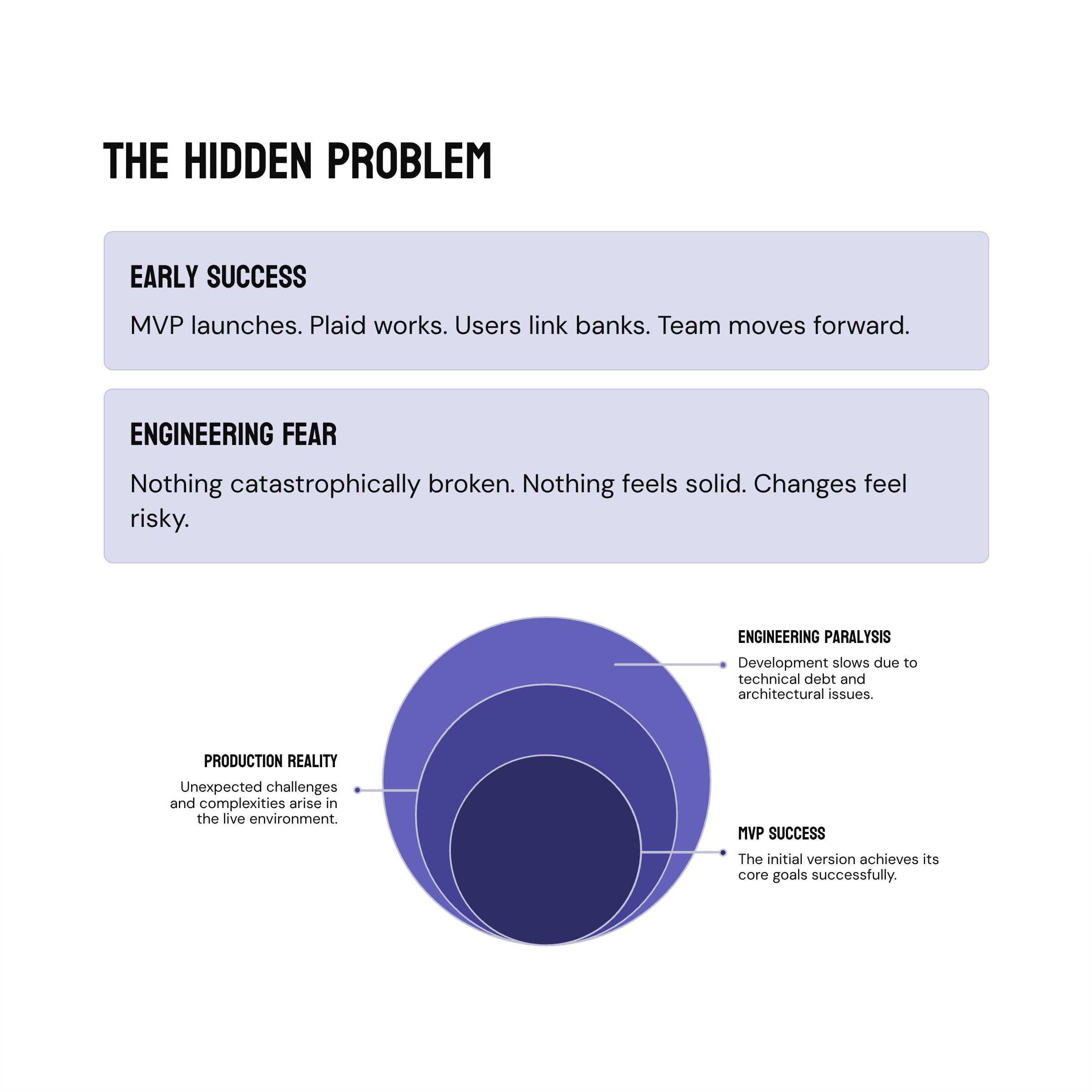

Most fintech teams integrate Plaid early. It usually happens during MVP or shortly after launch, when the priority is speed rather than rigor. The team follows the documentation, drops in Plaid Link, confirms that bank accounts can be connected, and moves on to the next milestone.

