At some point, every wealth management platform reaches a quiet but decisive moment.

It usually does not happen during a launch or a funding announcement. It happens when the platform grows beyond its early assumptions. When advisors rely on it daily. When client reports are no longer “nice to have” but scrutinized. When data inconsistencies stop being tolerable and start being dangerous.

That is when portfolio accounting enters the conversation.

Not as a feature. Not as an enhancement. But as infrastructure.

This case study explores how INSART would approach the integration of a portfolio accounting and performance engine into a wealth management platform serving registered investment advisors. It is not about wiring APIs together. It is about designing a system that can be trusted under regulatory pressure, operational complexity, and long-term growth.

The Moment the Platform Grows Up

The platform already exists. Advisors are using it. Clients log in. Reports are generated. But under the surface, something is missing.

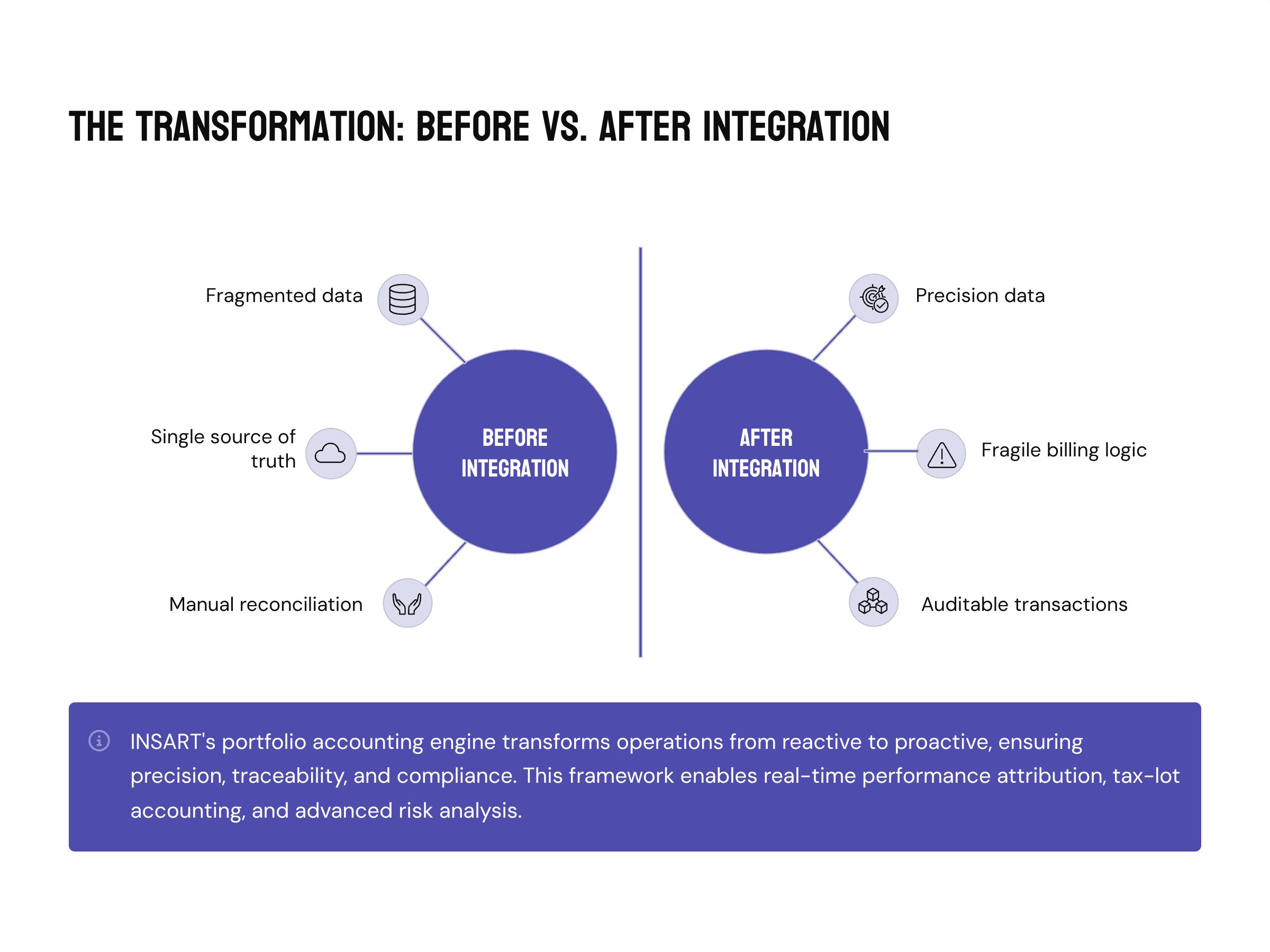

Performance data is fragmented. Holdings are reconciled manually. Billing logic lives in spreadsheets. The platform works, but only as long as everyone agrees not to look too closely.

