporting tools improve consistency and accuracy across regulatory submissions. When human error is minimized, delays shrink, audit confidence grows, and compliance stops being a point of friction.

Compliance Meets Conversion

Customer onboarding is where trust and conversion intersect, and RegTech sits right at that crossroads. Automated KYC, KYB, and AML processes can reduce onboarding times by 30–70%, eliminating the slow manual reviews that often cause drop-offs.

When clients see frictionless onboarding and responsive identity checks powered by AI and biometrics, confidence builds instantly. False AML flags decline, approval rates rise, and the experience feels seamless rather than suspicious.

Behind the scenes, automation scales throughput without scaling headcount, letting teams reallocate effort toward strategic oversight instead of repetitive verification.

Trust as a Growth Engine

Every friction removed from compliance is a trust signal added to your brand. Lower false positives mean fewer blocked accounts and fewer frustrated customers. Higher trust means longer relationships and higher lifetime value.

In this sense, RegTech compounds value. It accelerates revenue realization, lowers churn, and protects reputation, which together form the real growth metrics investors track.

Wrapping Up

RegTech has redefined what operational excellence looks like — and investors have noticed.

Not sure your compliance posture is investment-grade? We’ll benchmark your stack against DORA, SEC, and EU AI Act standards, audit your KYC/AML and risk registers, and return a 2-page investor-ready gap report with clear next steps and a 30-60-90-day action plan. Fill out the form, and our team will reach out to schedule your audit.