At that stage, the integration works well enough. Users can link their bank accounts. Verification passes. Onboarding flows forward.

The problem is that Plaid rarely stays an MVP concern for long.

As usage grows and real users start interacting with real banks under real conditions, bank account linking quietly becomes one of the most fragile and business-critical parts of the entire product. Conversion drops at the exact moment users are asked to connect their bank. Support tickets increase, but logs provide little clarity. Engineers hesitate to touch the integration because even small changes feel risky.

Nothing is catastrophically broken. Yet nothing feels solid.

This is typically the point where INSART is brought in. Not to “add Plaid,” but to rebuild confidence in an integration that has become core infrastructure.

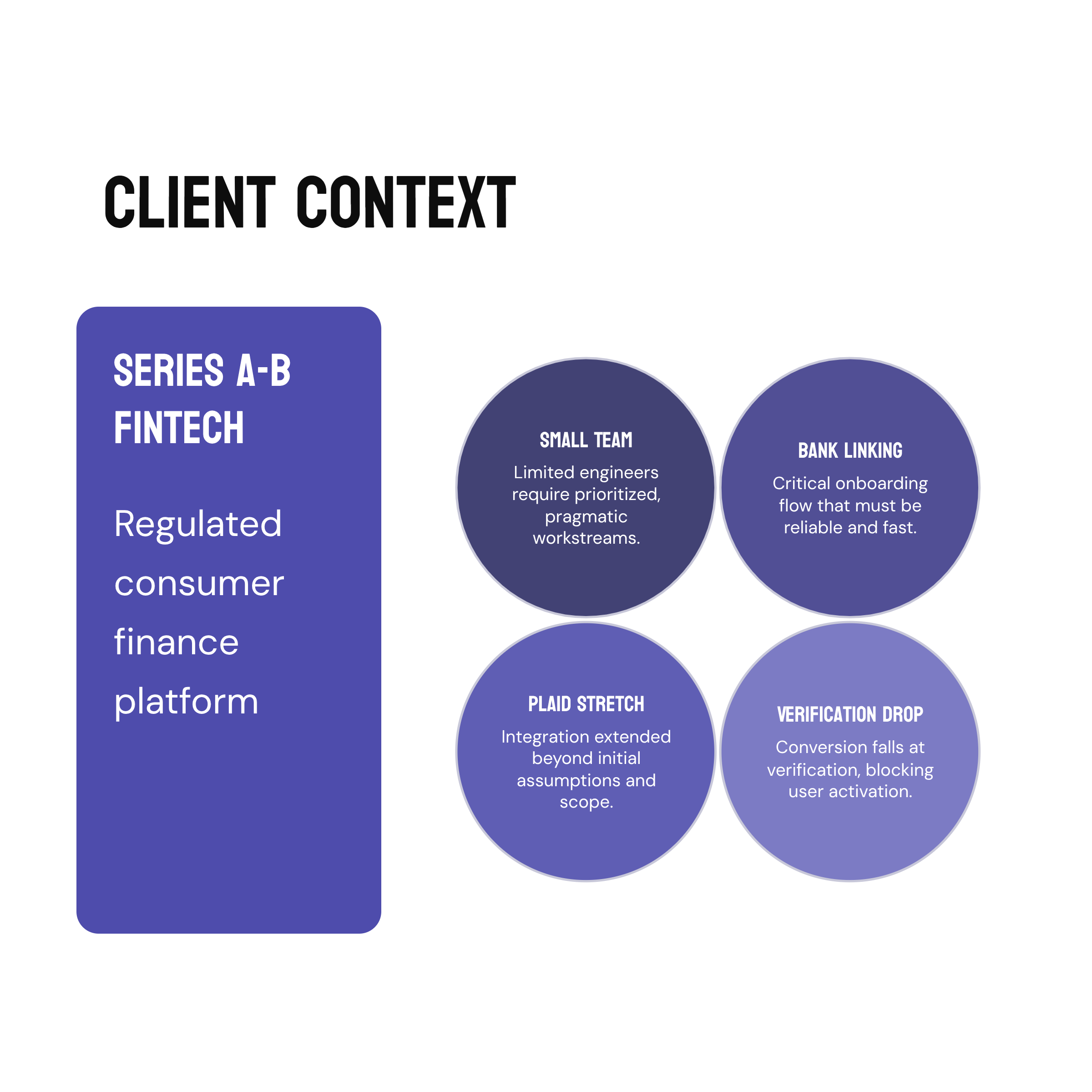

Client Context

The client in this case was a regulated fintech platform operating in consumer finance. The exact vertical could have been lending, payments, wealth workflows, or cash management. What mattered was that bank account linking sat directly on the critical path of onboarding. If Plaid failed, the business stalled.

The company was at a Series A to early Series B stage, with a growing engineering team of around 10–15 people. Plaid had already been implemented internally and was live in production. The initial integration had been built quickly and pragmatically, which was the right call at the time.

By the time INSART joined, however, that early implementation had been stretched far beyond what it was designed for.

Initial Situation

From a product perspective, the symptoms were subtle but persistent. Conversion dropped noticeably during the bank-linking step. Some institutions seemed to work reliably, while others failed more often, without a clear explanation. Users abandoned onboarding after vague errors, and support struggled to diagnose issues after the fact.

From an engineering perspective, the picture was more concerning. Tokens were encrypted, but lifecycle rules were inconsistent. Items were assumed to be permanently connected even when Plaid was signaling otherwise. Invalid or expired tokens caused downstream failures that appeared unrelated to Plaid at first glance. Sandbox testing gave false confidence because production behavior diverged in important ways.

Logging existed, but it focused on application errors rather than integration health. Monitoring showed uptime, not correctness. There was no single mental model of how the Plaid integration actually behaved over time.

