Introduction of Next-gen robo-advisor architecture for startups:

Next-gen robo-advisor architecture for startups (Robo-advisors) have evolved from niche fintech experiments into mainstream investment platforms managing trillions of dollars. In 2017, robo-advisors oversaw around $186.9 billion in assets; by 2023 this ballooned to well over $2.7 trillion, and growth continues unabated. This success is rooted in trustworthy automation – these platforms leverage algorithms to provide low-cost, personalized portfolios with minimal human intervention. Yet in mid-2025, simply automating asset allocation is no longer enough. Modern robo-advisor architecture blends time-tested investment principles with cutting-edge technologies like generative AI and cloud-native services. Fintech CTOs are now tasked with building systems that are hyper-personalized, scalable, explainable, and compliant with tightening regulations. In this analysis, we explore how to build a next-generation robo-advisor platform, from core investment philosophies to the latest AI integrations, all through the lens of a technically sophisticated CTO.

Core Principles and the Customer Journey in 2025

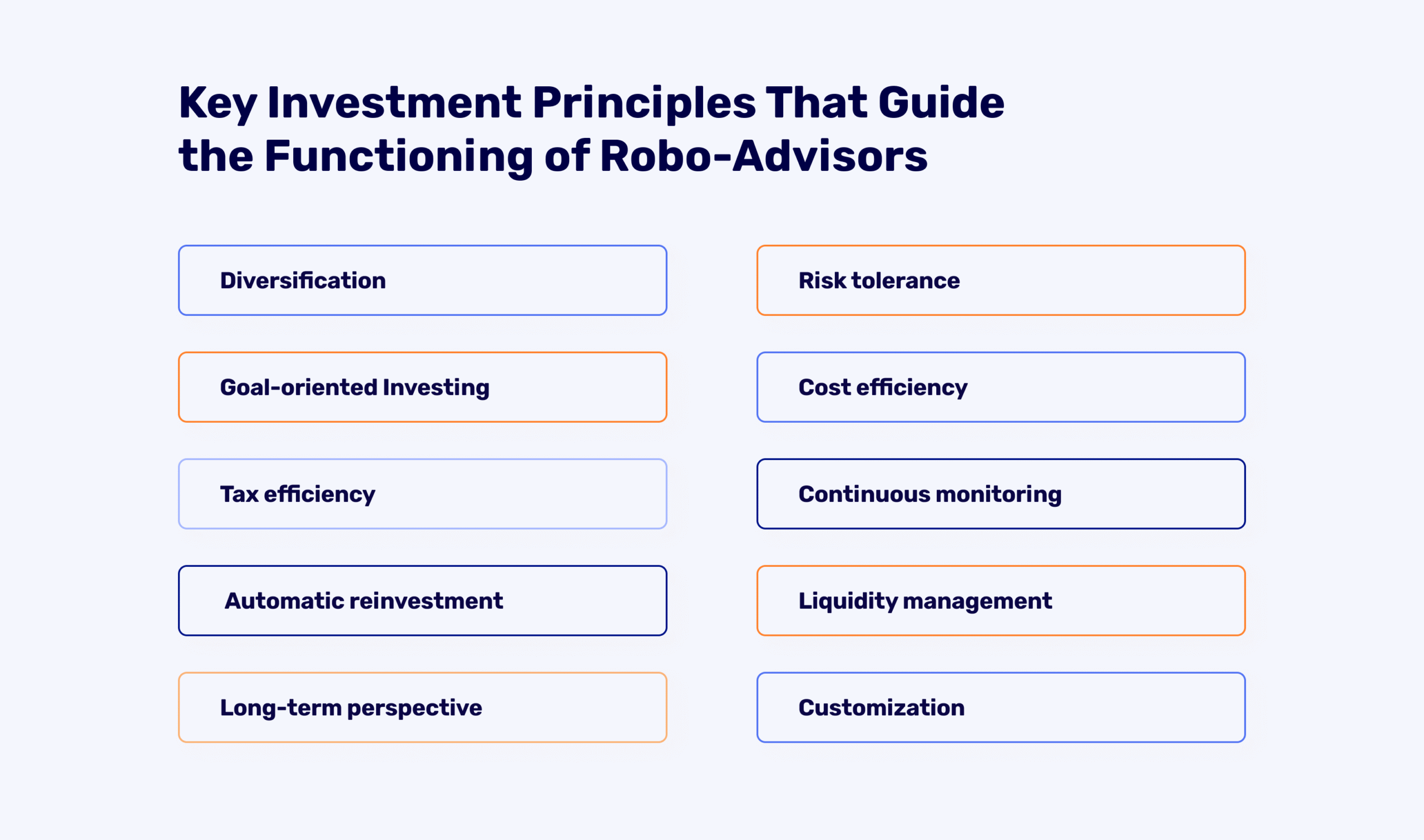

Fundamental investment principles continue to anchor robo-advisor strategies. Diversification across asset classes, risk-adjusted portfolio construction, cost-efficient indexing, and disciplined rebalancing are key tenets (as illustrated above). These principles ensure that even as algorithms and AI drive decisions, the financial advice remains sound and prudent.

At their heart, Next-gen robo-advisor architecture for startups are algorithm-driven investment managers. They begin by understanding the investor. It typically starts with an online questionnaire about the user’s financial situation, risk tolerance, investment horizon, and goals. Based on these inputs, the system recommends an appropriate portfolio – usually a mix of exchange-traded funds (ETFs) or index funds aligned to the user’s risk profile. This classic onboarding journey remains in 2025, but it’s enhanced by more data and smarter analytics. For example, beyond a basic risk score, platforms now incorporate preferences like environmental or social investment themes, and even use behavioral data (like spending patterns or past responses) to refine recommendations.

Crucially, long-term investing principles guide the robo-advisor’s allocations. Diversification helps spread risk and soften the impact of any single asset’s poor performance. Low fees and passive management are emphasized to maximize net returns – many robo-advisors stick to index-based portfolios to minimize costs and embrace the idea of market efficiency. Tax-efficient strategies such as automated tax-loss harvesting are commonly employed so that the investor keeps more of their gains. These core principles – diversification, cost efficiency, tax optimization, and risk alignment – are ingrained into the platform’s logic. Even as AI and automation have advanced, robo-advisors thrive by flaunting these timeless investing fundamentals in a user-friendly, automated package.

From the user’s perspective, the experience is smooth and increasingly hyper-personalized. A new client in 2025 can expect the robo-advisor to not only suggest a generic “60/40” portfolio, but to tailor nuances: for instance, excluding industries they dislike, adjusting for their personal risk tolerance (perhaps detected via how they interact with the app), and aligning with their retirement or life goals in fine detail. The ability of robo-advisors to deliver personalized insights at scale – something human advisors can struggle with – is a major reason they continue to lure in both novice investors and high-net-worth individuals alike.

