When a fintech startup approached INSART, they didn’t come asking for more leads – they came asking for clarity.

They had built a solid product: an embedded lending infrastructure designed to help regional banks launch digital credit services faster. They had early customers, decent traction, and an ambitious team. What they didn’t have was predictability.

Each new client felt like luck. Sometimes a connection clicked on LinkedIn. Sometimes a warm intro landed. But there was no system – no repeatable engine that could transform awareness into conversation and conversation into partnership.

That’s where INSART stepped in.

Phase 1: The Problem Behind “No Leads”

Before touching automation or outreach, we ran a discovery sprint — the same framework we use for every client acquisition onboarding.

We mapped the entire client journey and immediately spotted three invisible leaks:

The startup had no defined ICP (Ideal Customer Profile) beyond “banks interested in digitization.”

Outreach attempts were linear, not adaptive — everyone received the same message.

There was no behavioral feedback loop — they didn’t know why someone ignored, clicked, or responded.

We explained that in 2025, lead generation is a behavior science, not a numbers game.

And that to fix the problem, we had to teach their system how to listen before it talks.

Phase 2: Listening to the Market Through Signals

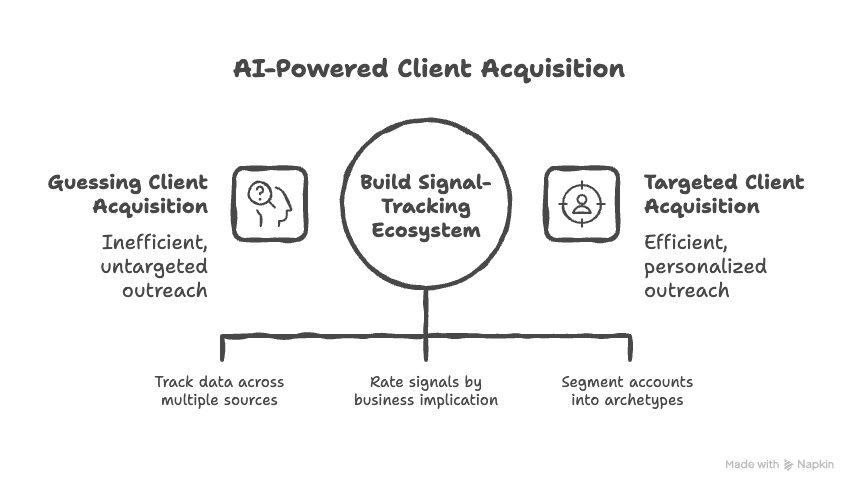

Instead of guessing, we built a signal-tracking ecosystem — a digital nervous system for client acquisition.

Our proprietary AI tool, SignalsAI, continuously monitored digital breadcrumbs across multiple data sources:

LinkedIn updates from target personas

Company hiring trends (“looking for Head of Digital Transformation”)

Funding rounds, tech stack changes, and product announcements

Mentions in fintech media or event speaker lists

Each signal was scored by intent level:

0–2: Noise (generic content, no business implication)

3–5: Warm (hints of product change, new roles, innovation talk)

6–10: Hot (funding, new market entry, partnership request)

In the first week, the system analyzed over 11,000 company activities and narrowed them down to 112 actionable signals.

Then we fed that data into persona clustering models. Using GPT-4 embeddings, we segmented potential accounts into archetypes like:

Transformers — banks investing in innovation teams

Builders — fintechs integrating lending APIs

Optimizers — CFOs reducing operational costs through automation

Every archetype got a unique emotional and logical profile: decision drivers, tone preferences, vocabulary patterns, even their preferred “communication tempo.”

Phase 3: Warming the Ground

We don’t send cold messages. We create digital proximity.

Using tools like Phantombuster, Texau, and our in-house warming scripts, we started interacting with targets before messaging them:

Our outreach avatars liked and commented on relevant industry posts.

Executives connected through mutual interests and shared insights.

Our AI tracked reciprocity — profile visits, likes back, mentions — and scored them as Trust Signals.

Only when an account reached a trust threshold score of 3+ did we move them into outreach mode.

This step increased our connection acceptance rate to 72% (industry benchmark: ~25%).

The result? When our message finally landed in their inbox, it didn’t sound like spam. It sounded like continuity.

Phase 4: Building the Story-Driven Outreach

At this point, we had data, context, and timing.