Introducing a portfolio accounting engine changes that dynamic instantly.

Suddenly, there is a source of truth. One that does not tolerate approximation. One that has opinions about how transactions are recorded, how performance is calculated, and how history is preserved.

INSART’s first step is not technical. It is conceptual.

We establish a clear rule that will guide every decision going forward:

The accounting engine owns truth.

The platform owns experience.

Everything else follows from that.

Drawing the Boundary Between Truth and Experience

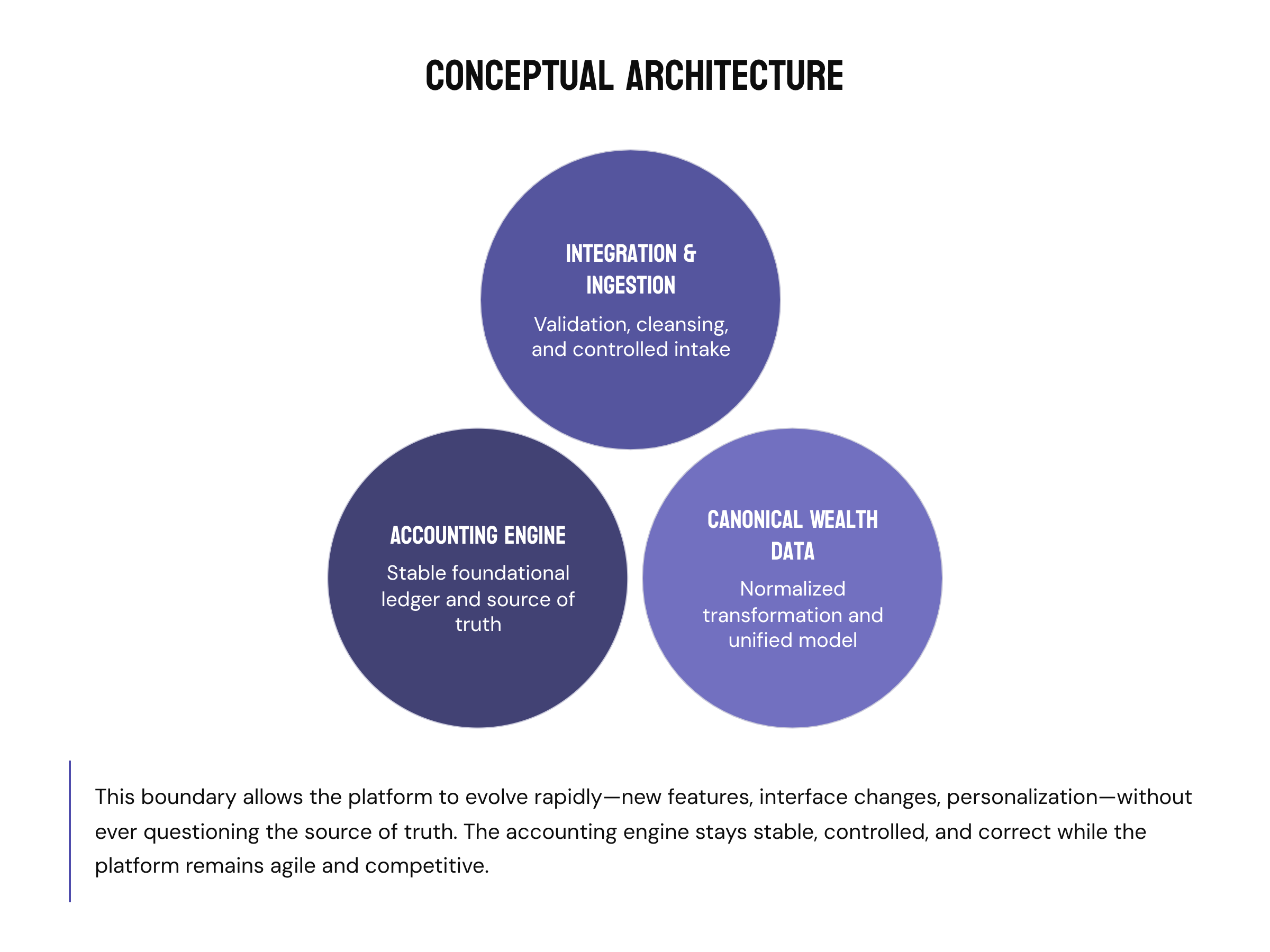

It is tempting to treat a portfolio accounting system as a backend like any other. INSART resists that temptation early.

Accounting engines are built for correctness, auditability, and reconciliation. They are not built for experimentation, rapid UX changes, or low-latency personalization. Trying to use them directly as the backbone of a modern platform usually leads to brittle systems and uncomfortable compromises.

Instead, INSART designs the integration so that the accounting engine remains authoritative, but insulated.

Conceptual Architecture

Accounting Engine

|

| Secure, controlled data access

v

Integration & Ingestion Layer

|

| Validation, normalization, reconciliation

v

Canonical Wealth Data Layer

|

| Contextual views and analytics

v

Wealth Management PlatformThis boundary allows the platform to evolve without ever questioning where official numbers come from.

Ingestion as a Discipline, Not a Pipeline

The next realization comes quickly. Portfolio data does not behave like product data.

Transactions arrive late. Corporate actions rewrite history. Fees appear retroactively. Holdings change for reasons no one anticipated.

INSART does not fight this reality. We design for it.

Data ingestion is treated as a controlled, repeatable process. Not as a fire-and-forget sync.