Data Integration and Preparation: The Fuel for AI

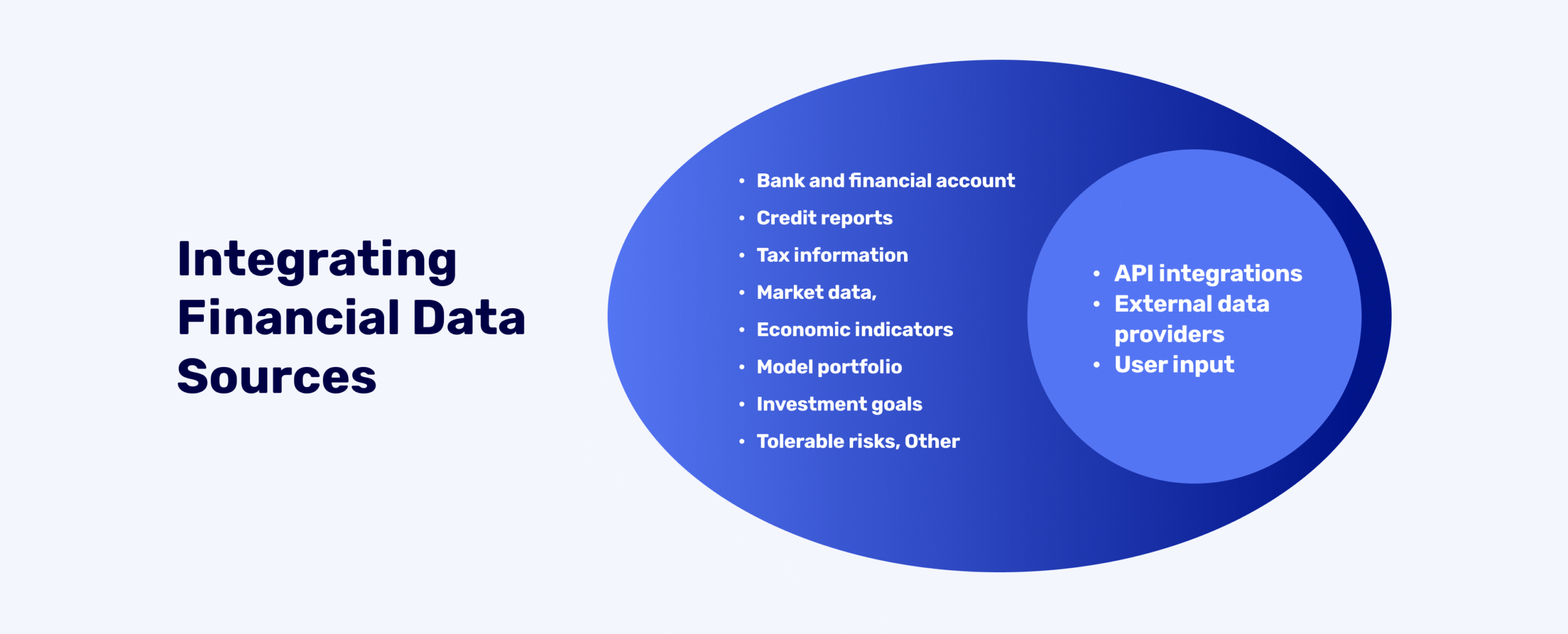

Integrating rich financial data sources is the foundation of any robo-advisor. Modern platforms aggregate data from market feeds, economic indicators, user bank accounts, credit reports, and more. Clean, well-integrated data (illustrated by the overlapping sources above) enables accurate analysis and personalized advice.

Behind the scenes, a robo-advisor’s “brain” is only as good as the data it feeds on. Data integration and preprocessing form the first technical challenge in building a robo-advisory platform. In 2025, this means aggregating a wide array of data streams: real-time market prices, historical asset returns, economic indicators, corporate financials, news sentiment, and the user’s personal financial data (like bank account balances, income, and spending patterns). Fintech CTOs often leverage open banking APIs and integrations with financial data providers to pull in this information. For example, aggregator services (Plaid, Yodlee, etc.) can connect to a user’s bank and investment accounts to paint a full picture of their finances. Market data services provide streaming quotes and fundamentals. Some robo-advisors even ingest alternative data (such as social media sentiment or Google Trends) to enhance their models’ predictive power.

Once collected, data preprocessing is critical. Raw data can be noisy – prices have outliers, different sources use varied formats, and user-input data may be incomplete. The system must continuously clean, normalize, and enrich this data. Techniques like outlier removal, missing value imputation, and time-series normalization are employed so that downstream algorithms can train on reliable inputs. In many cases, machine learning is used at this stage as well: for instance, anomaly detection models can flag unusual account activity or data points that don’t make sense (possibly indicating an input error or fraud).

Equally important is data freshness and flow. Investment advice is time-sensitive; a truly responsive robo-advisor uses cloud-based data pipelines that stream updates in real time or near-real time. Architecturally, this often means event-driven data processing – e.g. using message queues or streaming platforms (like Kafka) to feed new data into the system as it arrives. A cloud-native approach is helpful here: microservices dedicated to data ingestion can independently scale when there’s a surge in incoming data (such as during market volatility). By 2025, many robo-advisor platforms also implement continuous data pipelines that not only bring in data but also store historical data in scalable data lakes or warehouses. This historical trove is essential for backtesting investment strategies and training AI models.

The outcome of robust data integration is a centralized, secure, and high-quality data repository. All subsequent components – from portfolio algorithms to user-facing dashboards – rely on this. CTOs must also ensure strong data governance at this stage: compliance with privacy laws (e.g. GDPR, CCPA) and customer consent management for data usage are non-negotiable. In summary, data integration is the fuel that powers intelligent robo-advisory, and doing it right sets the stage for everything from accurate risk profiling to insightful recommendations.

