Every year, the period between December and January becomes a quiet but decisive window for scaling fintech startups. It’s the moment when product teams finally pause, examine what worked, confront what didn’t, and begin shaping the architecture that will carry them through the next phase of growth.

For Growing Stage fintech startups — companies with early revenue, active customers, and increasing product complexity — this period often exposes the same core realities:

- technical debt has accumulated faster than expected

• engineering velocity has slowed under the pressure of feature requests

• AI/ML adoption is no longer optional

• cloud costs are rising without a clear optimization strategy

• compliance and security expectations have tightened

• the architectural foundations that were “good enough for MVP” cannot support scaling into 2026

This is the stage where technology decisions either accelerate growth or silently block it.

It’s also where INSART’s work with Growing Startups often begins.

Below is a structured look at the top strategic decisions fintech startups must make in 2026, based on real pain points and transformation patterns observed across the segment.

The Top Strategic Technology Decisions for Fintech Growth in 2026

Growing fintech startups share a universal set of challenges. They’ve proven demand, built a functioning product, and found early users… but now need to scale. The technology that powered the first chapter becomes the very thing that restricts the next.

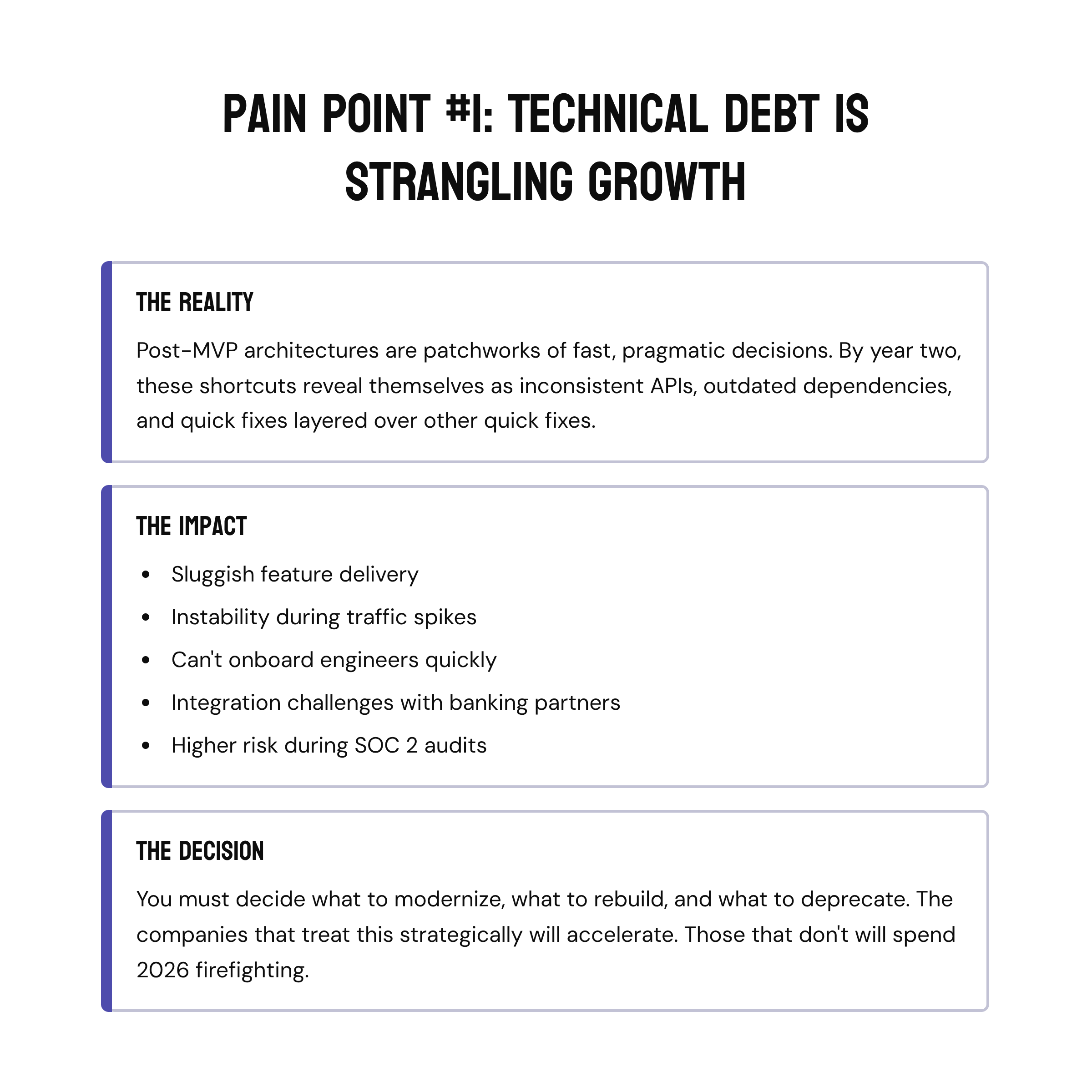

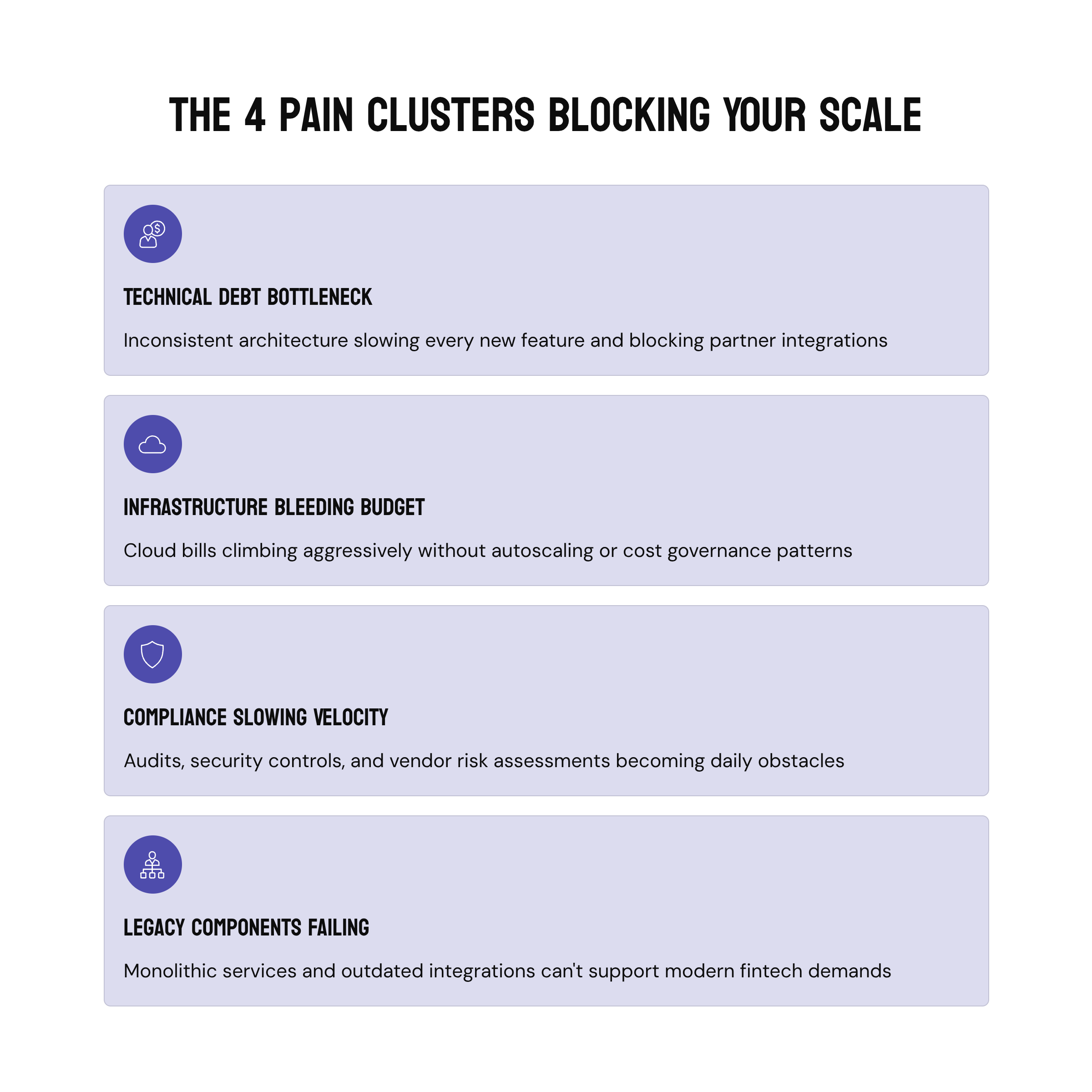

From our experience working with scaling fintechs, four pain clusters consistently appear:

1. Technical Debt Becomes a Growth Bottleneck

Most post-MVP architectures are a patchwork of fast, pragmatic decisions made under pressure. By year two or three, these shortcuts reveal themselves: inconsistent APIs, multiple architectural styles in one codebase, outdated dependencies, quick fixes layered over other quick fixes.

