Startups rarely approach fundraising as a smooth, linear process. For many founders, it begins as a tangle of unknowns: understanding what investors expect, translating early traction into a credible story, determining what metrics matter, and preparing documentation that communicates maturity rather than aspiration. INSART steps into this chaos not as a broker or investor, but as an operational and strategic partner whose goal is to make a startup fundable before it ever stands in front of a venture capitalist.

While many organizations focus on polishing pitch decks, INSART works on an entirely different layer. Our process is built on a deep, repeatable analytical framework that clarifies whether a startup is genuinely ready for investment, what gaps stand in its way, and which actions will meaningfully increase investor confidence. The work resembles a transformation, not a cosmetic touch-up. To understand how this unfolds, it’s useful to follow a typical founder as they enter INSART’s qualification and readiness journey.

When a Startup First Arrives

Founders usually come to INSART at a moment of pressure. They have validated their problem space, built early traction, and now feel confident enough to raise capital. Yet during early conversations, it becomes clear that neither their business materials nor their internal planning match the expectations of serious fintech investors. They have fragments of a financial model, perhaps a first prototype, and several warm conversations with potential customers. What they do not have is the integrated story, documentation, and operational rigor that investors inspect before committing capital.

Every engagement begins with a structured scoring process derived from INSART’s Investment Readiness framework. The purpose is not to grade the founders but to map out, with precision, which parts of the company meet investor standards and which do not. The scoring model examines the founding team’s experience, validation of the value proposition, demand signals, clarity of the business model, competitive analysis, go-to-market logic, technical documentation, regulatory readiness, product architecture, and a dozen other factors drawn from INSART’s rigorous scoring criteria .

This scoring process becomes the startup’s first moment of clarity. For many founders, the questions reveal blind spots they had not considered: why their financial projections lack runway logic, why their TAM/SAM/SOM estimates fail to persuade, why their pitch focuses on product features rather than distribution, or why their unit economics lack the evidence needed to be credible.

The scoring concludes with a decision: is the startup Investment-Ready, Acceleration-Ready, or not yet ready for any structured engagement? INSART takes on only those founders who show genuine potential and commitment; startups that do not meet minimum readiness requirements receive clear feedback on what must change before revisiting fundraising plans.

Designing the Acceleration Path

For founders who fall into the Acceleration-Ready category, INSART prepares a roadmap—a detailed blueprint describing what must be built, corrected, validated, or clarified before fundraising can begin. This roadmap becomes the backbone of the Strategic Acceleration Program, where the startup is coached, guided, and supported as it builds the missing foundations needed to persuade investors.

The roadmap is a living document. It defines the traction milestones the startup must demonstrate, the investor-facing materials that must be created, and the operational disciplines the team must adopt. It often exposes contradictions or weaknesses in the startup’s initial plans: unclear pricing structures, unvalidated customer personas, missing regulatory considerations, or technology choices that do not align with scalability expectations in fintech.

In many cases, founders are surprised by how much of fundraising preparation involves rewriting—not the pitch deck, but the startup’s internal logic. INSART helps them correct architectural flaws in the product blueprint, restructure their financial model, redesign their go-to-market strategy, and create a value proposition that stands clearly apart from competitors. This level of alignment typically requires weeks of work, but by the end, founders gain the ability to explain their business with the clarity, coherence, and confidence that investors expect yet rarely see.

Rebuilding the Investor Story

Once the strategic foundations are in place, INSART guides founders through the art of translating the business into a compelling narrative. Investors do not fund features—they fund momentum, inevitability, and clarity of purpose. INSART’s experience preparing founders for Demo Days and investor showcases reflects how critical this narrative is. Internal investor feedback emphasizes the need for a strong “why invest now” argument, market sizing clarity, and a powerful “wow” or “money slide” that anchors the pitch in tangible value creation .

INSART coaches founders to reverse the pitch. Rather than starting with the product and working outward, founders learn to begin with the market opportunity, the urgent problem, and the validated demand—supported by quantified intent revenue, real customer interviews, and early commercial agreements. Only after this foundation is established does the conversation move into the product and technology.

The pitch deck becomes an artifact of discipline: ten to fifteen pages that tell a coherent, data-backed story. INSART ensures that the deck reflects the founder’s mastery of the problem space, the clarity of the business model, and the sophistication of the roadmap. Investors repeatedly tell us that clarity and narrative coherence are the strongest indicators of founder maturity, often more than the technology itself.

Preparing the Data Room

As the founder’s story takes shape, INSART helps assemble a data room that reflects the professionalism of a company ready for diligence. Most pre-seed and seed founders underestimate the level of documentation investors expect. The data room we build together includes the financial model, business plan, market research, technology blueprints, pricing logic, customer interview transcripts, compliance considerations, and operational policies.

We call this the “invisible half” of fundraising. While the pitch deck may excite investors, the data room convinces them.

INSART’s internal DD frameworks ensure that each document follows a consistent structure, reflects realistic assumptions, and answers the questions investors typically raise. The goal is simple: no surprises, no inconsistencies, no gaps that suggest the company is not ready. By the time investors open the data room, the founders appear precise, thoughtful, and well-organized—exactly the profile that attracts capital.