AI-Driven Portfolio Management Strategies

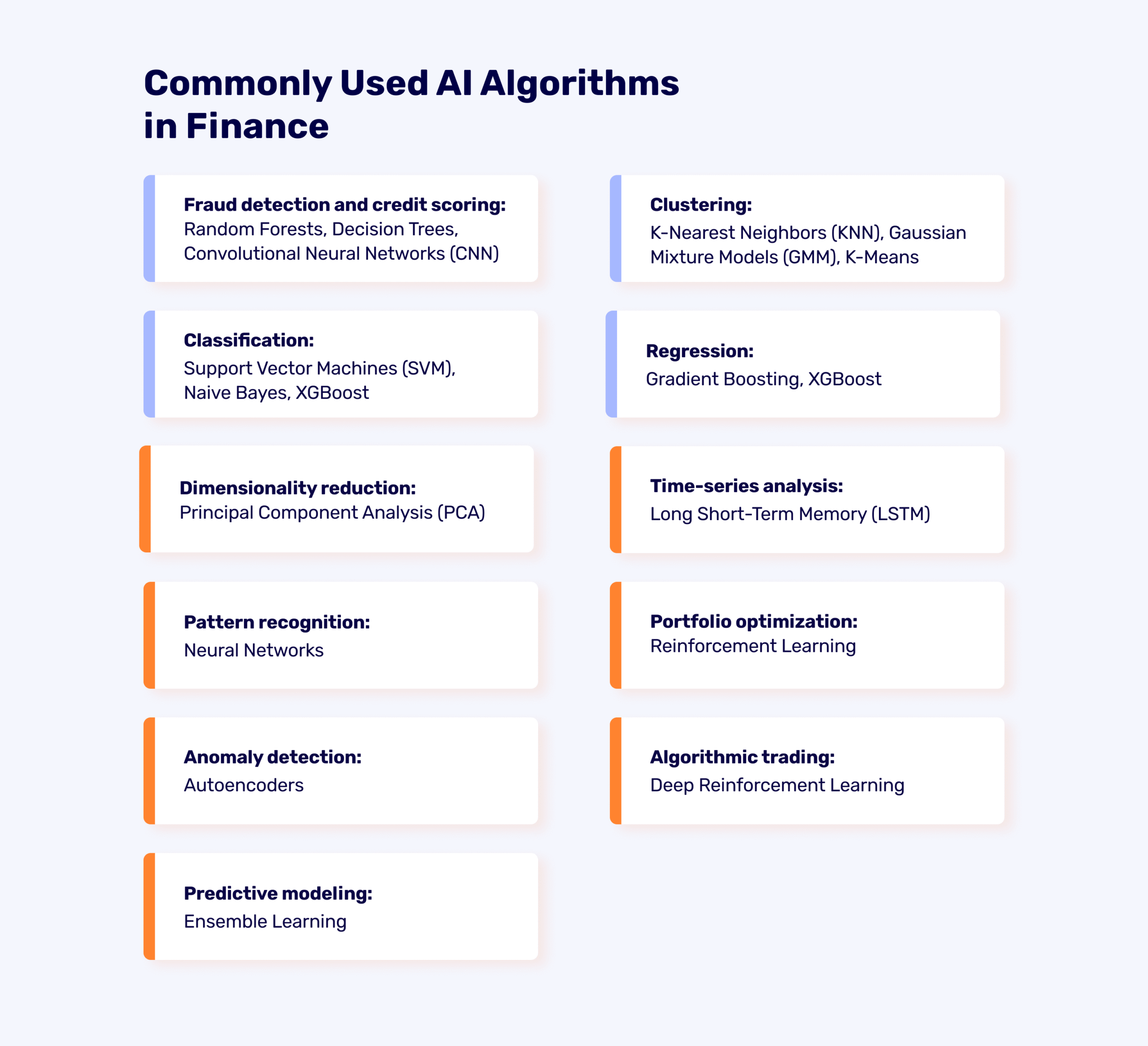

AI and machine learning techniques have permeated portfolio management. The diagram above highlights common AI algorithms in finance – from clustering and classification (useful for client segmentation and risk assessment) to deep learning and reinforcement learning (applied in pattern recognition, predictive modeling, and even algorithmic trading). A modern robo-advisor leverages these algorithms to construct and optimize portfolios, manage risk, and adapt to market changes.

At the core of a robo-advisor is the portfolio management engine – the component that decides how to allocate assets for each client. Initially, robo-advisors built their portfolios using traditional financial models like Modern Portfolio Theory (Harry Markowitz’s mean-variance optimization) to achieve an optimal trade-off between risk and return. They might also run Monte Carlo simulations to project thousands of potential future outcomes for a portfolio, gauging the probability of meeting a client’s goal (such as a retirement target). Those techniques are still valuable in 2025, but the arsenal has expanded to include advanced AI and machine learning models that can enhance decision-making.

Machine Learning (ML) now plays a significant role in portfolio construction and risk management. For example, clustering algorithms (unsupervised ML) can be used to segment clients into more nuanced groups beyond the basic risk categories – identifying patterns in how different users should be treated based on behavior or demographics. Classification models can help in risk assessment, predicting which investors might panic-sell in a downturn or which ones might need extra cushioning in their portfolio. ML regression models and time-series models (including deep learning models like LSTM networks) are employed to forecast market trends or asset returns, supplementing or sometimes challenging the assumptions of classical finance models. Even reinforcement learning – where an AI “agent” learns to allocate assets through trial and error to maximize long-term rewards – has been experimented with in robo-advisory, hinting at a future of AI that can adapt portfolios dynamically as it learns from market feedback.

Most robo-advisors combine these AI-driven approaches with the dependable frameworks of portfolio theory. A typical system might use ML predictions to adjust inputs or constraints for an optimization algorithm. For instance, if an AI model predicts higher volatility ahead, the robo-advisor could temporarily dial down exposure to riskier assets for vulnerable clients. Scenario analysis powered by AI can quickly assess how a portfolio might behave under hundreds of simulated market conditions (including stress scenarios). The use of generative models is also emerging – generative adversarial networks (GANs) or similar techniques can create synthetic financial data or simulate alternate universes of market behavior, which is useful for testing strategies under rare conditions that haven’t been seen historically.

Despite the power of AI, explainability remains crucial. Fintech CTOs must ensure that the portfolio decisions made by the algorithms can be explained in intuitive terms to both the end-user and regulators. In practice, this means even if a deep neural network is involved under the hood, the output might be distilled to something like: “We’re allocating 10% more to bonds because your risk tolerance is low and market volatility is predicted to increase.” Many platforms thus implement a layer of business rules or an explanatory model on top of complex AI, to translate the rationale into human-friendly terms. This way, clients gain trust knowing that the strategy still aligns with classical reasoning (e.g. “reduce risk when volatility is high”) even if an AI model did the complex calculations behind the scenes.

In summary, AI-driven portfolio management in 2025 is a blend of old and new: the rigor of time-tested investment theory enhanced by the adaptability of machine learning. The result is more robust and responsive portfolio strategies. Systems can adapt in real-time to market changes, learn from vast datasets, and potentially foresee risks and opportunities that traditional models might miss. For CTOs, the challenge is architecting this AI layer in a modular, scalable way – often deploying models via microservices or using cloud-based ML platforms – while ensuring that the whole thing remains a well-oiled machine that serves the investor’s best interests.