This debt shows up as:

- sluggish feature delivery

- instability during traffic spikes

- inability to onboard new engineers quickly

- integration challenges with banking/fintech partners

- higher risk during audits and SOC 2 readiness

Growing startups must decide what to modernize, what to rebuild, and what to deprecate.

2. Scaling Infrastructure Without Bleeding Budget

Cloud bills climb aggressively as customer usage increases. Without cloud-native patterns, autoscaling, and Observatory tooling, startups overspend dramatically.

2026 will see fintech engineering leaders shift toward:

- containerization and orchestration (Kubernetes, ECS, GKE)

- event-driven and serverless patterns

- automated cloud cost governance

- infrastructure-as-code maturity

This is the foundation for sustainable growth.

3. Meeting Compliance Requirements Without Slowing Down

As fintech startups win larger clients — RIAs, broker-dealers, neobanks, payment companies — they enter a world where audits, reporting, permissioning, security controls, and vendor risk assessments become part of daily work.

Tech strategy must therefore embed:

- encrypted data flows

- access control models

- logging and traceability

- bank-grade API reliability

- formal SDLC and QA practices

Startups that treat compliance as a project fail. Those that treat it as architecture scale.

4. Modernization of Legacy Components

Growing fintechs often run parts of their systems on:

- monolithic services built early

- outdated payment integrations

- legacy data pipelines

- homegrown deployment scripts

Modernization decisions — rewrite vs. refactor vs. modularize — require clarity, not guesswork.

This is where a structured modernization roadmap becomes essential.