The integration worked often enough to ship features, but not reliably enough to trust.

Resetting the Mental Model

Before touching any code, INSART reframed how the team thought about Plaid.

We made one thing explicit: Plaid is not an SDK that you drop into onboarding and forget about. It is a distributed financial system dependency, and it needs to be treated with the same seriousness as payments infrastructure or identity verification.

That shift in mindset changed how decisions were made. Instead of asking whether something “worked,” the team started asking whether they could explain what happened when it failed, whether they could prove how credentials were handled, and whether the system could be observed under real load.

Only after aligning on this perspective did the technical redesign begin.

Designing the Architecture Around Ownership

INSART rebuilt the Plaid integration as a first-class backend subsystem, with clear ownership boundaries.

The client application was intentionally simplified. Its responsibility was reduced to initiating the linking flow and rendering states returned by the backend. All sensitive logic moved into the backend, where it could be secured, audited, and evolved safely.

Diagram: High-Level Plaid Linking Architecture

[Client Application]

- Initiates bank linking

- Displays connection state

- No access to tokens or Plaid APIs

[Backend Platform]

- Link token generation

- Public token exchange

- Encrypted access token storage

- Item lifecycle management

- Webhook verification & handling

- Observability & monitoring

[Plaid]

- Plaid Link UI

- Bank authentication

- Data provider

- Event sourceThis separation eliminated entire classes of risk related to token leakage, inconsistent state, and environment confusion.

Rebuilding the End-to-End Linking Flow

With architecture clarified, INSART rebuilt the Plaid Link flow as a deterministic, state-driven process. Every step was modeled explicitly, and every outcome had a defined meaning inside the system.

When a user initiated bank linking, the backend generated a short-lived link token scoped precisely to the intended verification use case. Once Plaid Link completed, the returned public token was treated as a transient artifact and exchanged immediately on the backend.

The resulting item was persisted with explicit metadata: environment, creation time, current status, and verification intent. From that moment forward, the system always knew exactly where each bank connection stood.