Hyper-Personalized Recommendation Engines

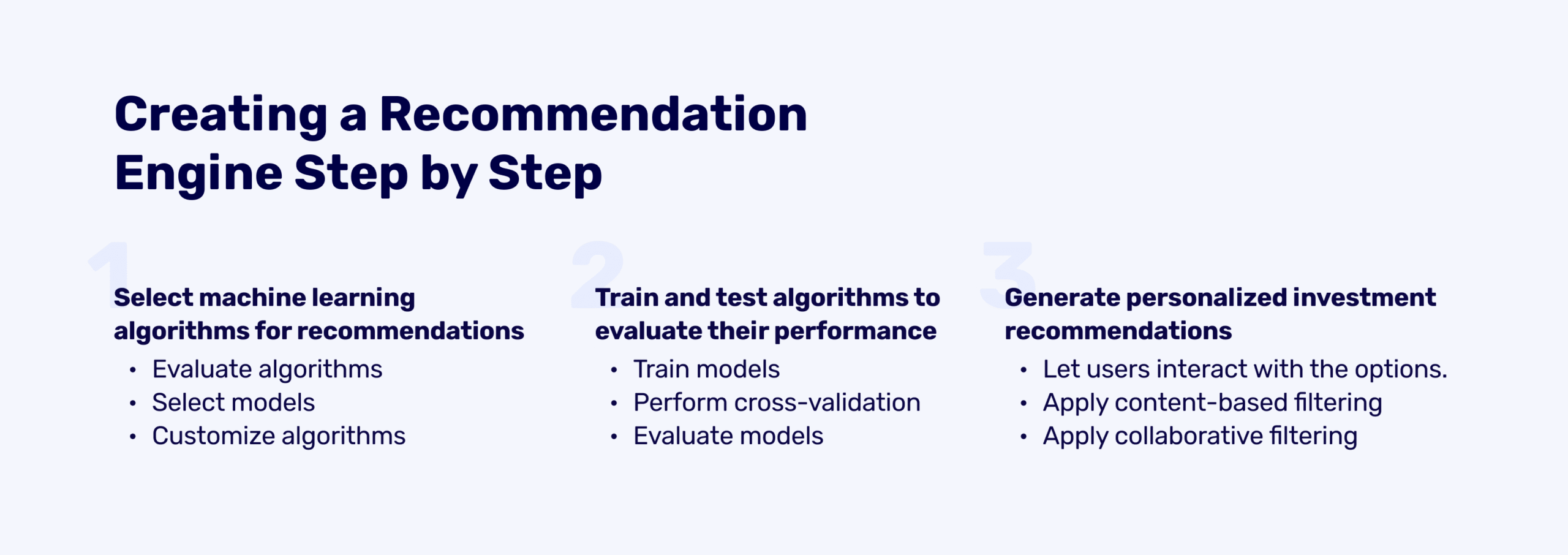

Designing a recommendation engine for investments involves multiple steps. First, appropriate ML algorithms (e.g. rating systems, collaborative filters) are selected. Next, these algorithms are trained and tested on historical data to ensure they can predict suitable recommendations. Finally, the engine generates personalized investment suggestions for each user. Modern robo-advisors combine content-based filtering (matching recommendations to a user’s own profile and holdings) with collaborative filtering (mining patterns from similar users) to achieve hyper-personalization.

Beyond core portfolio allocation, robo-advisors differentiate themselves through the recommendation engine – the intelligence that delivers tailored advice and insights to each customer. In earlier years, this might simply have been a risk questionnaire leading to a model portfolio. Now, in 2025, clients expect a more nuanced, ongoing advisory experience. This includes suggestions like adjusting monthly contribution levels, alerts about reaching a financial milestone, or recommending specific financial products (for example, a tax-advantaged account or a different fund that better suits the client’s interests). Achieving this level of personalization at scale requires sophisticated recommendation algorithms.

A common approach is to use hybrid recommendation systems. Content-based filtering utilizes data about the user – their profile, current portfolio, and preferences – to recommend actions or products that are similar to what has benefited them personally. For instance, if the user’s portfolio is heavily composed of low-cost index funds, a content-based engine might suggest another index fund in a sector they haven’t covered yet, aligning with their apparent preference for passive investments. On the other hand, collaborative filtering looks at patterns across many users: “people like you also liked X.” In a robo-advisor context, collaborative filtering might reveal, for example, that many users with a similar risk profile and age have opted to increase their emergency fund during volatile times, thus the system might recommend the user consider something similar. Combining these approaches allows the platform to capture both individualized trends and broader wisdom of the crowd.

Crucially, the data feeding into the recommendation engine isn’t limited to the user’s initial survey. As the user interacts with the platform, behavioral data is continuously collected: which advice notifications do they read or ignore? Do they frequently check their portfolio (implying nervousness)? What questions do they ask the support chatbot? Every interaction can refine the recommendations. If a user tends to ignore rebalancing suggestions but engages with educational articles about retirement, the robo-advisor might adjust by providing more educational content and fewer rebalance nudges, or frame them differently (“Did you know rebalancing now could lock in your gains from the tech stocks rally?”). In this way, the service becomes adaptive, learning the client’s communication preferences and financial habits over time. This is the essence of hyper-personalization – moving from segment-based advice to truly individual guidance.

The rise of Large Language Models (LLMs) and generative AI is turbocharging recommendation engines as well. These AI models can analyze unstructured data and converse in natural language, opening new possibilities. For example, an LLM-based module might read through a user’s short text inputs (perhaps a goal description like “I want to save for my kids’ college but also buy a house”) and parse the nuance to adjust the financial plan. LLMs can also be used to generate personalized summaries of one’s financial situation each month: a friendly narrative like “Good news! You’re on track for your 2028 home down payment, but your portfolio’s bond allocation drifted 5% above target – we recommend a quick rebalance.” This kind of human-like communication can greatly enhance user engagement, making the advice feel more personal and intelligible. Fintech CTOs in 2025 often consider integrating APIs from OpenAI or similar providers (or even deploying fine-tuned in-house language models) to power chatbots and advice explanations within their robo-advisor apps. The key is to use these models carefully – ensuring factual accuracy and compliance – since a confident-sounding AI can occasionally generate incorrect suggestions if not properly constrained. Nonetheless, when combined with a solid underlying financial engine, LLMs provide a conversational layer that can clarify recommendations and answer user questions in real-time, effectively acting as a virtual financial advisor alongside the automated platform.

In building a recommendation engine, evaluation and iteration are important too. CTOs will set up A/B tests and feedback loops: do users act on the recommendations? Are the recommendations improving outcomes (e.g. higher savings rates, better diversification)? Machine learning models require retraining on newer data as markets change or as more user behavior is observed. Therefore, a modern robo-advisor must include an MLOps pipeline – regularly updating models and rules in the recommendation system to keep the advice relevant. The result of all these efforts is a robo-advisory service that doesn’t treat a customer as a static risk number, but as a dynamic individual whose financial journey is continuously guided by an ever-learning, personalized engine.

Automated Rebalancing and Portfolio Maintenance

Robo-advisors apply automated rebalancing rules to keep portfolios aligned with target allocations and risk levels. Common strategies include: (1) Threshold-based rebalancing – e.g. if any asset’s allocation drifts 5% beyond its target, the system automatically buys/sells to correct it; (2) Time-based rebalancing – e.g. re-evaluating and rebalancing every quarter or year; (3) Cash-flow-based rebalancing – using new deposits or withdrawals as opportunities to rebalance; and (4) Hybrid approaches that combine multiple rules for flexibility. These rules ensure the portfolio stays on track with the client’s goals and risk profile.