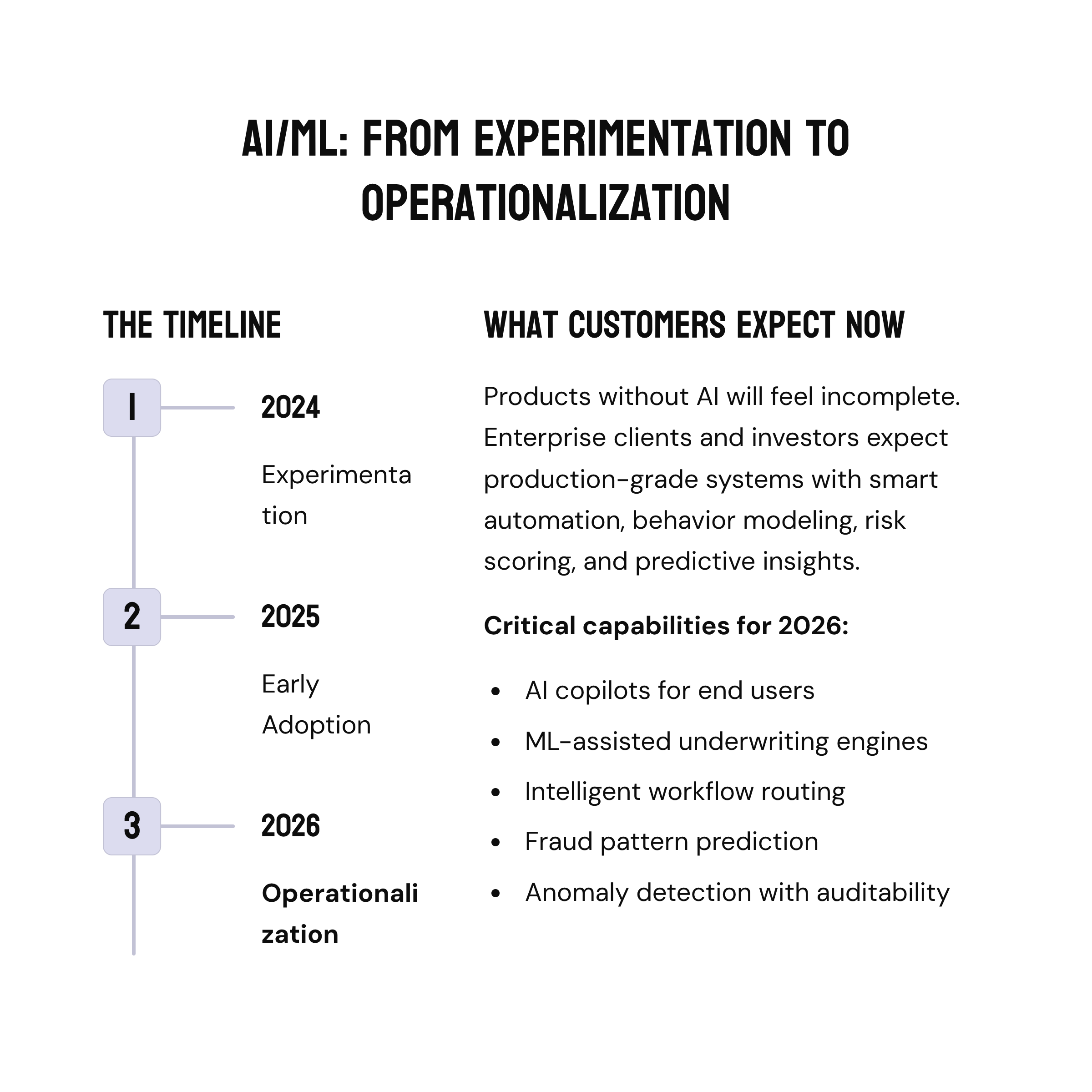

Why AI/ML Adoption Matters Now More Than Ever

2024 was experimentation.

2025 was early adoption.

2026 will be operationalization.

Fintech customers increasingly expect smart automation, behavior modeling, risk scoring, data enrichment, and predictive insights.

The Growing Startup segment experiences the same challenge: they understand the potential of AI/ML, but lack a guided path to implement it safely, ethically, and productively.

AI adoption in 2026 must move beyond prototypes and into production-grade systems:

- AI copilots for end users

- ML-assisted underwriting or risk engines

- AI-driven data categorization

- intelligent workflow routing

- natural-language interfaces

- anomaly detection

- fraud pattern prediction

The expectation from investors and enterprise clients is clear:

Products without AI will feel incomplete.

But implementing AI correctly requires:

- architecture designed for training, inference, and monitoring

- ethical and regulatory considerations

- secure data pipelines

- high-performance compute patterns

- auditability and explainability

Growing startups that navigate this transition early will stand out dramatically in their segment.