Diagram: Bank Linking Lifecycle

User initiates linking

→ Backend creates link_token

→ Plaid Link opens

→ User authenticates bank

→ public_token returned

→ Backend exchanges token

→ Item created with explicit state

→ Verification and monitoring begin

Nothing was implied. Nothing happened silently.

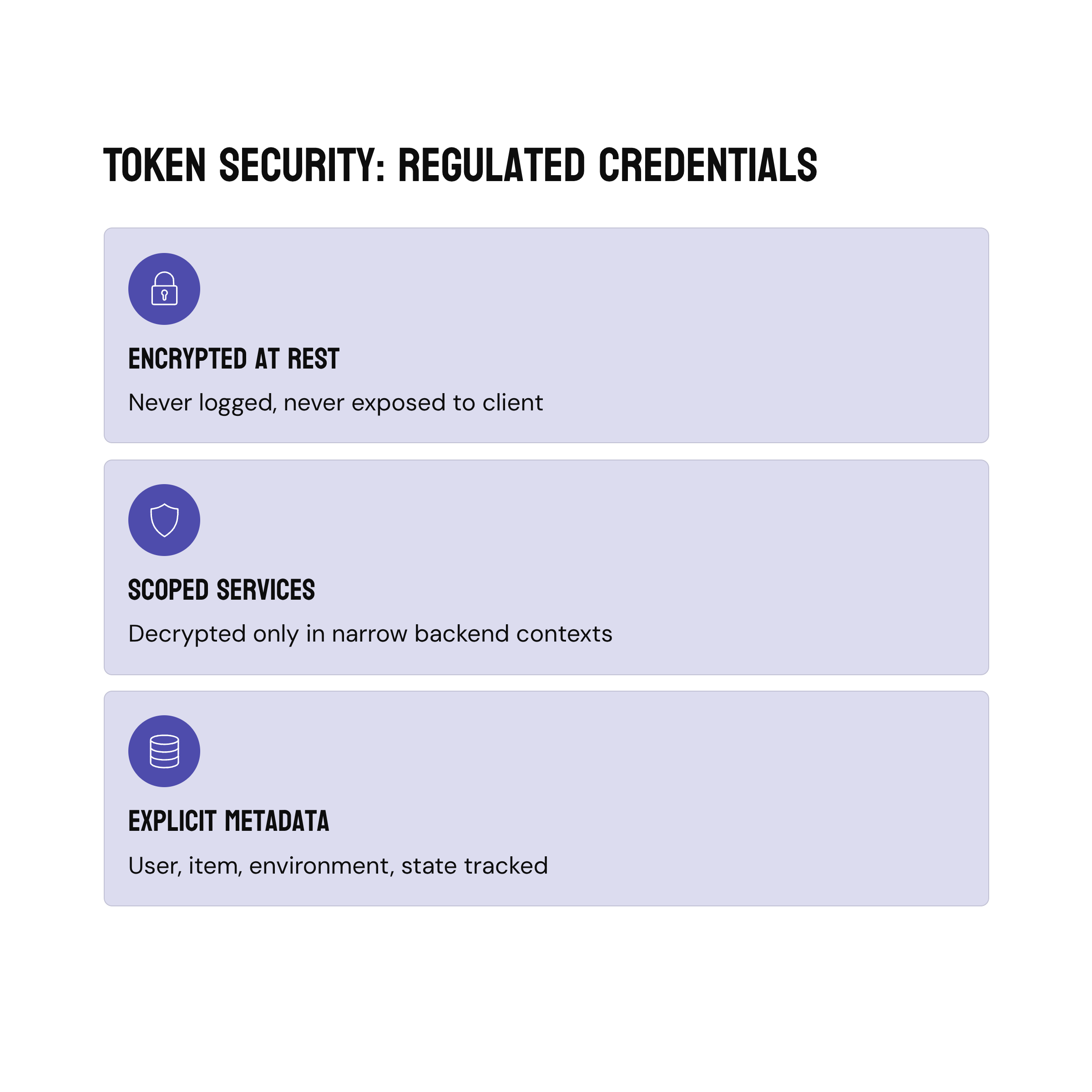

Treating Tokens as Regulated Credentials

One of the most important improvements was how Plaid tokens were handled. Instead of treating them like ordinary API credentials, INSART treated them as regulated artifacts with strict lifecycle rules.