Now we needed a story.

Our content team — supported by a fine-tuned LLM trained on over 40 INSART case studies — created adaptive outreach frameworks:

The model analyzed every signal and generated a custom conversation starter tied to it.

Each message contained a micro-story, a case study link, or a visual snapshot instead of a dry pitch.

The tone matched the persona: visionary for founders, technical for CTOs, efficiency-driven for CFOs.

A typical sequence looked like this:

Step | Message Type | Purpose |

|---|---|---|

1 | Context Hook | Reference the detected signal — “noticed your new product announcement…” |

2 | Insight | Share a relevant industry stat or case study (e.g. how we helped a similar lender automate risk scoring). |

3 | Value | Suggest a 15-min talk about solving the same challenge. |

4 | Nurture | Share a short video, deck, or article from Signals Magazine. |

Each line was A/B tested through our analytics layer, which rewrote underperforming sentences in real time based on engagement metrics.

Phase 5: AI in the Loop

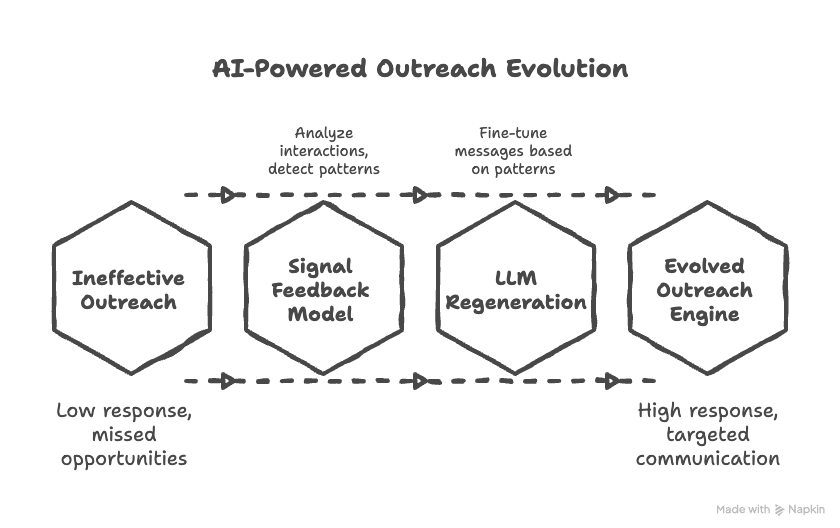

This wasn’t just automation — it was learning.

Every interaction, open, click, and response went into our Signal Feedback Model.

The model vectorized message content, response sentiment, and timing to detect what narratives worked best for each persona cluster.

We discovered fascinating insights:

CTOs replied 2.4x more often when we used “performance metrics” language instead of “innovation.”

Marketing VPs responded best to visuals (carousel or one-pager).

CEOs ignored anything longer than 70 words.

Our LLM then regenerated message versions based on these micro-patterns, automatically fine-tuning tone, structure, and length.

In essence, our outreach engine evolved with the market — learning week after week who listens and why.

Phase 6: Turning Engagement into Relationships

Once engagement reached a threshold (e.g. three message exchanges or a content download), the system handed control to a human BDR — trained to convert curiosity into connection.

Each BDR had access to the signal history:

What the prospect recently liked

Which posts they engaged with

What pain points their company is publicly discussing

That made follow-ups deeply contextual:

“I saw your team is testing automated underwriting — we recently helped another regional bank integrate decisioning APIs. Want me to show the flow?”

Instead of selling, we were continuing a conversation the market had already started.

