“Traction” is one of the most overused and least defined words in the founder–investor conversation. Ask five fintech founders what traction means, and you’ll hear five different answers. For one, it’s 5,000 people downloading your budgeting app; for another, it’s chasing a flashy feature.

This article explores how to separate vanity metrics from real traction, and how to prove demand before burning resources.

The Problem with the Word “Traction”

Few words get tossed around in startup circles as often as “traction.” Founders are told they need it to raise, investors ask for it in every pitch, and advisors warn that without it, the company won’t survive. Yet for all the emphasis, almost no one stops to define what traction really means.

Many early-stage founders equate traction with visible output: how many features they’ve built, how sleek their dashboard looks, or how many people have signed up for an account but never returned. These are easy to measure and easy to showcase in a pitch, which is why founders gravitate toward them. But they don’t prove that the product is solving a real problem, or that customers are willing to pay for it.

Investors know this. They aren’t evaluating you on the elegance of your codebase or the number of screens in your demo. What they want to see is evidence — proof that your idea is more than software. That could be in the form of user behavior, customer commitments, or market pull. So, traction is less about what you launch, and more about what you validate.

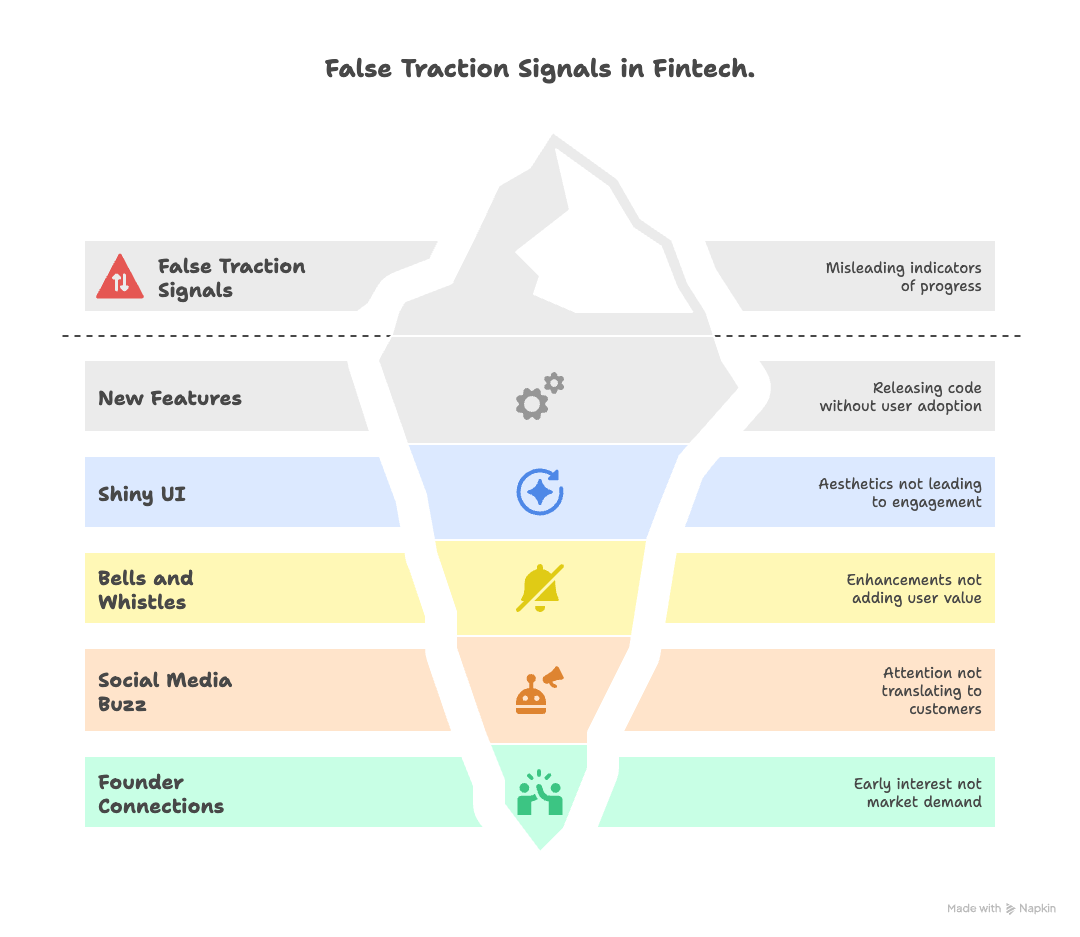

False Traction Signals

In fintech, it’s easy to mistake activity for progress. A founder might proudly tell an investor: “We just released version two of our app with five new features” or “Our new dashboard looks like it could compete with PayPal.” But these are false signals of traction — and there are plenty more like them.

- Releasing new features or code without these actually driving user adoption or solving key customer problems.

- Improving UI/UX aesthetics that don’t lead to increased engagement or customer satisfaction.

- Adding screens or bells and whistles that don’t enhance core functionality or user value.

- Attention like social media followers, media mentions, or conference talks that don’t translate into paying customers or usage.

- Early interest driven by founders’ connections rather than genuine market demand.

These are examples of signals that create the illusion of progress while masking the absence of genuine traction. The real measure of traction is whether you’ve proven that someone outside your circle cares enough to use it, engage with it, or pay for it.

The Hidden Cost of False Traction

False traction acts like a slow leak in a startup’s fuel tank, bleeding resources, energy, and trust until there’s nothing left to power real growth — here’s how.

You’re burning cash in the wrong places

