There’s something deeply energizing about starting a fintech product. You’ve spotted a gap in the market, imagined a better way to solve a specific financial problem, maybe even raised your first round or pulled together a scrappy team. The temptation is immediate: build fast, build big, and prove to the world you’re serious.

And yet, that impulse — to build out the vision completely — is where most fintech MVPs quietly collapse. Not because the market didn’t need the product. Not because the team lacked technical chops. But because they built too much, too soon, without validating the essentials first.

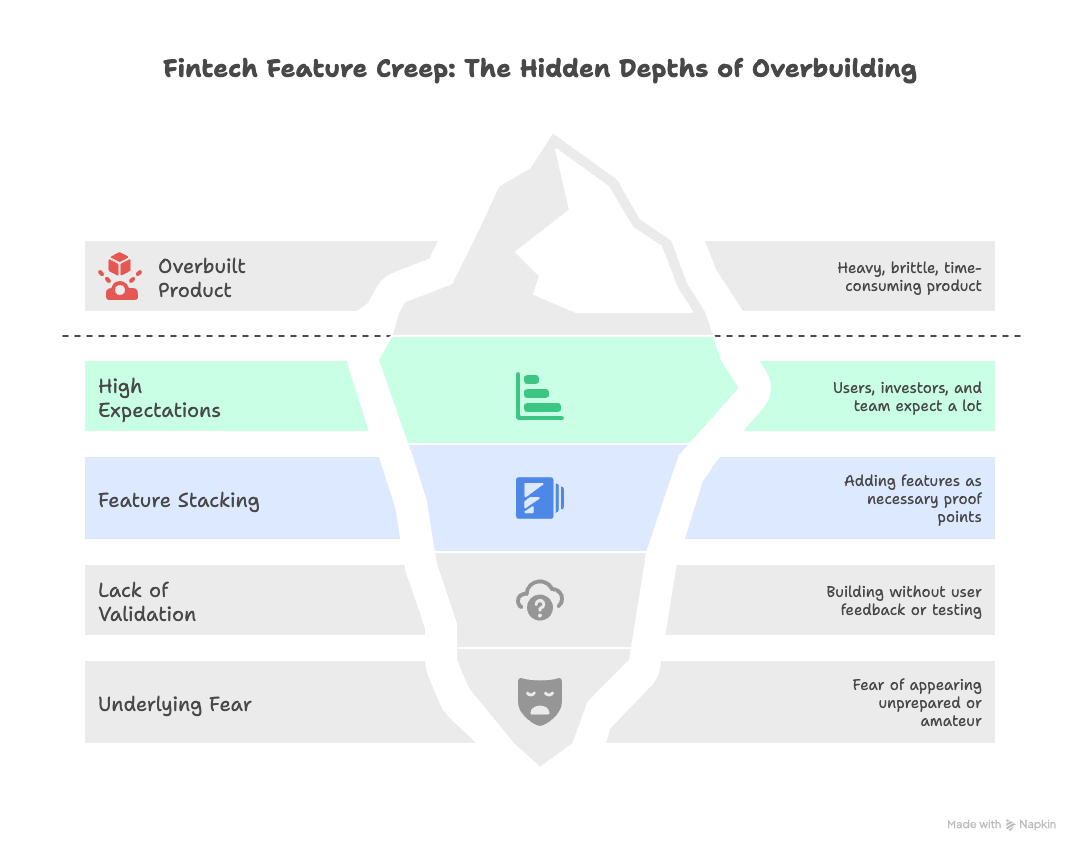

Overbuilding is the most common mistake we see among early-stage fintech founders. And unlike a visible bug or a failed demo, its consequences aren’t always loud or dramatic. They show up subtly, in delayed launches, confused feedback, scope creep, and ultimately — in the death of momentum.

The pressure to do it all (right now)

There are a few reasons this mistake happens, and most of them are understandable.

In fintech, the bar feels higher from day one. You’re not just launching a productivity app — you’re dealing with people’s money. That means users expect trust, polish, and regulatory compliance. Investors expect clear architecture. Your team expects a roadmap with depth. So naturally, you start stacking features: onboarding, KYC, money movement, transaction history, analytics, notifications, maybe even partner APIs.

Each feature feels like a necessary proof point. But together, they form a product that’s heavy, brittle, and time-consuming. What began as a lean MVP is suddenly a six-month roadmap that hasn’t touched a real user.

Underneath it all is fear — fear of looking unprepared, of seeming amateur, of missing a key capability. But in reality, the more you build without validation, the more you’re guessing.

What founders often miss about MVPs

The idea of a Minimum Viable Product has been widely misunderstood. Many founders translate it to “the smallest version of the full product.” But in practice, an MVP is not a tiny product — it’s a learning tool. Its job is not to impress. Its job is to test.