Phase 7: Operational Infrastructure

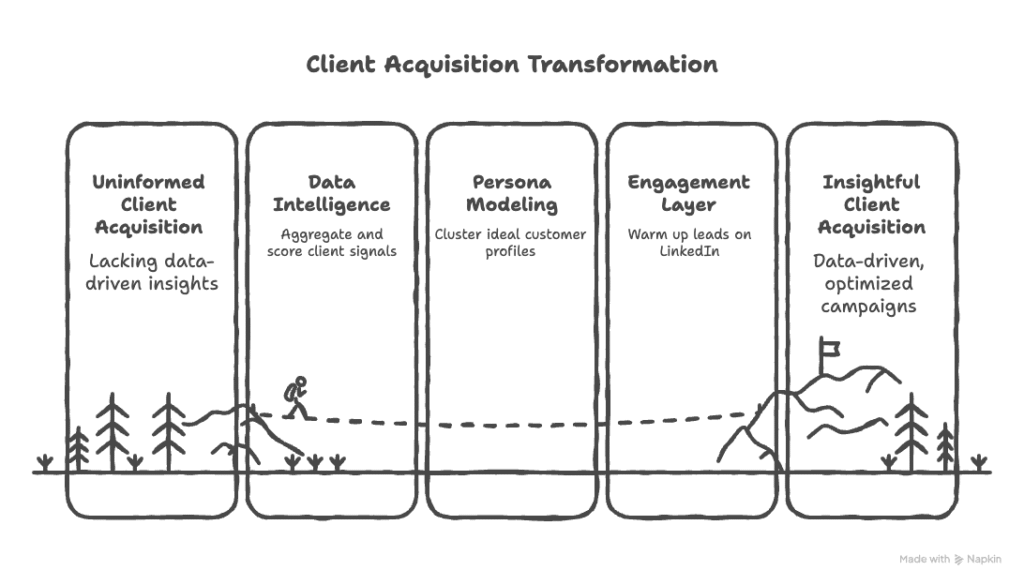

To sustain this approach, we built a Client Acquisition Infrastructure inside the client’s ecosystem.

Layer | Function | Tools |

|---|---|---|

Data Intelligence | Signal aggregation and scoring | SignalsAI, Crunchbase API, GPT embeddings |

Persona Modeling | ICP clustering | GPT-4, OpenAI fine-tuned LLM |

Engagement Layer | LinkedIn warm-up & activity tracking | Phantombuster, Texau |

Outreach Layer | Message automation + analytics | HubSpot, Lemlist |

Creative Layer | Storytelling content & visuals | Canva AI, Gamma Decks |

Feedback Layer | Continuous optimization | BigQuery dashboards, LLM sentiment tracker |

This stack didn’t just run campaigns — it generated insights. The client could now open a dashboard and literally see:

Who’s warming up

Which messages are resonating

Which industries are “heating up” in real time

Phase 8: The Results

Within 8 weeks of launch, the outcomes spoke for themselves:

38% reply rate across all sequences (vs 9% industry average)

24 new discovery calls booked within 2 months

5 new clients signed by end of the quarter

37% higher average deal value, as leads came pre-nurtured

Zero negative feedback — every response was polite, contextual, or constructive

But the bigger win wasn’t in numbers — it was in clarity.

For the first time, the client’s growth team could articulate exactly how each deal began — what signal triggered it, which narrative worked, and how many touchpoints it took to convert.

Lead generation became transparent, measurable, and repeatable.

Phase 9: The Cultural Shift

What started as a marketing project evolved into a company-wide mindset shift.

The founders stopped asking, “How do we get more leads?” and started asking, “What signals are we missing?”

They began using the same tools to:

Detect partnership opportunities

Track potential investors

Recruit engineers in regions showing fintech ecosystem growth

The Client Acquisition System turned into a universal growth radar.

Phase 10: From Reactive to Predictive

Six months later, we added a predictive AI layer.

By correlating three months of signal data with closed deals, the model started forecasting high-probability prospects before they even went public with intent.

For example:

When a bank hired both a Digital Transformation Lead and API Developer within a 30-day window, it predicted a 71% chance of new integration initiatives — a perfect moment for outreach.

When a startup announced a seed round and simultaneously posted a job for Marketing Manager, it indicated a go-to-market acceleration — another perfect signal.

That’s when we knew: the system had matured beyond outreach.

It had become an intelligence engine.

The Outcome

INSART’s approach turned randomness into rhythm.

The startup now operates with a living acquisition ecosystem that listens, learns, and scales itself.

Their sales team focuses only on pre-warmed, high-probability accounts.

Marketing builds content around detected intent patterns.

Leadership can see signal-driven forecasts that guide strategy.

What began as a quest for more leads became a blueprint for how B2B sales should look in the AI era — deeply human, relentlessly intelligent, and endlessly adaptive.

The world doesn’t need more outreach tools — it needs better ways to hear intent.

At INSART, we don’t sell lead generation; we engineer signal ecosystems that connect logic with emotion, data with storytelling, and AI with human empathy.

Because real growth doesn’t start when you message someone.

It starts when you finally understand why they’d want to hear from you.