The fintech market kept moving in 2025, but the rules for what counted as progress have changed.

Teams that relied on feature velocity, ambitious roadmaps, and surface-level innovation found themselves under pressure from every side, including AI acceleration, tighter capital, regulatory scrutiny, and rising operational complexity. At the same time, teams with fewer features but stronger foundations continued to grow, raise, and execute.

As a fintech business accelerator, we saw the difference in how systems were built, decisions were sequenced, and risk was absorbed.

This article looks at what 2025 revealed about fintech engineering: why feature-driven planning broke down, how data and infrastructure became growth multipliers, what founders consistently underestimated about scalability, and why engineering decisions now shape fundraising outcomes.

If 2025 changed how you think about building, this breakdown will help explain why and what to take with you into 2026.

Why 2025 Punished Feature-Driven Roadmaps

If 2025 felt unusually resistant to feature-driven planning, there’s a reason. The forces that broke traditional roadmaps are structural, not tactical; and they’re worth understanding before planning what comes next.

Fixed Feature Plans Collapsed Under AI and Market Volatility

Feature roadmaps assumed a level of predictability that no longer existed in 2025. Rapid AI advances, shifting customer behavior, and economic uncertainty invalidated product assumptions faster than teams could replan. What once broke quarterly now broke weekly. Roadmaps optimized for certainty became outdated almost immediately, turning planning into a liability rather than a guide.

Feature Commitment Replaced Learning, and Outcomes Drifted

As teams defended committed roadmaps, discovery work suffered. Instead of testing assumptions, teams shipped against plans that no longer reflected reality. Scope expanded to “patch” misalignment, while core outcomes like engagement, revenue efficiency, or risk reduction stagnated. Execution continued, but learning stopped (and with it, real progress).

Fintech Rewarded System Credibility, Not Feature Volume

In fintech, the cost of misalignment was higher. Regulatory change, diligence scrutiny, and partner expectations exposed weak data foundations, unclear system boundaries, and brittle infrastructure. Missing features could be explained. Unexplainable systems could not. In 2025, credibility came from resilience, auditability, and clarity, not from how many features shipped.