One of the promises of robo-advisors is hands-free portfolio maintenance – the client shouldn’t need to worry about tweaking their investments; the platform handles it. The primary mechanism for this is automated rebalancing. Over time, as markets move, a portfolio will drift away from its intended allocation. For example, if stocks have a great quarter, a 60% stocks / 40% bonds portfolio might become, say, 65/35. A robo-advisor continuously monitors such drifts and periodically rebalances: selling a bit of the over-performing asset and buying more of the under-performing one to restore the target mix. This disciplined approach enforces “buy low, sell high” behavior unemotionally. In traditional advising, a human might do this annually or when they remember; the robo-advisor does it with algorithmic precision according to predefined rules.

There are a few common rebalancing strategies as noted. A threshold-based strategy triggers whenever an asset class breaches a certain deviation (for instance, more than 5% off target allocation). A time-based strategy triggers on a fixed schedule (like the first of each month, or quarterly). Many robo-advisors use a combination: check monthly, but only execute if a threshold is exceeded, which is effectively a hybrid approach. Another nuance is cash-flow-based rebalancing: whenever the user adds new funds or requests a withdrawal, the system uses that event to rebalance (directing new contributions into underweight assets, for example, instead of selling overweight assets). This approach can minimize transaction costs and tax events by coupling natural portfolio changes with the rebalancing process.

Tax efficiency is an important consideration in rebalancing. Automated platforms often implement tax-loss harvesting in tandem with rebalancing for taxable investment accounts. This means if a particular holding has dropped in value below its purchase price, the system might sell it to realize a tax loss (which the client can use to offset other gains), and simultaneously buy a similar asset to maintain the portfolio exposure (for example, sell one international stock ETF at a loss and buy a different international stock ETF). This must be done carefully to avoid tax wash-sale rules, but robo-advisors excel at this kind of rule-based optimization. By harvesting losses periodically and rebalancing, the platform can significantly improve the after-tax returns for clients without any manual intervention.

Continuous portfolio monitoring allows for some innovative twists as well. For instance, if the system’s AI predicts that market conditions are about to increase volatility significantly, it could proactively tighten rebalancing thresholds or shift to a more frequent check for certain clients (especially risk-averse ones). While most platforms stick to their rule-based cadence to avoid excessive trading, the more advanced ones in 2025 may dynamically adjust rebalancing logic based on market regimes – essentially a smarter rebalancing that can pause during extreme turmoil (to avoid trading at bad times) or accelerate when beneficial.

There’s also a trend toward automating the advisors’ oversight of portfolios. In hybrid robo models (where a human advisor still oversees many clients, aided by the robo-platform), the system can generate alerts or recommendations for the advisor. For example, the robo-advisor might notice that a client’s portfolio no longer fits their stated goals (perhaps the client took on a new mortgage, and their risk capacity changed). The platform could then recommend the advisor to initiate a “portfolio remodel” for that client. Some robo-advisors have features like automated model updates: they periodically suggest to either the user or the advisor that the client should shift to a more conservative or aggressive model portfolio based on their age or new data. This is essentially automating the financial planning process on a schedule – e.g. a notification: “It’s been 3 years since we last updated your investment plan; we suggest revisiting your asset allocation.” If the client accepts, the system will adjust the portfolio and set a new baseline. This kind of meta-management ensures the portfolio strategy itself stays aligned with life changes, not just day-to-day market movements.

From a CTO’s perspective, implementing rebalancing involves building a robust scheduling and trading system. The platform needs to efficiently batch trades for potentially thousands of accounts (often executing through a brokerage API or custody platform), and do so in a way that optimizes trading costs. Cloud-native architectures help here: a serverless function or a dedicated microservice can wake up on schedule or when triggered by a threshold event and compute the necessary trades. High reliability is a must – missing a rebalance trigger due to a system error could mean portfolios stay misaligned longer than they should. Testing is also crucial: each change in rebalancing logic should be simulated on historical data to ensure it doesn’t inadvertently cause excessive churn or other issues. In 2025, with volatile markets and global events, this component of the robo-advisor provides clients peace of mind that someone (or rather something) is always watching their portfolio. The result is a disciplined investment process that continuously keeps the client on track toward their goals, with minimal effort on their part.

User Experience and Interface Design for Next-gen robo-advisor architecture for startups

