TL;DR

Across top SaaS products, the biggest revenue unlock in onboarding is getting users to value fast (shorter time-to-value) and guiding them to a clearly defined activation moment. Patterns that work again and again: gradual engagement (Duolingo), activation-first flows (Slack), frictionless entry (Zoom), referral at the moment of delight (Dropbox), and zero-blank-screen starts via templates (Notion). Below is a practical teardown of each pattern plus concrete flow suggestions for a fintech SaaS.

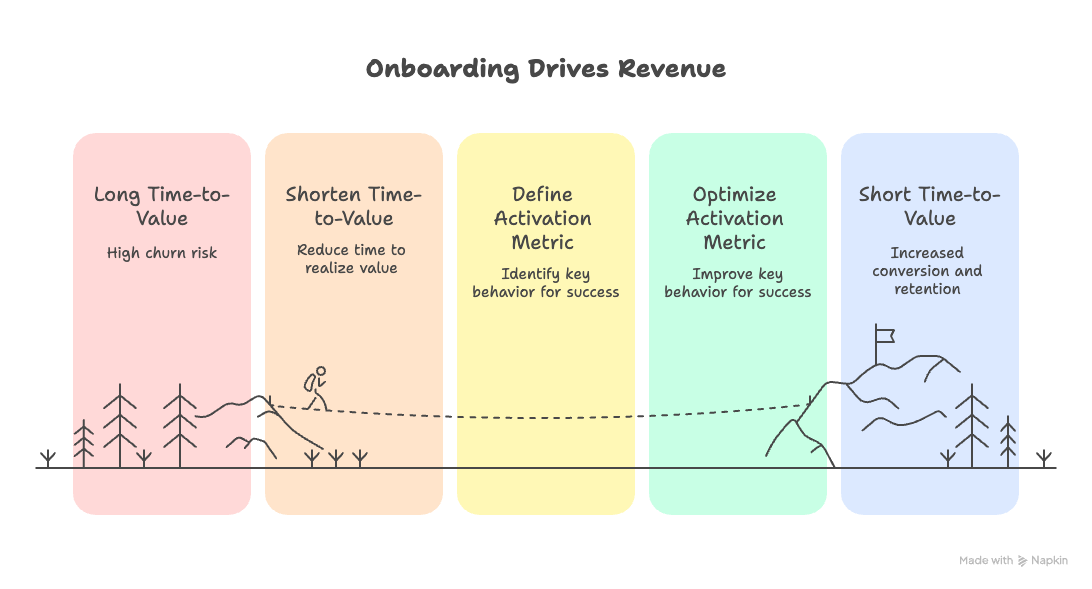

Why onboarding drives revenue (not just “nice UX”)

Time-to-value (TTV) is directly tied to conversion and retention; the longer it takes to realize value, the higher the churn risk. Onboarding is the prime place to shorten TTV.

Teams that define and optimize a crisp activation metric (the behavior that predicts long-term success) see step-changes in paid conversion and expansion.

Pattern 1 — Gradual Engagement (Duolingo)

What Duolingo does

Duolingo lets you start learning before creating an account. Registration is postponed until you’ve experienced a win—classic “gradual engagement.”

Sample screen analysis from UX Collective.

Why it works

Commitment feels justified after an “aha” moment. Reducing friction pre-value boosts completion of the first session and makes later asks (profile, payment) feel reasonable.

Fintech flow to copy

Start playable: Offer a 60-second demo portfolio or sample ledger on first visit. Let users click through reconciled transactions or a mock risk report—no setup.

Defer heavy asks: Gate KYC / billing only when moving from demo to “use with my data.” Keep early walls to the legally required minimum; collect the rest as progressive profiling after first value.

Psychology: Label the path “Try a sample report first (1 minute)” vs. “Set up your account.” The former frames immediate value.

Pattern 2 — Activation-First Design (Slack)

What Slack does

Slack’s early flows nudge toward the behavior that predicts long-term success—collaboration. Inviting teammates, and historically hitting defined usage thresholds (e.g., message counts), are treated as the goal of onboarding.

Why it works

Onboarding that optimizes for the right action (not just sign-ups completed) compounds ARR: users who reach activation are far more likely to convert and retain.

Fintech flow to copy

Define activation: e.g., “Generated first reconciled report,” “Connected a bank feed + saw insights,” or “Created first compliant client profile.” Put this on a 3-step checklist visible everywhere.

Design the slope: Make the activation step the default next action on each screen; everything else is optional or postponed.