Building Investor-Ready Technology Blueprints

Fintech investors are especially sensitive to technical execution. Many deals collapse not because of the pitch but because investors discover during diligence that the underlying architecture cannot scale. INSART’s technical teams step in long before this point, helping founders create full software requirements specifications, architectural plans, and prototypes that demonstrate engineering maturity.

These blueprints reflect the company’s future, not only its present. Our work draws on frameworks from the Investment Readiness Scoring Process, where technical maturity is assessed alongside product-market clarity and operational readiness . By the time fundraising begins, the founder can present not only what the team has built but also a credible plan of what will be built in the next twelve to eighteen months—supported by clear technical documentation rather than vague intentions.

This technical depth often becomes a deciding factor for investors in fintech, where product execution risk is unusually high.

Constructing the Go-to-Market Engine

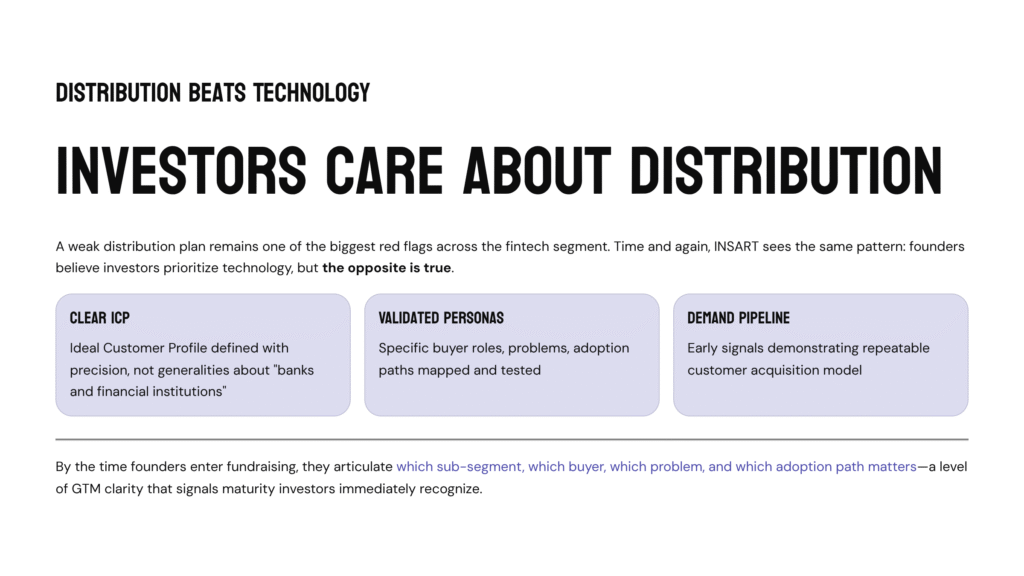

Founders often believe that investors care most about technology, but time and again the INSART team sees the opposite. Investors care about distribution. A weak distribution plan is one of the biggest red flags for investors across the fintech segment.

INSART helps founders build a GTM strategy that reflects the realities of enterprise fintech sales. By the time a founder enters fundraising, they have a clear ICP, validated buyer personas, a pipeline of early-demand signals, and a repeatable model for acquiring customers. This level of GTM clarity is rare among early-stage founders, and when investors see it, they recognize maturity.

Our GTM frameworks draw heavily on insights from INSART’s Fintech Innovators ICP segmentation and the patterns observed across dozens of fintech founders we support. The result is a founder who no longer speaks in generalities about “banks and financial institutions” but in specific terms about which sub-segment, which buyer, which problem, and which adoption path matters.

Simulating the Fundraising Campaign Before It Begins

One of INSART’s most significant contributions is helping founders understand what a real fundraising process looks like. Founders often imagine that fundraising is a series of inspiring conversations, but in practice it is a tightly managed pipeline more similar to enterprise sales than storytelling.

INSART draws on its internal fundraising methodology and the structured pipeline model used for Demo Days and investor introduction programs to teach founders how to run their fundraising like a campaign, not an improvisation. Founders learn how to target the right investors, how to manage cadence, how to handle follow-ups, and how to transform initial curiosity into due diligence.

Our fundraising scenarios—ranging from basic introductions to highly structured diligence packs—help founders understand exactly what level of credibility and documentation is expected before investors take them seriously .

By the time a founder begins outreach, they are no longer experimenting. They are executing a controlled process.

The Transformation Experienced by Founders

The most important outcome of INSART’s fundraising preparation is not a pitch deck, a financial model, or a data room. It is an internal shift in the founder’s mindset. Through the scoring, acceleration, and readiness process, founders evolve from storytellers into operators. Their language becomes sharper, their assumptions more grounded, and their confidence grounded in preparation rather than hope.

Investors consistently report that startups emerging from INSART’s readiness programs stand out immediately. They articulate their market better, quantify their traction more precisely, and present technical plans with a level of detail uncommon among early-stage fintech teams. These impressions matter; they often determine how quickly a deal progresses and how seriously a founder is taken.

Conclusion

INSART does not simply prepare startups for fundraising. It reshapes them into companies that deserve to be funded. By combining rigorous scoring frameworks, strategic acceleration roadmaps, deep technical support, and storytelling refinement, we remove the ambiguity that founders typically face and replace it with clarity, structure, and momentum.

Fundraising becomes less of a gamble and more of a calculated, strategic act. For founders operating in the fintech domain—where complexity, regulation, and distribution challenges are exceptionally high—this level of preparation is not simply beneficial; it is essential.