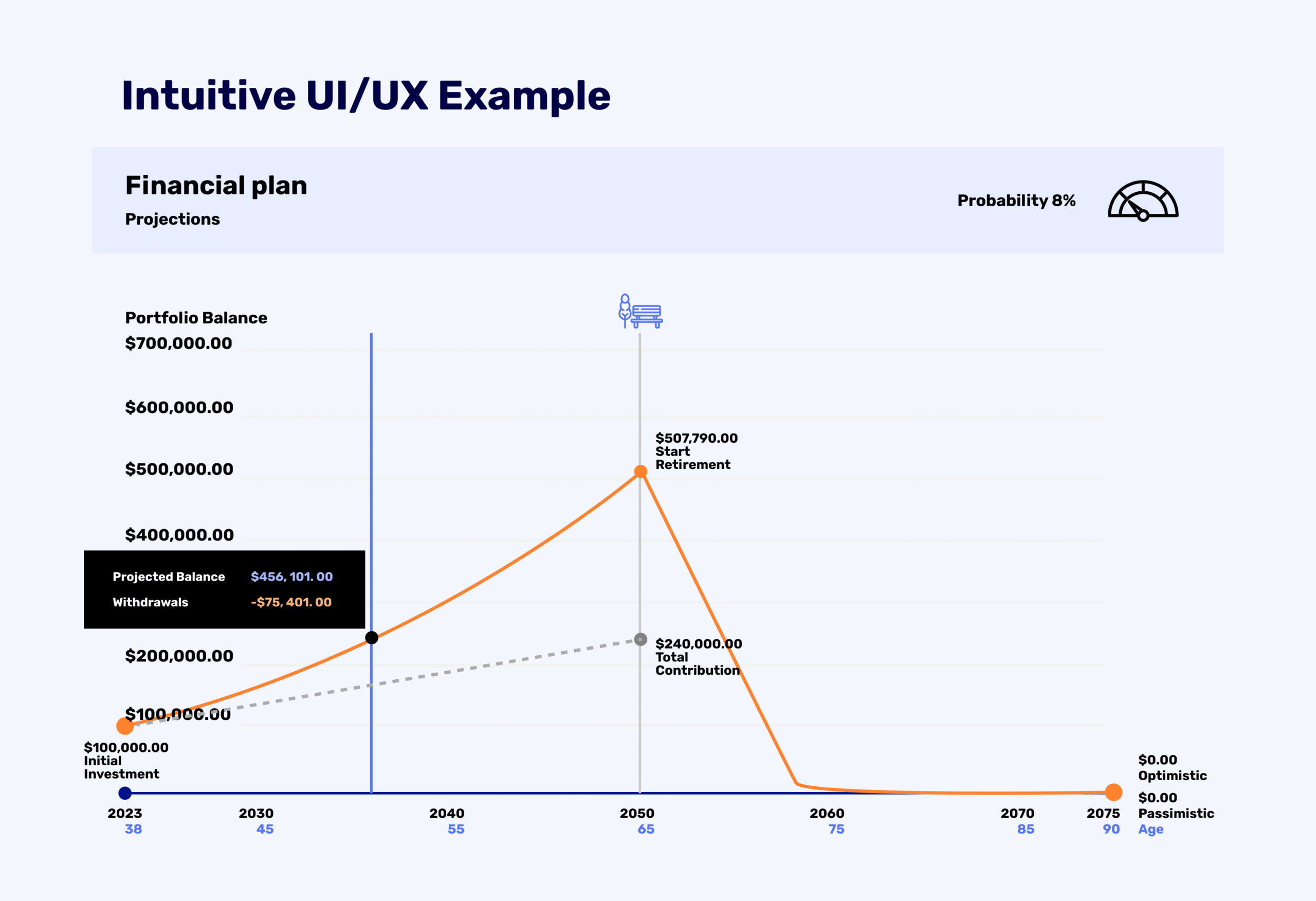

An intuitive UI/UX is essential for client trust and engagement. The example above showcases a clear visual of a financial plan’s trajectory – projected portfolio growth, contributions, and withdrawals over time – presented in a simple, interactive chart. Effective robo-advisor interfaces present complex financial data in an easily digestible format, avoid jargon, and allow users to explore their portfolio and goals without confusion.

No matter how advanced the analytics and algorithms, a robo-advisor will not succeed unless clients can understand and comfortably interact with it. User Interface (UI) and User Experience (UX) design is therefore a critical component, especially for fintech CTOs who need to ensure that all the technological sophistication translates into a clear and reassuring experience on the front end. In 2025, users have grown accustomed to slick, mobile-first financial apps. They expect their robo-advisor to be as easy to navigate as their favorite social media or e-commerce platform – while dealing with very sensitive information. This puts an emphasis on simplicity, transparency, and responsiveness in design.

One key design principle is to avoid overwhelming the user with financial jargon or data dumps. Instead of showing a table of numbers, the interface might show a personalized financial dashboard: e.g. “You’re 70% towards your goal of $500k for retirement, projected to hit it by age 65.” Interactive charts (like the one above) let users visualize their portfolio value growing over time, contributions going in, and how withdrawals in retirement might draw it down. Asset allocation pie charts, risk meter gauges, and progress bars for goals are all commonly used visual elements. These give users a sense of control and clarity. Importantly, any recommendations or changes the robo-advisor makes should be communicated with context. For example, if the platform rebalanced the portfolio, a simple note like “We adjusted your portfolio back to target allocations today, selling a bit of X and buying Y, to keep you on track” goes a long way in building trust. Users appreciate knowing what’s happening under the hood in plain language.

The design also varies depending on the target audience. Some robo-advisory platforms are B2C, catering directly to retail investors, while others are B2B2C, serving as white-label solutions for traditional advisors or financial institutions who provide the robo service to their clients. If the end-user is a professional advisor (B2B scenario), the interface might include more advanced analytics, detailed portfolio customization tools, and features to manage multiple client accounts. Those users are financially savvy and need more complex functionality (for instance, a dashboard showing which of their clients are off track or which accounts need attention today). In contrast, a pure retail client interface should be as straightforward as possible – often offering a conversational experience or guided workflows. Many successful robo-apps include a chat-style Q&A: a client can ask, “Why did my portfolio go down today?” and the app (possibly powered by an AI) can respond, “Your international stock fund dropped 2% amid global market declines, leading to an overall portfolio dip of 0.5%. This is normal volatility for your risk level.” Providing this kind of immediate, personalized answer can greatly enhance user comfort during market turbulences.

In fact, conversational UI backed by AI is a hot trend by mid-2025. Large Language Models and voice assistants are increasingly integrated into fintech apps. A CTO might integrate an LLM-based chatbot in the robo-advisor so that users can get on-demand explanations or even financial planning advice in natural language. For example, a user might type, “Can I afford to buy a house in 5 years?” and the system will analyze their data and produce a helpful answer or action plan, or at least guide them to use the tools in the app to model that scenario. This transforms the user experience from clicking through menus to having a dialogue with their digital advisor. It’s important, however, that any AI-driven answers remain within correct and compliant boundaries – the UX should be designed such that the AI’s responses are verified or constrained by the platform’s financial logic (to avoid the chatbot making unauthorized promises or going off-script).

Performance and reliability are also part of UX. The app should feel fast – e.g., quickly updating charts after a deposit, or instantly reflecting a portfolio change. Using cloud infrastructure and CDNs (Content Delivery Networks) for front-end assets ensures the UI is snappy globally. Additionally, downtimes or glitches in a robo-advisor can seriously erode trust. Imagine an investor logging in during a market downturn and not being able to see their balance – panic could ensue. Thus, CTOs implement rigorous monitoring on the front-end performance and uptime, often with fallback modes (like a read-only cached view of the last known portfolio if the backend is momentarily unreachable, along with a friendly message).

Lastly, security measures must be seamlessly integrated into UX. Two-factor authentication, biometric logins, and secure account recovery flows are standard now. The challenge is implementing these without making the experience cumbersome. Many platforms use biometrics (fingerprint or face ID on mobile) to make secure login effortless. When designing UI flows, every step is considered from the user’s emotional perspective: will this screen make sense to someone who is not a finance expert? Does the app convey the right level of confidence and empathy? For example, showing a big red arrow down on a bad day could frighten users unnecessarily – instead interfaces often use neutral colors and messaging like “markets had a downturn today” rather than “you lost money!” to keep users focused on long-term goals. In sum, the UI/UX of a robo-advisor should translate the complexity of financial planning into an engaging, informative, and reassuring journey for the user, whether they are a DIY investor or a professional using the platform to assist clients.

Security, Compliance, and Trust of Next-gen robo-advisor architecture for startups

Building a robo-advisor in 2025 means operating in a highly regulated and security-conscious environment. When people entrust their life savings to an AI-driven platform, trust is paramount. Earning and keeping that trust involves robust security practices and strict compliance with financial regulations at every level of the system’s design.

Data Security: Fintech CTOs must enforce bank-grade security for customer data and transactions. This includes end-to-end encryption – sensitive data (personal info, account numbers, portfolio details) should be encrypted in transit (using protocols like TLS for network communications) and at rest in databases. Encryption keys need proper management (often using hardware security modules or cloud key management services). Systems are designed under a zero-trust philosophy: even internal microservices authenticate and authorize every request. Regular security audits, penetration testing, and vulnerability scans are conducted to catch and patch any weaknesses. In 2025, cybersecurity threats are ever-evolving, so a robo-advisor platform typically has dedicated security engineers on the team, and might employ AI-based security monitoring tools that can detect unusual patterns (for example, an account showing activity that might indicate it’s been hacked).