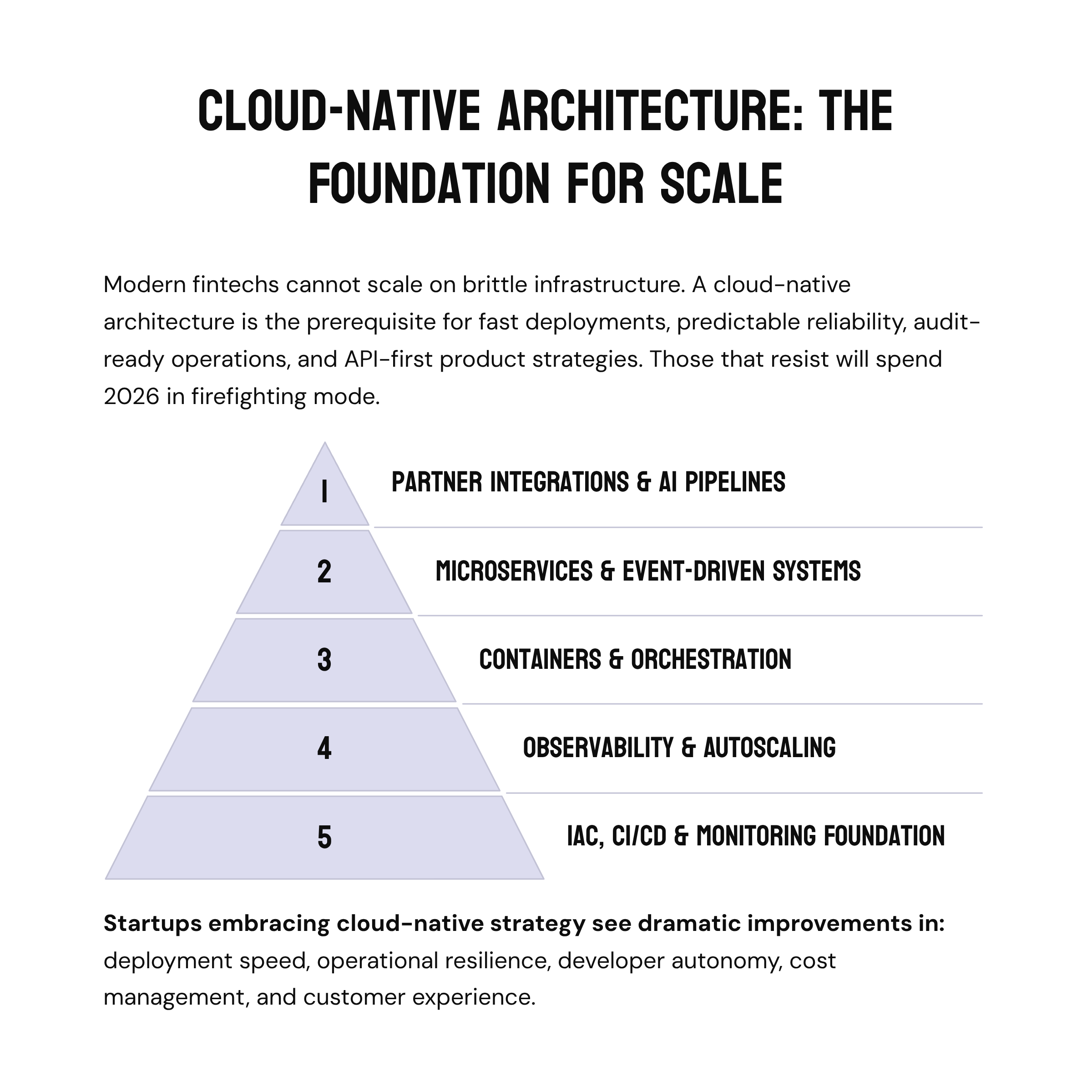

Cloud-Native Architecture as the Foundation for Scale

Modern fintechs cannot scale on brittle infrastructure.

A cloud-native architecture is no longer a preference — it is the prerequisite for:

- fast deployments

- predictable reliability

- audit-ready operations

- integration-heavy ecosystems

- API-first product strategies

In 2026, a modern fintech cloud architecture embraces:

Containers → Microservices → Event-driven systems → Observability → Autoscaling → Zero-downtime deployments

This is often visualized as a Cloud-Native Pyramid, where the foundational layers (IaC, CI/CD, monitoring) support higher-level capabilities (microservices, AI pipelines, partner integrations).

Startups that embrace cloud-native strategy see improvements in:

- deployment speed

- operational resilience

- developer autonomy

- cost management

- customer experience

Those that resist will spend 2026 in firefighting mode.