Celebrate activation: Replace “Welcome” with an achievement screen that shows saved time (“You automated 50 transactions”), and unlocks the next value loop (e.g., scheduling an auto-report).

Pattern 3 — Frictionless Entry (Zoom)

What Zoom does

You can join a Zoom meeting without an account; the path from invite → value is intentionally minimal.

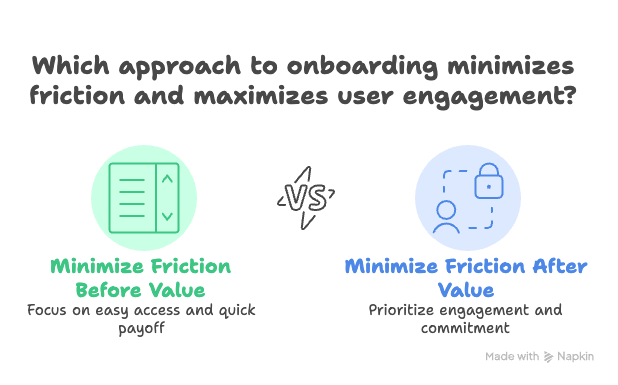

Why it works

Minimize the steps between curiosity and payoff. Friction after value is less harmful than friction before value.

Fintech flow to copy

One-tap SSO (Google/Microsoft) for trials; magic links preferred over passwords.

Guest/sandbox mode: Let prospects “join” a live demo workspace or view read-only analytics with sample data—no commitment.

Inline install: When integrations are required (banks, brokerages), prepare OAuth in-app with prefilled context and a promise: “Back here in 30 seconds.”

Pattern 4 — Referrals at the Moment of Delight (Dropbox)

What Dropbox did

Dropbox’s legendary two-sided referral—rewarding both sender and recipient—was surfaced when users felt the product’s value, driving outsized growth.

Why it works

Referrals convert best when placed immediately after the first “wow.” Incentives mirror core value (Dropbox gave storage).

Fintech flow to copy

Place it right: Show referral after activation (“Your first portfolio is synced”).

Make it double-sided: Offer both parties perks tied to your core value: free automated reconciliations, extra client seats for a month, or discounted advisory reports.

Reduce toil: One-click share with precomposed copy and compliance-approved language.

Pattern 5 — Zero Blank Screens via Templates (Notion)

What Notion does

Notion’s Template Gallery lets users start with structured pages and databases instead of a blank canvas, accelerating first success.

Why it works

Blank states are silent churn. Templates create instant scaffolding and teach the product’s “grammar” by example. (Empty-state best practices consistently recommend showing context + next action.)

Fintech flow to copy

Industry templates: Prebuilt “RIA onboarding checklist,” “KYC + risk profile,” “Quarterly performance report,” “Revenue forecast” templates.

Contextual empty states: If no accounts are connected, show a filled sample dashboard + primary CTA (“Connect your custodian → match this with your data”).

Template swapping: Let users switch templates easily—early choice shouldn’t feel binding.

Pattern 6 — Concierge for High-Value Segments (Superhuman)

What Superhuman popularized

A high-touch, expert-led setup that ensures first value and habit formation—even if it doesn’t scale to every user, it can be ROI-positive for high-LTV segments.

Why it works

Concierge onboarding shortens learning curves for complex workflows and cements product behavior quickly—especially for executive buyers or larger teams.

Fintech flow to copy

Targeting: Offer a 15-minute “done-with-you” setup to firms above a seat/LTV threshold.

Script the session: Connect data sources → demonstrate automated categorization → ship the first compliance report live.

Operationalize: Pre-record micro-demos for mid-market; reserve live sessions for enterprise.