Each data category is handled differently. Holdings are synchronized predictably. Transactions are ingested incrementally with reconciliation logic. Performance data is treated as snapshot-based, not recalculated on the fly.

This creates a system where data changes are expected, traceable, and explainable.

Making Sense of Complex Accounting Schemas

Portfolio accounting systems speak their own language. Their schemas reflect decades of financial logic, not modern application design.

INSART introduces a canonical data layer that translates this language into something the platform can reason about.

Data Transformation Flow

Vendor-Specific Schema

|

| Field mapping and validation

v

Canonical Portfolio Model

|

| Contextual projections

v

Advisor and Client ViewsThis layer is intentionally boring. Stable schemas. Versioned changes. Explicit lineage.

The benefit becomes clear later, when features evolve without requiring renegotiation of the integration itself.

Compliance Becomes Part of the Architecture

At this stage, compliance quietly moves from the background to the center.

Not through policies. Through design.

Data ingested from the accounting engine is immutable. Corrections are additive, never destructive. Every value displayed can be traced back to its origin. Access is governed by role, context, and intent.

Audit trails are not an afterthought. They are a natural byproduct of how the system operates.

Compliance Visibility

Source Data

|

v

Ingestion Logs

|

v

Transformation Records

|

v

Access and Usage LogsWhen questions arise, the system answers them without panic.

Security Without Drama

The integration itself becomes one of the most sensitive parts of the platform. INSART treats it accordingly.

Credentials are isolated. Access is tightly scoped. Network boundaries are explicit. No client application ever touches the accounting system directly.

This is less about paranoia and more about inevitability. Systems evolve. Teams change. Threat models shift.

Security that depends on discipline eventually fails. Security that is enforced by architecture scales.