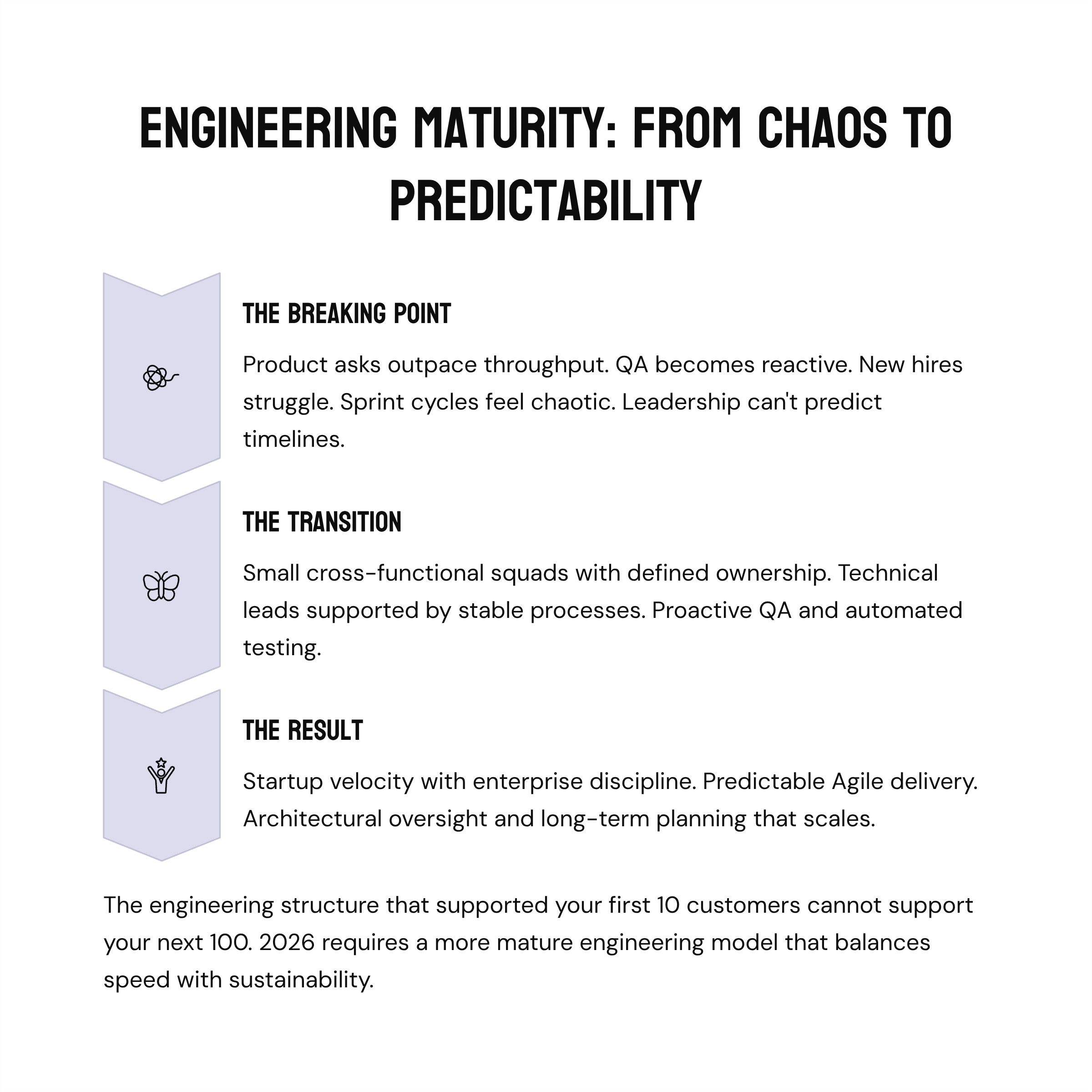

Engineering Team Structure & Agile Maturity for 2026

The engineering structure that supported a startup’s first 10 customers cannot support its next 100.

Growing fintechs often reach a tipping point where:

- product asks outpace engineering throughput

- QA becomes reactive instead of preventive

- new hires struggle to onboard

- sprint cycles feel chaotic

- leadership cannot predict delivery timelines

2026 requires a more mature engineering model:

- small cross-functional squads

- defined ownership areas

- technical leads supported by stable processes

- proactive QA and automated testing

- architectural oversight and long-term planning

- predictable Agile delivery frameworks

The teams that succeed create a balance:

maintaining startup velocity while gaining enterprise discipline.

When Fintechs Should Use INSART’s Accelerator Model

INSART’s Engineering Accelerator Model becomes relevant when a startup feels the pressure of growth hitting the limits of its technical foundation.

This typically happens at moments like:

- the product needs to scale faster than the team can deliver

- modernization must happen without stopping development

- AI/ML adoption requires new architectures

- the startup is preparing for fundraising and must show engineering maturity

- enterprise clients require stronger reliability and compliance posture

- integrations with multiple financial partners create architectural strain

INSART’s accelerator supports this transition by combining:

- modernization expertise

- cloud-native engineering

- AI enablement

- team augmentation

- architectural leadership

- compliance-ready engineering practices

This model helps Growing Startups reach Phase II scale — the period when they graduate from “we built something that works” to “we built a platform ready for expansion.”

Instead of Conclusion

Fintech startups entering 2026 face an industry where pace, intelligence, reliability, and compliance define competitive advantage. The companies that succeed will be those who use this December–January planning window to rethink their architecture, modernize their infrastructure, introduce AI capabilities, and strengthen engineering execution.

If you want your 2026 technology strategy to be clear, actionable, and investor-ready, INSART offers dedicated December consultations to help fintech founders assess where they stand and outline a modernization roadmap.

Book your December consultation today.