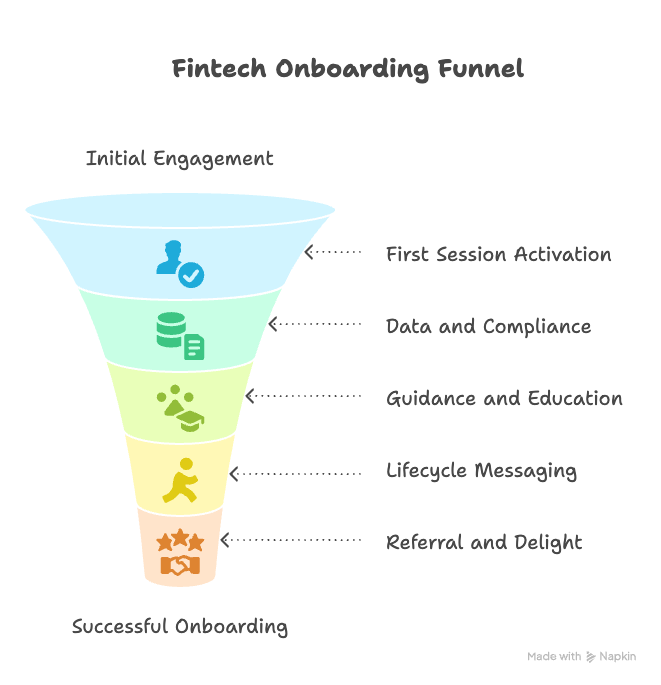

A practical fintech onboarding blueprint (combine the patterns)

Before sign-up (Duolingo + Zoom):

“Try a live sample dashboard” entry point; no account needed.

Promise up front: “See a client-ready report in 60 seconds.”

First session (Slack + Notion):

Single activation checklist (3 steps): Connect one data source → auto-categorize N items → export a PDF/CSV.

Start with a template (e.g., “Wealth summary for ACME Household”) and show exactly what the end report looks like.

Data & compliance (Duolingo-style deferral):

Ask only what’s legally required to preview value; defer the rest to post-activation progressive profiling.

Guidance & education:

Replace tooltips with guided, clickable tasks (“Auto-apply these 3 rules to your last 50 transactions”).

In empty spots, show one next action with context, not a carousel of tips.

Lifecycle messaging (timed to behavior):

Day 0 in-app nudge: “You’re one step from your first export.”

Day 1 email: deep link straight to OAuth bank connect.

Day 3: 60-second video “From messy ledger to compliant report.”

Delight → referral (Dropbox):

After the first export, surface a double-sided referral tied to core value (“Both firms get 1 month of auto-reconciliation”).

Safety rails:

Accessibility and clarity (contrast, copy, states) in every first-run component.

Escape hatches: “Use sample data instead” on any step that might stall.

What to measure (and how to learn fast)

Activation rate within 24/48 hours (your defined “aha”). Benchmarks vary by product; use internal baselines, not vanity metrics.

Time-to-first-value (median minutes/hours from first session to activation). Reduce relentlessly.

Checklist completion and per-step drop-off (especially at integrations/KYC).

Early-life retention (week 1, day 7 task completion) and trial→paid.

Support contacts per new account (down = clarity up).

Referral rate after activation (exposure + conversion).

Experiment ideas

Sample-first vs. setup-first entry.

3-step activation checklist vs. multi-card tour.

SSO only vs. SSO + email/password.

Referral shown at activation vs. after 24 hours.

Concierge nudge shown to high-intent vs. broad audience.

Anti-patterns to avoid

Blank dashboards with generic tips (users bounce). Use templates + previews.

All fields now, value later (premature KYC/profile overload). Defer non-essential asks.

Onboarding tours that teach features, not outcomes. Swap for tasks that produce an outcome (e.g., an actual export).

Referrals buried in settings. Trigger at the moment of delight.

One-page onboarding spec you can hand to your team

Activation = “First compliant report exported” (or your equivalent).

Promise on hero: “See it in 60 seconds (sample data).”

Checklist (global): Connect data → Auto-categorize 50 → Export.

Templates: Provide 3 finance-specific starter templates; sample data preloaded.

Progressive profiling: Ask for firm details only after export.

Lifecycle: Day 0 in-app nudge; Day 1 deep-link email; Day 3 short video.

Referral: Double-sided, shown on export success (Dropbox-style).

Concierge: Offer to >X seats or high-intent; tight script to guarantee first value.

Metrics: Activation 48h, TTV median, drop-offs by step, support contacts per new account.

Final Word: Onboarding as a Growth Engine

The examples from Slack, Dropbox, and Canva prove that onboarding is not just a UX nicety—it’s a direct revenue driver. In all three cases, the companies treated onboarding as an evolving product, not a static welcome screen. They used clear guidance, contextual nudges, and personalized flows to reduce friction at every step.

For SaaS startups, especially in fintech where trust and clarity are paramount, a well-designed onboarding process can shorten the path to value, improve retention, and dramatically increase ARR. The lesson is clear: the moment a user signs up is the most critical touchpoint you have—optimize it relentlessly.

When building or revamping onboarding:

Map the shortest route to “aha”

Segment users for relevance

Automate reminders and support touchpoints

Measure, test, and iterate constantly

In competitive markets, onboarding done right isn’t just good design—it’s a competitive advantage that can mean the difference between churn and growth.