Access Controls and Privacy: Given that many robo-advisors serve thousands of clients on a single platform, multi-tenant data isolation is critical. Each user should only be able to access their own data. If the platform also has advisor or admin roles (as many do), those roles should have carefully scoped permissions – e.g., an advisor can see data for their assigned clients but not others, an admin can see aggregated metrics but not personal details unless necessary, etc. Role-based access control (RBAC) and even attribute-based access control (ABAC) systems are implemented to enforce these rules systematically. Furthermore, compliance with privacy regulations like GDPR in the EU and CCPA in California is mandatory. Users have rights over their data (export, deletion), so the system must be designed to accommodate data deletion requests (which can be tricky in a system with backups and ML models trained on data – one needs procedures to retrain or mask data if a user opts out). Clear privacy policies and consent screens are part of the user experience as well, and those tie into the legal compliance the CTO oversees.

Financial Regulations and Compliance: Robo-advisors are typically registered as financial advisers or the equivalent in their jurisdictions, which subjects them to many of the same regulations as human advisors. For instance, in the U.S., robo-advisors must comply with SEC and FINRA rules regarding suitability – they have to ensure the investment advice given is appropriate for the client’s profile. In practice, that means the onboarding questions and any subsequent advice logic must align with what a prudent advisor would recommend given that data. As CTO, one must encode compliance checks into the system: if a user’s answers imply very low risk tolerance, the software should not allow assigning them to a high-risk portfolio – that’s a simple rule, but essential. Every recommendation or portfolio change ideally should be accompanied by an explanation that could justify its suitability if ever audited. Many platforms maintain an audit trail of advice: a log of what recommendations were made or what portfolio changes happened and why (with timestamp and data snapshot), so that if a regulator or the company’s compliance officer reviews it, they can follow the reasoning.

New regulations in 2025 are increasingly focused on algorithmic transparency and AI accountability. For example, the EU is finalizing an AI Act that classifies automated financial advisory services as “high-risk AI” systems, likely requiring additional documentation, risk assessments, and human oversight of the algorithms. Even outside of explicit AI laws, regulators worldwide have been issuing guidance on robo-advisors – emphasizing the need for clear client disclosures (clients should know it’s an algorithm managing them, what the algorithm’s strategy is, and its limitations), robust testing of algorithms (to prevent scenarios where the robo-advisor might malfunction in extreme conditions), and contingency plans (such as human advice stepping in if the algorithm encounters something it can’t handle). A CTO must work closely with a Chief Compliance Officer to implement these requirements technically. This could mean building a compliance rule engine into the platform – for instance, disallowing trades or recommendations that violate certain constraints, or triggering alerts if a client’s portfolio drifts into an allocation that doesn’t match their documented profile.

Fraud and Risk Management: In addition to investment compliance, operational risks like fraud must be controlled. This includes identity verification (KYC – Know Your Customer – checks) during account setup to prevent bad actors or money launderers from using the platform. Many robo-advisors integrate with third-party verification services to validate government IDs, perform AML (Anti-Money Laundering) screening against sanction lists, and so forth. Transactions are monitored for suspicious behavior – e.g., rapid in-and-out money movements that could indicate money laundering, or multiple accounts controlled by the same entity. Modern AI tools also assist here: machine learning models can flag unusual account patterns more effectively than static rules. For instance, if a fraudster took control of an account and started behaving differently, an anomaly detection system might catch that. Upon detecting an issue, the platform should be able to lock down and require re-authentication or human intervention. All these checks add layers of safety for both the user and the platform’s integrity.

Systemic Resilience: Trust also comes from reliability. Regulators care about operational resilience – the platform should have disaster recovery and business continuity plans. Technically, this means data backups in multiple regions, failover systems if one data center goes down, and the ability to restore service quickly after an outage. Cloud infrastructure makes it easier to have geographically distributed redundancy. Periodic drills or chaos engineering tests are useful to ensure that if, say, the primary database cluster fails, the secondary takes over seamlessly without data loss. From the user’s viewpoint, this resilience might not be visible (and that’s the goal – any incident should ideally be invisible or minimal), but it’s a crucial part of keeping their trust. If an outage does occur, transparent communication is important: many fintech companies will promptly notify users via email or app notifications if something’s amiss and update them when resolved.

In summary, security and compliance are not just tick-boxes but core features of a robo-advisor platform. They require a combination of technology (encryption, monitoring, access control), process (audits, model validation, legal reviews), and culture (every developer thinking about security implications, every data scientist aware of bias and fairness in models). When done right, they form a competitive advantage – users and partners feel safe and regulators view the company as a trustworthy operator. For a CTO, prioritizing these areas is as important as delivering fancy new AI features, because without a secure and compliant foundation, even the most innovative robo-advisor will not survive for long in the financial industry.

Cloud-Native Architecture and Scalability

The architecture underpinning a robo-advisor must support all the capabilities discussed – from real-time data processing to AI model serving to secure transactions – while being able to scale with a growing user base and adapt to new features. In 2025, the de facto approach is to build robo-advisory platforms as cloud-native applications using microservices, containerization, and managed cloud services to accelerate development and ensure reliability.

Microservices Architecture: As the original guide wisely pointed out, choosing a microservices architecture ensures that the robo-advisor is scalable and maintainable. Each major function of the platform can be a separate service: one for user authentication and account management, one for data ingestion, one for portfolio calculations, one for trade execution, one for the notification/recommendation engine, etc. By decoupling these components, the development team can update or scale each service independently without affecting the others. For example, during trading hours, the trade execution service might need to handle high load (many trades) and can be scaled out temporarily, whereas the onboarding service might be under less load and remains minimal. If a bug appears in the recommendation engine, it can be fixed and redeployed without taking down the entire platform. This modular approach also enforces clear boundaries – which is helpful for security (each service has limited access) and for compliance (e.g., the service handling personal data can be isolated and given extra scrutiny).

Implementing microservices often goes hand-in-hand with using containers (via Docker, etc.) and orchestration platforms like Kubernetes. Many fintech CTOs opt to deploy on a Kubernetes cluster (whether self-managed or via cloud providers’ services) to manage these microservices. Kubernetes provides resiliency (auto-restarting crashed services, load-balancing requests) and makes scaling relatively easy. By writing appropriate auto-scaling rules, the system can automatically add more instances of a service under high load. In a robo-advisor context, imagine there’s a sudden influx of new users signing up in a week – the account service and risk profiling service can scale out to handle onboarding without a hitch. Or consider a market crash day when every user is logging in to check their portfolio – the services for portfolio data and UI API calls can scale up to meet the demand, ensuring the app stays responsive.