Tokens were encrypted at rest, never logged, never exposed to the client, and only decrypted inside narrowly scoped backend services. Each token was associated with a user, an item, an environment, and a known state.

Code Sample: Secure Token Exchange and Storage

async function exchangePublicToken(publicToken: string, userId: string) {

const response = await plaidClient.itemPublicTokenExchange({

public_token: publicToken

});

const encryptedToken = await encryptionService.encrypt(

response.data.access_token

);

await itemRepository.create({

userId,

itemId: response.data.item_id,

accessToken: encryptedToken,

status: 'active',

environment: process.env.PLAID_ENV,

createdAt: new Date()

});

}

The code itself was straightforward. What mattered was the discipline around where it lived, how it was invoked, and how little it exposed.

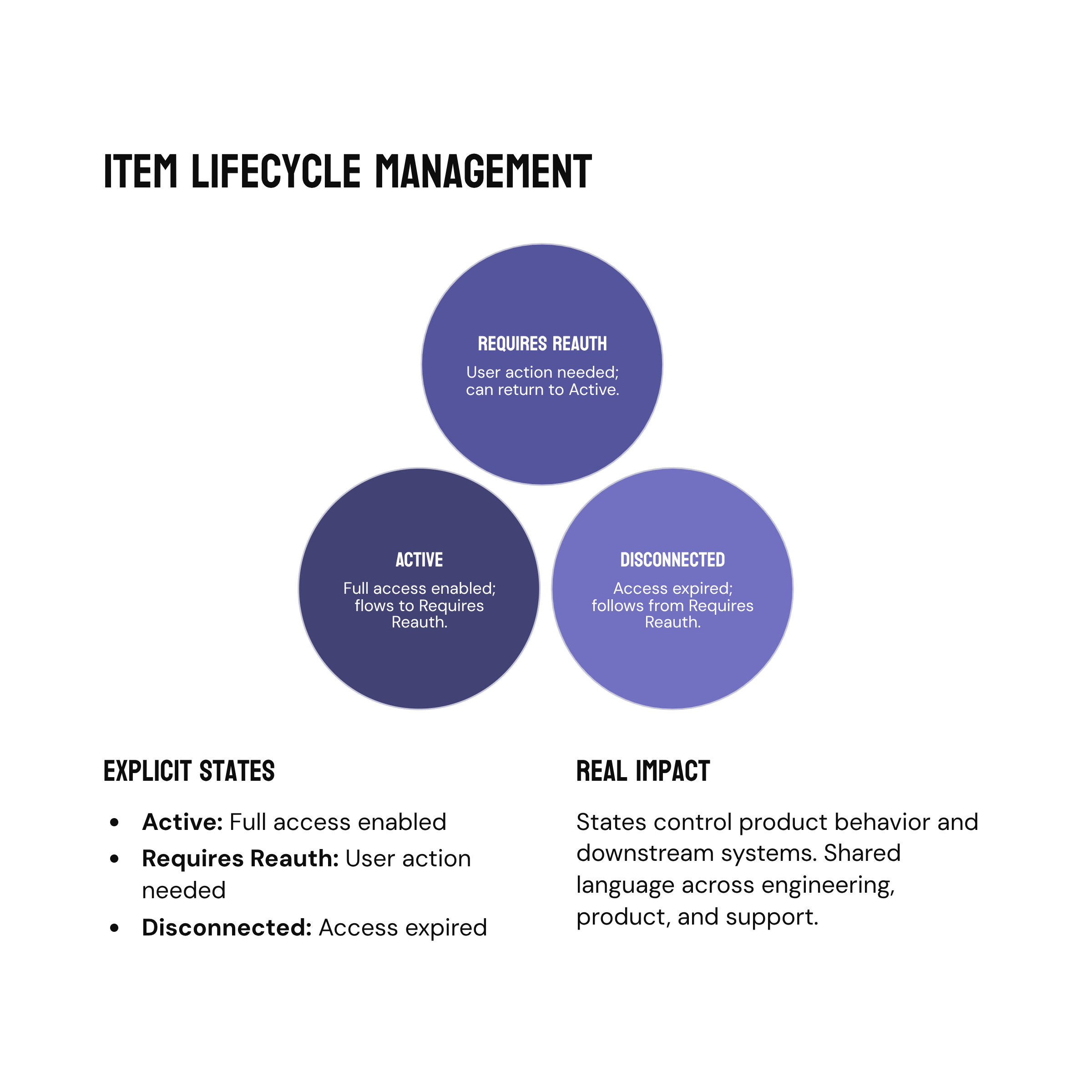

Explicit Item Lifecycle Management

INSART introduced an explicit lifecycle model for Plaid items. Rather than assuming a connected account would remain connected indefinitely, the system modeled real-world banking behavior directly.

Items could be active, require reauthentication, or be fully disconnected. These states were not cosmetic. They controlled what the product allowed users to do and how downstream systems behaved.

Diagram: Item State Transitions

active

→ requires_reauth

→ active

→ disconnected

This shared language aligned engineering, product, and support teams and eliminated ambiguity during incidents.

Webhooks as Signals, Not Commands

Webhooks were redesigned around a simple principle: they signal that something changed, but they do not dictate what the system should do.

Every webhook was cryptographically verified, persisted exactly as received, and processed idempotently. Events triggered background jobs that performed controlled syncs or state transitions based on current context.

Code Sample: Webhook Verification

function verifyPlaidWebhook(rawBody: string, signature: string) {