Every sprint spent polishing dashboards or adding features no one asked for consumes time, money, and energy that could have been directed toward testing customer demand. Early-stage startups don’t have the luxury of endless capital; every dollar invested in activity that doesn’t validate the market shortens the runway.

You notice problems when it’s too late

When the product looks alive, the team can miss the uncomfortable truth: no one is actually adopting it. By the time founders realize their market signals are weak, they’ve often burned through months of runway.

You confuse priorities

Without clear metrics tied to customer behavior or business outcomes, teams struggle to know whether to refine, pivot, or scale. Instead of learning quickly from real-world feedback, they end up guessing, doubling down on the wrong bets while missing the signals that matter.

Over time, this erodes morale. Burnout sets in when founders and their teams work hard but don’t see tangible impact and the work doesn’t translate into validation. It feels like running on a treadmill: plenty of motion, no real movement.

Traction at Pre-Seed vs. Seed

If code shipped and feature count aren’t traction, what is? What matters is the quality of the signals you capture — evidence that someone outside your founding team cares enough to engage.

For a pre-seed company, that could be as simple as:

- 100 people waiting for access before you’ve even built the product. A list of real names and emails, gathered without incentives, shows that your idea resonates enough for people to raise their hands. That’s signal.

- 10 users who gave unprompted feedback after trying a rough prototype. Feedback you didn’t have to chase down tells investors that your product is scratching at a real pain point.

- Email from a pilot partner can mean more than a fully built app. One serious engagement from a business that’s willing to test your solution proves market pull in a way that endless coding sprints never will.

- Screens shared in a pitch deck that get callbacks from investors can count as traction at this stage. If the concept itself makes people lean forward and ask for a second meeting, you’ve already validated interest.

None of these examples require a finished product. They require clarity about what you’re testing and the discipline to capture real-world signals instead of chasing surface-level output.

By the seed stage, investors expect more — they want to see the first signs of a solution taking hold. Revenue may still be limited, but the signals are sharper and more concrete: evidence that customers are engaging, buying, or at least moving closer to it.

For a seed-stage company, that could look like:

- A waitlist that keeps growing, signed letters of intent, or a handful of pilot programs show that the company can generate demand and start converting it into commitments.