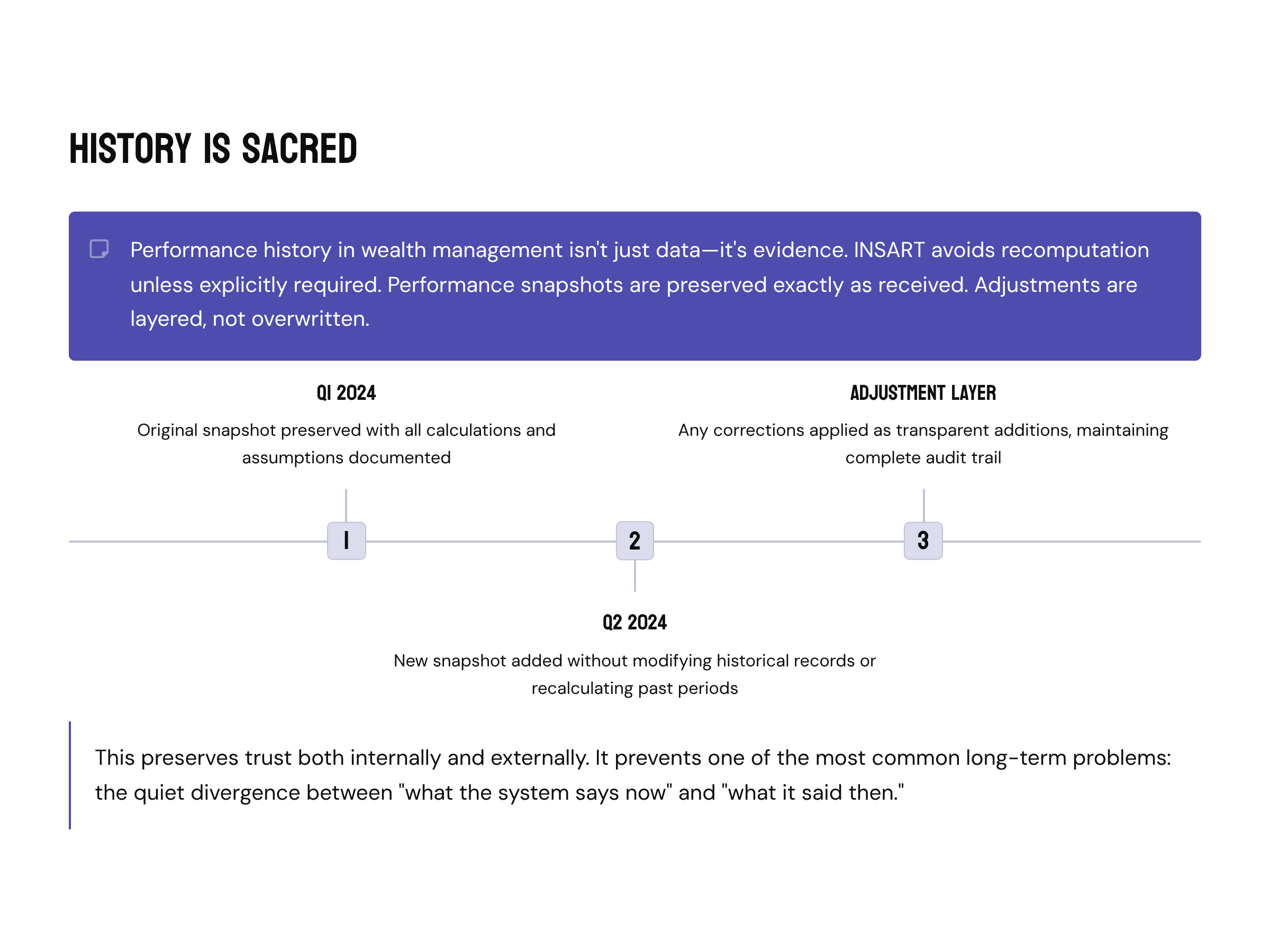

History Is Sacred

Performance history in wealth management is not just data. It is evidence.

INSART avoids recomputation unless explicitly required. Performance snapshots are preserved as they were received. Adjustments are layered, not overwritten.

This preserves trust. Both internally and externally.

It also prevents one of the most common long-term problems in wealth platforms: the quiet divergence between “what the system says now” and “what it said then”.