return crypto.timingSafeEqual(

Buffer.from(signature),

Buffer.from(

crypto

.createHmac('sha256', process.env.PLAID_WEBHOOK_SECRET!)

.update(rawBody)

.digest('hex')

)

);

}

This design made the integration resilient to retries, duplicates, and out-of-order delivery.

Error Handling That Preserves User Trust

Instead of surfacing raw Plaid errors directly to users, INSART introduced an error-mapping layer that translated technical failures into meaningful product states.

Credential expiration became a reauthentication prompt. Invalid tokens became a clean disconnect state. Unknown errors were handled conservatively, without confusing users.

Code Sample: Error Mapping

function mapPlaidError(errorCode: string) {

switch (errorCode) {

case 'ITEM_LOGIN_REQUIRED':

return { state: 'requires_reauth', userMessage: 'Reconnect your bank' };

case 'INVALID_ACCESS_TOKEN':

return { state: 'disconnected', userMessage: 'Bank access expired' };

default:

return { state: 'unknown', userMessage: 'Temporary issue detected' };

}

}

This change alone reduced support volume and improved onboarding completion.

Observability Built for Real Questions

INSART introduced integration-specific observability, focused on questions the team actually needed answered.

Metrics included linking success rates by institution, token exchange failures, item state distribution, reauthentication frequency, and webhook processing latency. These signals made the integration visible for the first time.

Diagram: Plaid Integration Health Dashboard

Link success rate by institution

Token exchange errors

Item state distribution

Reauthentication frequency

Webhook processing latency

Handover and Ownership Transfer

The project concluded with comprehensive handover documentation focused on operations rather than theory. Architecture diagrams, failure scenarios, token handling rules, reauthentication flows, and incident response guidelines were all documented.

INSART’s goal was not long-term dependency. It was ownership transfer.