- Even a small base of active users who keep coming back and provide detailed feedback is meaningful.

- Founders can explain not just the pain point, but why their product addresses it better than existing alternatives. This clarity tells investors the team is moving beyond hypotheses into real differentiation.

- At this stage, the numbers don’t have to be big, but they should be moving in the right direction. A growing pipeline, more inbound interest, or repeat usage all suggest traction that can scale.

- Teams that incorporate feedback quickly and are willing to iterate demonstrate resilience. Investors notice when founders learn fast and adjust course instead of clinging to assumptions.

The Smarter Path to Early Traction

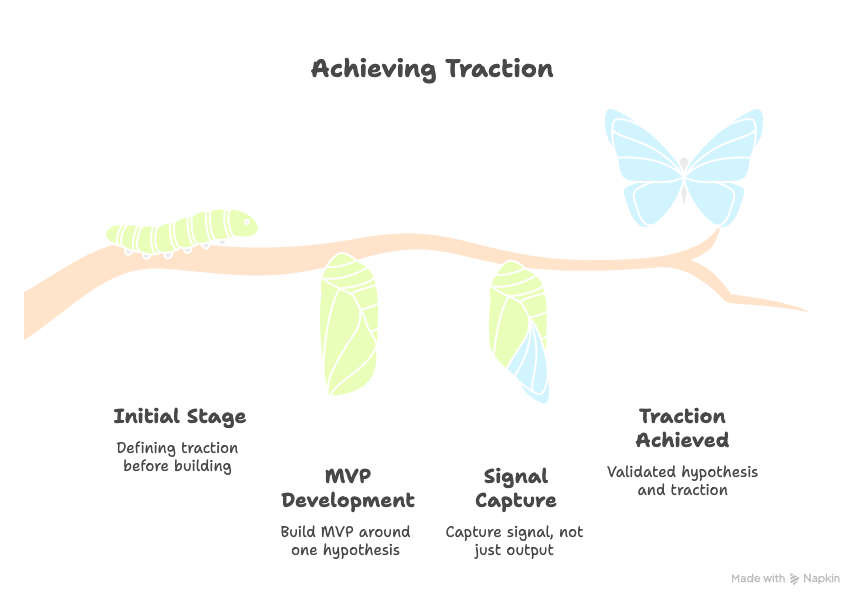

Instead of treating traction as a buzzword, treat it as a system: define what progress means, design your MVP as an experiment, and measure signals over outputs.

Define Traction Before You Build

Most founders start coding without a clear definition of what progress should look like. They measure success by outputs instead of outcomes. The smarter move is to ask upfront: What signal, if I saw it, would convince me this product is worth building further? That definition of traction becomes a reference point for your next decisions.

Build Your MVP Around One Hypothesis

It’s worth treating MVP as an experiment. Its sole purpose is to test whether a specific assumption about your customer holds true. Maybe it’s: Will SMBs try our payments tool if it lowers transaction fees compared to Stripe or PayPal? Or: Will consumers sign up for a savings app if it automatically rounds up spare change into an investment account?

By building around one clear hypothesis, you ensure that every feature you add serves a validation purpose.

Capture Signal, Not Just Output

A finished prototype with zero usage isn’t traction. A simple landing page that collects 200 signups from your target audience is. A deck that gets investor callbacks is. A rough mockup that convinces a pilot partner to commit is. The goal is to capture evidence that someone outside your team cares enough to lean in.

INSART’s POV

At INSART, we’ve seen both sides of the traction story. Some founders raise capital with nothing more than sharp mockups because they’ve defined their traction goals clearly and gathered the right signals early. Others burn out after building full products that never resonate, because they measure progress by code and polish instead of proof. Our work starts at the idea stage: helping founders define what real traction means for their stage, and designing the fastest path to capture it. If you’re ready to clarify your traction goals and avoid costly detours, fill out the form — let’s map the signals that will move your startup forward.