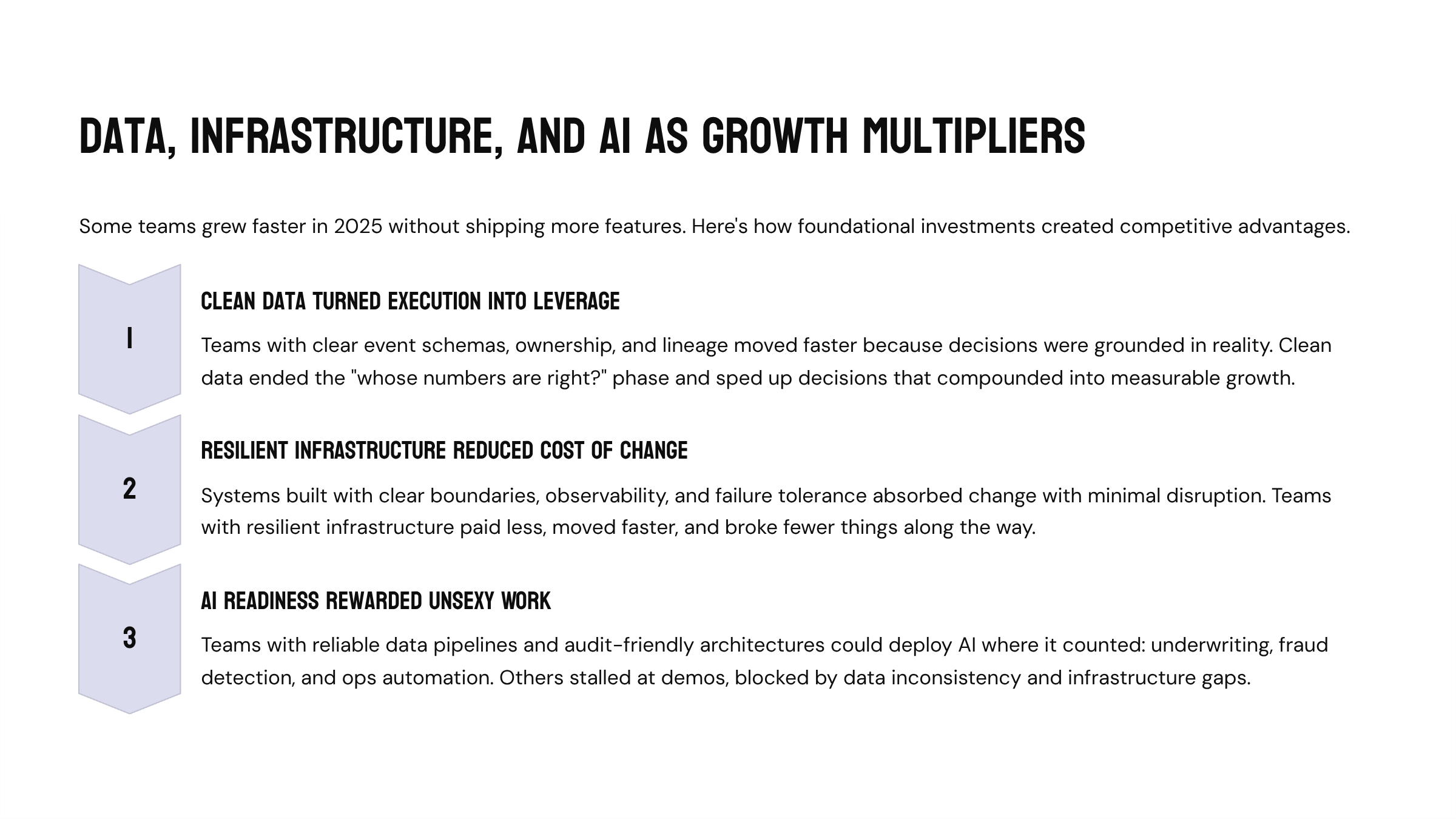

Data, Infrastructure, and AI Readiness as Growth Multipliers

Some teams grew faster in 2025 without shipping more features. Here’s how data, infrastructure, and AI readiness made that possible.

Clean Data Turned Execution Into Leverage

In 2025, data quality stopped being an analytics concern and became an execution advantage. Teams with clear event schemas, ownership, and lineage moved faster because decisions were grounded in reality. Pricing changes, risk adjustments, and product iterations happened with confidence, while teams with fragmented data spent cycles reconciling numbers instead of acting on them.

Clean data ended the “whose numbers are right?” phase and sped up decisions, which compounded into measurable growth over the year.

Resilient Infrastructure Reduced the Cost of Change

Infrastructure choices determined how adaptable teams could be. Systems built with clear boundaries, observability, and failure tolerance absorbed change with minimal disruption. New integrations, regulatory requirements, or AI experiments didn’t trigger cascading rewrites.

In contrast, brittle stacks turned every adjustment into a high-risk project. The difference was scale in change. Teams with resilient infrastructure paid less, moved faster, and broke fewer things along the way.

AI Readiness Rewarded Teams Who Had Done the Unsexy Work

Teams that had reliable data pipelines, well-defined system responsibilities, and audit-friendly architectures could deploy AI where it counted: underwriting, fraud detection, ops automation, and support workflows. Others stalled at demos, blocked by data inconsistency, compliance concerns, or infrastructure gaps.

In 2025, AI became a multiplier only when foundations were already in place. Without them, it stayed a side project.

What Founders Underestimated About Scalability

Scaling rarely failed because demand was missing. In 2025, it failed because systems, decision-making, and finances couldn’t keep up. This section breaks down what founders consistently underestimated as growth accelerated.

Scale Broke Founder-Centric Decision Making

What worked at early stages often became a bottleneck at scale. Many founders continued to personally own decisions around roadmaps, pricing, and prioritization well into growth phases. As complexity increased, this slowed execution instead of protecting quality.

By 2025, research and operator experience aligned on the same conclusion: founder-led control that accelerates early momentum actively limits scale later. In fintech, where decisions intersect with risk, compliance, and infrastructure, this bottleneck compounded quickly, turning leadership strength into operational drag.

Premature Expansion Outpaced Operating Reality

The most common scaling failure was expansion without systems.