That’s especially true in fintech, where the actual challenge is rarely technical. The challenge is getting someone to trust your solution enough to use it. That trust doesn’t come from the number of screens you’ve built — it comes from focus, clarity, and delivering on a single core promise.

When you overbuild, you delay the moment of truth. You make it harder to isolate what works and what doesn’t. You invite more feedback, but less signal. You might even fall in love with features that users never asked for — and now can’t live without, because you’ve already spent weeks engineering them.

The hidden costs of doing too much

Building more than necessary doesn’t just cost you development time. It carries operational, strategic, and psychological costs that stack up quickly.

More features mean more surface area for bugs, user confusion, and technical debt. In fintech, they also mean greater exposure to compliance risks. Every new flow must be audited, secured, possibly regulated. That slows down iterations, inflates QA cycles, and creates anxiety around releases.

From a product standpoint, overbuilding muddies your ability to test assumptions. If your MVP has ten features and users only use two, was the product good or bad? Was the acquisition strategy wrong, or was the product just too broad? These are hard questions to answer when too much is in play at once.

Finally, there’s team morale. When launches are delayed because you’re “almost done” for the third time in a row, it chips away at urgency and belief. Your MVP is supposed to be the momentum-builder — not the thing dragging you into endless polishing.

What a lean fintech MVP actually looks like

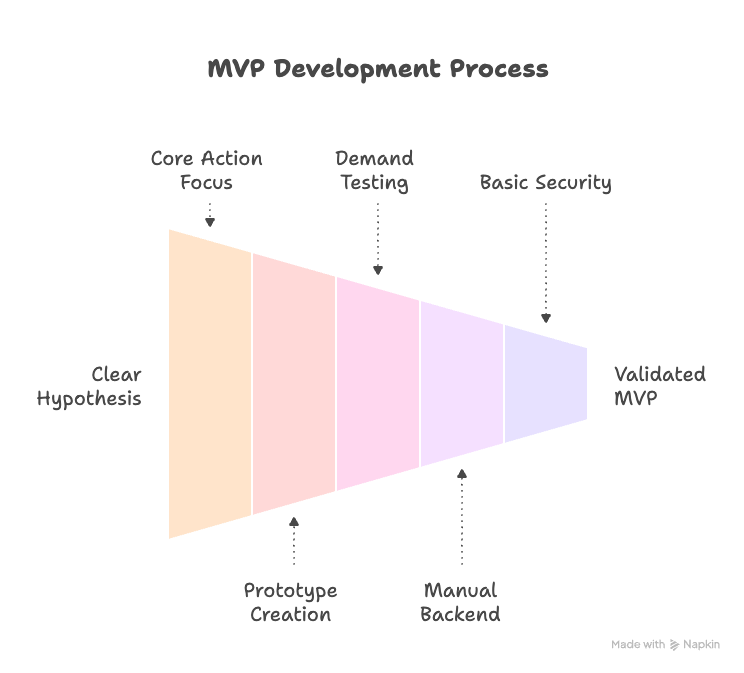

A good MVP starts with a clear hypothesis. It focuses on a single core action or behavior that, if validated, gives you the confidence to move forward. That might be “users will connect their accounts to track savings” or “users want early paycheck access through X flow.”

You don’t need real-time dashboards, push notifications, or predictive analytics for that. You need just enough to run the experiment. Often, that means:

A clickable prototype instead of code

A waitlist landing page to test demand

A manually-operated backend behind an automated UI

Basic security principles without full-scale compliance

None of this means cutting corners where it matters. It means choosing your battles — and learning fast.

We’ve seen fintech teams launch MVPs in six weeks that validated key behaviors and helped them pivot their entire positioning before writing a single backend integration. We’ve also seen teams spend nine months building a “lite” version of their final product, only to learn that no one wanted it in the first place.

Guess which team raised a follow-on round.

Conclusion: Build less. Prove more.

Fintech is a hard space. Regulation, trust, and user expectations make the margin for error small. But that’s precisely why overbuilding is so dangerous — it feels safe, but it delays the one thing that matters: truth.

Truth about your users. Truth about your product’s promise. Truth about whether your idea is worth scaling.

Your MVP is not a launch party — it’s a reconnaissance mission. It should answer: are we on the right track? And it should do so with the least amount of effort, time, and code required.

So before you add another feature, another dashboard, another integration — ask yourself: what am I really trying to learn?

If you need help figuring that out, that’s exactly where we come in. At INSART, we guide fintech startups through lean, focused MVP development that validates before it builds. Because the smartest way to build? Is to build less — and learn more.