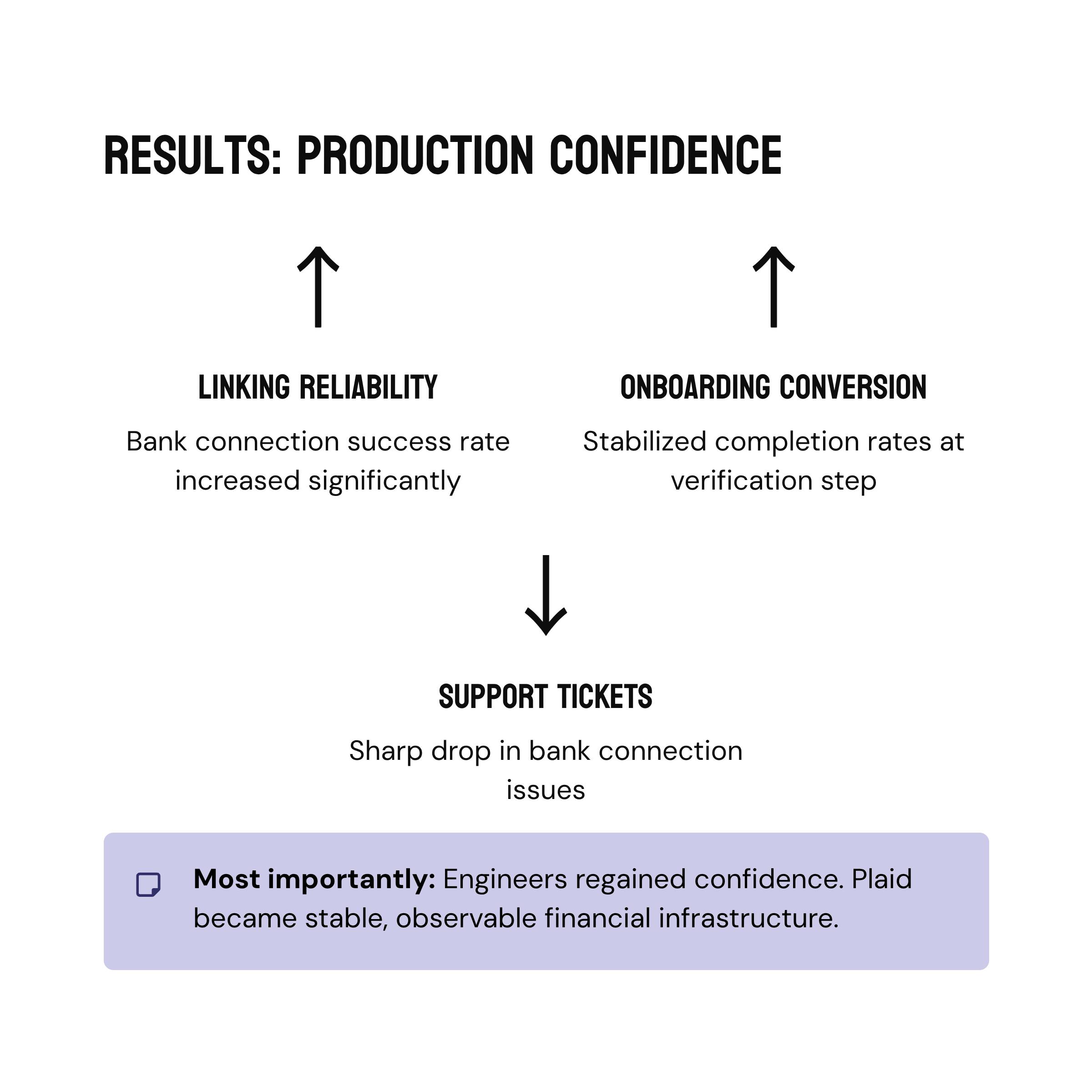

Outcome

The results were immediate. Bank linking reliability increased. Onboarding conversion stabilized. Support tickets related to bank connections dropped sharply. Engineers regained confidence in the integration and could iterate without fear.

Most importantly, the platform crossed a threshold. Plaid was no longer a fragile dependency. It had become stable, observable financial infrastructure.

Closing Thought

Bank account linking is often underestimated because it works early. The real challenge appears later, when scale, regulation, and user expectations collide.

INSART’s approach treats Plaid integration as a long-term commitment to ownership, security, and observability. This case study reflects how that commitment is built, deliberately and end-to-end.