Teams added headcount, features, and customers faster than their operating models could support. Role clarity lagged, processes stayed implicit, and ownership blurred. This pattern explains why 74% of high-growth startups fail due to premature scaling: growth exposed gaps that planning never addressed.

In fintech, premature scale was especially costly. Customer growth amplified compliance load, feature growth multiplied maintenance cost, and team growth increased coordination friction, all without corresponding structural maturity.

Financial, Infrastructure, and Compliance Stress Compounded

Founders also underestimated how quickly financial and structural pressure accumulates at scale.

By 2025:

- 69% of founders reported larger-than-expected financial risk.

- 67% relied on personal savings or remortgaging to sustain growth.

- 28% faced funding mismatches, particularly mid-sized firms beyond early-stage support.

At the same time, infrastructure built for early traction failed under volume, and compliance demands intensified. In fintech, scaling trust, auditability, and regulatory alignment proved harder than scaling users. Teams burned out managing technical debt, audits, and incident response, often simultaneously.

Scalability failed when systems, finances, and governance weren’t designed to grow together.

How Engineering Decisions Now Shape Fundraising Outcomes

Fundraising in fintech now starts long before the pitch deck. Below is how architecture, infrastructure, and team delivery systems began influencing who raised, on what terms, and why.

Tech Stack Choices Became Signals of Execution Risk

By 2025, VCs stopped treating engineering as an implementation detail and started reading it as a risk signal.

During diligence, investors increasingly assessed whether a product was built on modular, layered systems that could evolve without rewrites. Architectures with isolated components (clear service boundaries, replaceable modules, and well-defined interfaces) signaled future-proofing. These stacks reduced rewrite risk by an estimated 50–70%, improved security posture, and made onboarding new engineers faster.

By contrast, monoliths or mismatched tooling raised immediate concerns. They suggested future bottlenecks, slower iteration, and higher long-term cost, often resulting in valuation haircuts or rejected terms. Cloud-native, portable stacks consistently outperformed by demonstrating 2–3× faster delivery velocity with lower operational drag.

Infrastructure and Scalability Entered Core Diligence

Infrastructure moved from “technical appendix” to headline diligence topic.

Investors now routinely examined:

- Data pipeline maturity and ownership.

- AI readiness tied to real workflows, not demos.

- Throughput and reliability metrics (e.g., TPS capacity, failure tolerance).

- Alignment between infrastructure design and revenue model.

In fintech, this scrutiny was especially pronounced. Infrastructure-focused platforms commanded 12–20× revenue multiples because their scalability was usage-driven and marginal costs declined with volume. Systems that could clearly explain how scale improved unit economics earned confidence faster.

Engineering Systems Signaled Team Quality and M&A Readiness

VCs also read engineering decisions as proxies for how teams operate.

Stacks that enabled autonomous teams, clean handoffs, and safe experimentation suggested operational discipline. These teams shipped faster without central bottlenecks and adapted more easily during pivots or integrations. As a result, companies with strong delivery systems attracted up to 1.5× more funding, particularly in AI-heavy contexts where product and engineering spend dominated burn.

From an investor’s perspective, these systems also mattered for exits. Modular architectures improved M&A portability, reduced integration risk, and made companies easier to absorb or spin out. In selective capital markets, that optionality carried real value.

What INSART Sees Founders Planning Differently for 2026

By the end of 2025, many founders stopped asking how to move faster and started asking how to move with fewer regrets.

Planning conversations shifted away from feature scope and toward foundations: data ownership, infrastructure resilience, and systems that can absorb change without constant rework. Founders became more deliberate about sequencing, recognizing that not everything should be built early just because it can be built early.

There’s also a noticeable change in how teams think about AI. Instead of asking where can we add AI?, founders are asking where AI will still make sense once this system scales, audits, and integrates. That question pushes architectural discipline upstream before experimentation turns into dependency.

Operationally, 2026 planning looks less ambitious on paper and more constrained by design, with fewer parallel bets, clearer accountability, and stronger alignment between engineering choices, compliance reality, and capital strategy.

Perhaps the biggest shift is philosophical. Founders are no longer optimizing for momentum alone. They are optimizing for survivability with upside: systems that can grow, contract, pivot, and compound without breaking trust with users, regulators, or investors.