Cloud Services and Serverless: Another aspect of cloud-native design is leveraging managed services to reduce complexity. For instance, instead of building a custom infrastructure for message queuing or streaming data, teams use services like AWS Kinesis or Azure Event Hubs to stream price updates and signals. For the database layer, a managed cloud database (with high availability and automated backup) can be used for user data, and perhaps a time-series database for storing historical prices. Many robo-advisors use caching layers (like Redis) to serve frequently accessed data (such as reference data or last known portfolio values) quickly. In certain parts of the system, serverless functions can be very handy – for example, a scheduled Lambda function that triggers the rebalancing logic every night, or serverless tasks that run periodic model training jobs. Serverless architectures automatically handle scaling and charging only for actual usage, which can be cost-efficient for jobs that run infrequently or have bursty workloads.

Integration vs. In-House Development: A strategic decision for CTOs is which parts to build and which to buy or integrate. There are white-label robo-advisory solutions available that offer a shortcut – essentially a ready-made robo-advisor that can be customized and branded. Using such a solution means you primarily focus on building the user-facing app and perhaps some unique features, while the heavy lifting of portfolio management and trading is handled by the white-label provider. This can drastically reduce time-to-market. However, as the original guide noted, the downside is limited customization and integration challenges. The white-label’s capabilities might not align perfectly with your envisioned features (for instance, maybe it doesn’t support the latest AI recommendation feature you want to add, or it can’t easily incorporate an LLM-based chatbot). Integration with other systems (say, your custom mobile app or a specific data source) might also be constrained or require heavy workarounds. Moreover, relying on a third-party’s architecture could raise concerns about scalability or security if you can’t control those aspects fully.

Another approach is building on top of various specialized integrations without a single white-label system – for example, use a brokerage API for executing trades, a risk engine API for value-at-risk calculations, etc. This can speed up development (because you’re leveraging existing components), but each integration is a dependency that needs to be managed. If one of them has an outage or doesn’t scale, your platform could be affected. Also, stitching together many external services can introduce complexity and data latency. Thus, many CTOs decide on a core vs context approach: keep the core intellectual property and critical systems in-house (like your unique AI models, your customer experience, and the orchestration of portfolios), but outsource non-differentiating components where possible. For example, use a well-established identity verification API for KYC rather than building your own, or use a cloud ML service to host your models rather than maintaining your own GPU servers – as long as those choices don’t box you in.

Scalability and Future Growth: A robust architecture anticipates growth in both number of users and features. It should be relatively straightforward to onboard 10x more customers by adding infrastructure (horizontal scaling with more servers or enabling multi-region support). Cloud-native setups shine here – you might deploy the platform across multiple availability zones or even multiple geographic regions so that users always connect to a nearby, low-latency server and the system can handle regional outages or spikes. Additionally, as the feature set grows (for example, if you later add support for crypto investments, or integrate a new banking product), the modular architecture allows those to be built as new services and then plugged into the existing ecosystem with minimal disruption.

DevOps and Continuous Deployment: Modern fintech companies practice agile development and continuous deployment. Infrastructure as Code (using tools like Terraform or CloudFormation) ensures that environments can be replicated and changes are tracked. Automated testing and CI/CD pipelines allow new code (including model updates) to be deployed quickly but safely. Feature flagging is commonly used – new algorithms or features might be rolled out to a small percentage of users, monitored, and then gradually expanded. This devops culture and toolchain are part of the architecture too, in a sense – enabling the team to iterate quickly in the competitive fintech landscape without sacrificing stability.

In essence, the cloud-native architectural mindset offers both flexibility and control. It acknowledges that the future is hard to predict – new fintech trends or regulatory changes could demand changes in the system. By keeping the architecture flexible, decoupled, and scalable, a CTO ensures that the robo-advisor platform can adapt to whatever the future brings (be it a sudden influx of users, a new AI technique to incorporate, or expansion to new markets with different regulatory needs). The payoff is a system that not only meets today’s needs but is prepared for tomorrow’s opportunities, embodying the idea that in fintech, the only constant is change.

Conclusion: The Road Ahead for Next-gen robo-advisor architecture for startups

The robo-advisor of 2025 is a marvel of finance and engineering – a platform where classical investment wisdom intertwines with artificial intelligence, all running on resilient cloud infrastructure. For fintech and startup CTOs, building such a platform is a multidimensional challenge. One must balance the innovative (deploying LLMs for chat-based advice, using deep learning for market insights) with the fundamental (ensuring portfolios stay diversified and suitable). One must deliver hyper-personalized user experiences while maintaining rigorous security and compliance standards behind the scenes.

In this reimagined landscape, several themes stand out. Hyper-personalization is key to winning client loyalty – tomorrow’s investors will gravitate to services that understand their unique story, not just their risk score. Achieving this means digesting more data about the client and employing smarter algorithms, but doing so responsibly and transparently. Generative AI and conversational interfaces promise to make financial advice more accessible, turning what used to be dry pie charts into engaging dialogues. We can expect robo-advisors to continue integrating these AI advancements, perhaps evolving into full-fledged financial “companions” that can advise on a broad range of life decisions, not just investments, all within regulatory guardrails.

Meanwhile, the back-end architecture must remain a step ahead to support these features at scale. Cloud-native, modular systems allow fintech teams to iterate quickly – a crucial advantage as competition in digital wealth management intensifies. New players are emerging not only from fintech startups but also from incumbent banks and brokerage firms upgrading their tech. The ability to innovate rapidly (for example, rolling out a new ESG investment option, or adding support for a new asset class like digital securities) will distinguish the leaders. A well-architected platform is the launchpad for such rapid innovation.

Regulation will undoubtedly continue to shape the journey. As authorities gain more experience with algorithmic advisors, we’ll likely see more defined standards for things like algorithm testing, disclosures, and perhaps even requirements for “human-in-the-loop” checks for certain decisions. Rather than viewing this as a hurdle, the best robo-advisors will use it as an opportunity to strengthen their platforms – building even more robust compliance automation and leveraging technology (like explainable AI techniques) to satisfy regulatory demands in elegant ways. After all, a platform that is provably fair, transparent, and secure is more appealing to users as well.

In closing, building a state-of-the-art robo-advisor today is as much about architecture and strategy as it is about code. It requires a holistic vision: combining finance domain knowledge (so that the algorithms honor investment principles) with top-notch software engineering (so that the system is fast, flexible, and reliable) and a product mindset (putting the user’s needs and experience first at all times). For those who get it right, the reward is not just a successful product, but a chance to democratize finance – to provide sophisticated, personalized financial guidance to millions who might never have accessed it before. Robo-advisors are here to stay, and they are only getting smarter and more integrated into our financial lives. By leveraging the trends of 2025 – from LLMs and generative AI to cloud-native architectures and hyper-personalization – fintech leaders can build the next generation of robo-advisors that deliver both high-tech and high-touch financial care, at scale. The journey from a simple automated portfolio tool to an intelligent, trusted financial partner is well underway, and the innovations on the horizon promise to make the ride even more exciting.