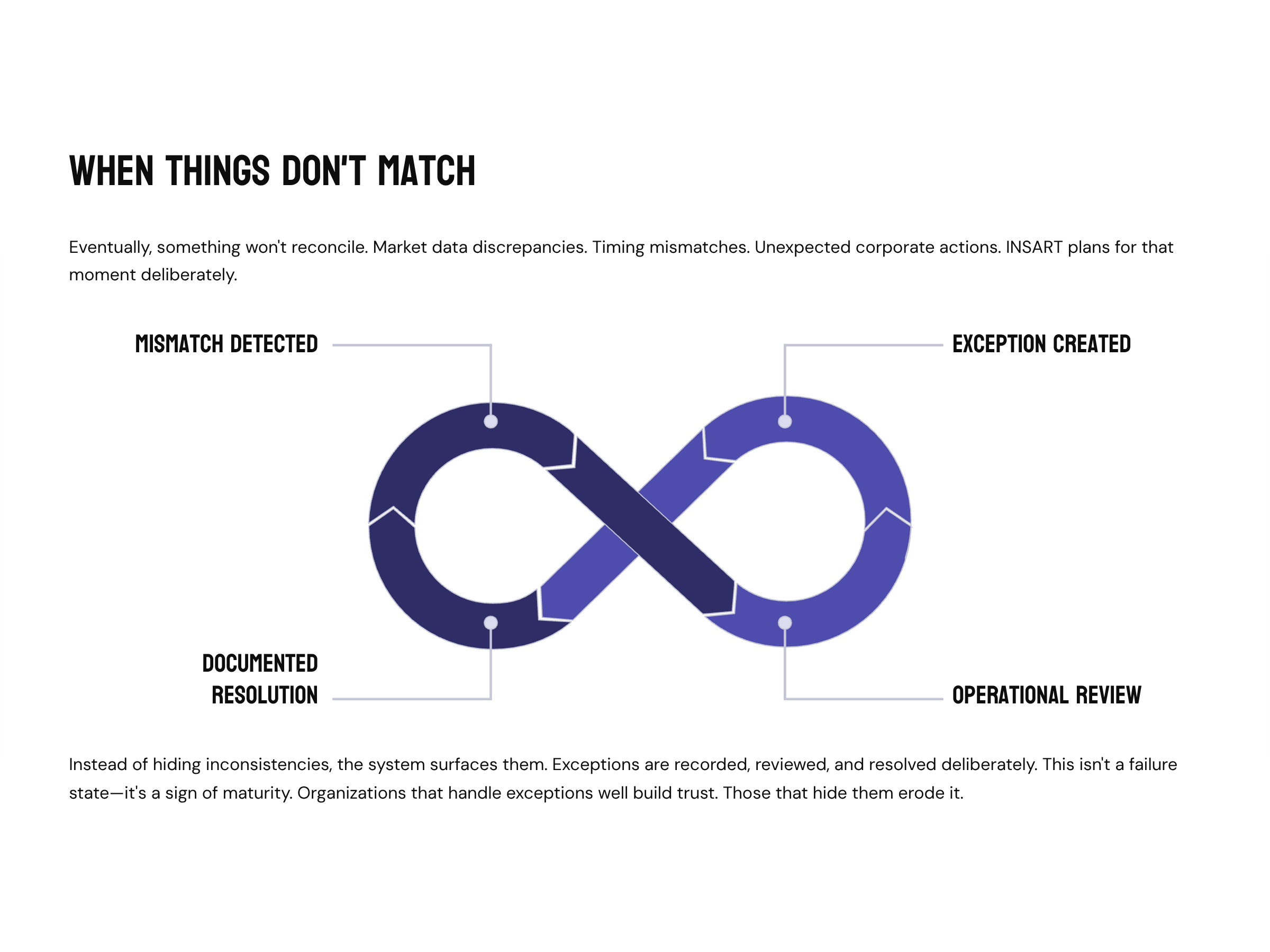

When Things Do Not Match

Eventually, something will not reconcile.

INSART plans for that moment.

Instead of hiding inconsistencies, the system surfaces them. Exceptions are recorded. Reviewed. Resolved deliberately.

Exception Flow

Mismatch Detected

|

v

Exception Created

|

v

Operational Review

|

v

Documented ResolutionThis is not a failure state. It is a sign of maturity.

Unlocking Innovation Without Breaking Trust

Once the foundation is stable, new possibilities emerge.

Advisors want insights. Clients want clarity. The platform wants to differentiate.

INSART enables advanced analytics, scenario modeling, and AI-assisted insights on top of the canonical data layer. But with a clear distinction:

These features inform.

They do not redefine truth.

That distinction keeps the platform compliant while still competitive.

The Quiet Payoff

The real value of this approach does not appear immediately.

It appears later.

When a new advisory firm is onboarded without fear.

When an audit request arrives and is handled calmly.

When features evolve without destabilizing the core.

When trust is assumed, not defended.

That is when the integration stops being visible.

And that is when it has succeeded.

Closing Thought

Integrating a portfolio accounting engine into a wealth management platform is not about connection. It is about commitment.

Commitment to correctness. To traceability. To long-term thinking.

INSART approaches this work with the understanding that once trust is broken, it is rarely repaired. Architecture is where that trust is either protected or quietly eroded.

This case study reflects how we choose the former.